Micron Technology’s Q1 Earnings: What to Watch

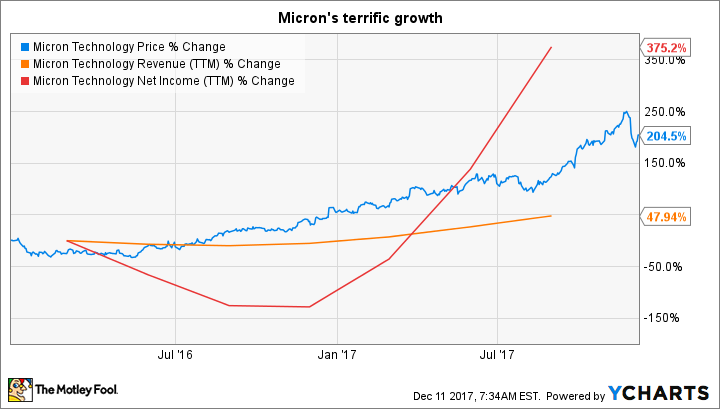

Micron Technology (NASDAQ: MU) stock has tumbled more than 10% since a late November analyst report raising concerns about a potential decline in NAND memory prices. But the stock has had a terrific run over the past couple of years, driven by a huge spike in memory prices and demand that has led to robust growth in revenue and earnings.

Investors will get an inside look at how things are going when Micron releases its fiscal first-quarter results on Dec. 19. Here's what investors can expect.

Set to deliver outstanding growth

The strength in memory prices should have boosted Micron's revenue and earnings by a big margin. Wall Street analysts expect the chipmaker to report earnings of $2.19 per share on revenue of $6.41 billion. This is a huge jump from last year's earnings of $0.32 per share and revenue of $3.97 billion. Micron had guided for $2.16 per share in earnings on revenue of $6.3 billion, but it should be able to top those numbers as the upswing in memory pricing continued last quarter.

Image Source: Getty Images.

For instance, contract DRAM (dynamic random access memory) prices improved 16% sequentially during the July September quarter, according to industry watcher DRAMeXchange. The forecast for the December-ended quarter remains bright as well, with prices expected to rise in the range of 10%-20% depending on product specifications.

A strong jump in DRAM prices will help Micron meet (or even surpass) Wall Street's ambitious forecasts, as this market supplies two-thirds of its total revenue. But investors will be more concerned about the outlook given the recent buzz about the potential weakness in NAND memory pricing, as this segment accounts for 30% of the top line.

NAND pricing will be in focus

Micron stock's recent drop is a result of Morgan Stanley analyst Katy Huberty's prediction that NAND prices have peaked. However, another Morgan Stanley analyst, Joseph Moore, raised Micron's price target based on DRAM strength, telling investors not to worry about the NAND market.

A closer look at the end-market developments indicate that it is too early to throw in the towel. There are two reasons it is unlikely that NAND prices will peak anytime soon despite a forecast 42.9% increase in NAND bit growth next year.

First, a majority of the potential supply increase will go toward satisfying rapidly growing 3D NAND demand, which is expected to clock an annual growth rate of 33.7% over the next five years. Second, the shortage in NAND supply has created a vacuum in this market, so any increase in output next year will be used to satisfy the currently unfulfilled demand.

Therefore, Huberty's argument that NAND prices could fall at an alarming pace of 7%-15% every quarter in 2018 seems harsh.

Also,yahoo NAND flash is used to power solid-state drives (SSDs). Now, the SSD market is expected to more than double over the next five years, hitting $60 billion in revenue in 2023 as compared to projected revenue of $26 billion in 2017. Additionally, smartphone manufacturers have begun deploying larger NAND flash memory.

Both these catalysts led to a 14.3% sequential jump in NAND flash revenue during the third quarter, which bodes well for the future of NAND pricing as they will continue being long-term growth drivers.

In all, Micron could put the fears about the weakness in NAND pricing to rest with a strong outlook, which should convince investors that it is not done growing yet.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.