Michigan property tax bills are about to go up: Why homeowners will pay more

Thanks to skyrocketing inflation, we're paying more to buy groceries, fill up the tank with gas, take out a mortgage — and soon to cover our property tax bills for homes in Michigan.

Homeowners can get ready to see bigger than normal increases in their summer property tax bills that are being sent out in July. And many are very likely going to need to prepare for an even bigger hike in property taxes next year too, thanks to red hot inflation in the past year.

"A lot of homeowners are going to be shocked because they've gone for so long with very low inflation," according to Patrick Anderson, CEO of the Anderson Economic Group consulting firm in East Lansing.

How inflation hits property taxes in Michigan

The inflation rate adjustment for this year's property taxes in Michigan is 3.3% — less than a maximum 5% allowed under Proposal A but it is the highest it has been in about 15 years. The 3.3% rate is the maximum increase in taxable value that can apply this year to a home in Michigan, if the home hasn’t changed ownership or seen additions to the property over the last year.

"For the first time since 2007, the inflation rate multiplier is over 3%," Anderson said.

By comparison, the inflation rate multiplier was 1.4% for the 2021 tax year. The multiplier was 3.7% for the 2007 tax year.

When inflation was low in recent years, Michigan homeowners might have been looking at an annual hike of 1% or so in the taxable value in other years.

The dollars add up but costs will vary

How much will this cost you?

It all depends on the size and value of your home, of course, and where you're living.

Consider this quick example: If your property taxes were $6,000 last year, a 3.3% inflation-adjusted increase would add roughly another $200 a year. That assumes no changes in millage rates in a community, which would drive up taxes, or major additions to the home that would drive up the home's taxable value.

Another more detailed example: The estimated annual tax bill increase would be about $169 in the 2022 tax year on a typical Livonia home with a taxable value of $125,000 last year in a Livonia Public Schools school district, which had a 2021 total millage rate of 40.9672 mills, according to Scott Vandemergel, director of assessment and equalization for the Wayne County Department of Management and Budget.

The taxable value on that home after the inflation adjustment would go up by $4,125 to hit $129,125.

Or consider a house that is worth $300,000 but the owner has been living there for some time and it has a taxable value of $150,000. It now means you are paying property taxes based on roughly an additional $5,000 in value for many years.

Consumers quickly see higher prices for eggs, flour, chicken and other items at the grocery store. And they can't ignore gas prices at the pump of around $5 a gallon or higher. But inflation's impact on property taxes can be somewhat hidden.

"That property tax increase is going to come and cost them a lot of money and they may not be expecting it," Anderson said.

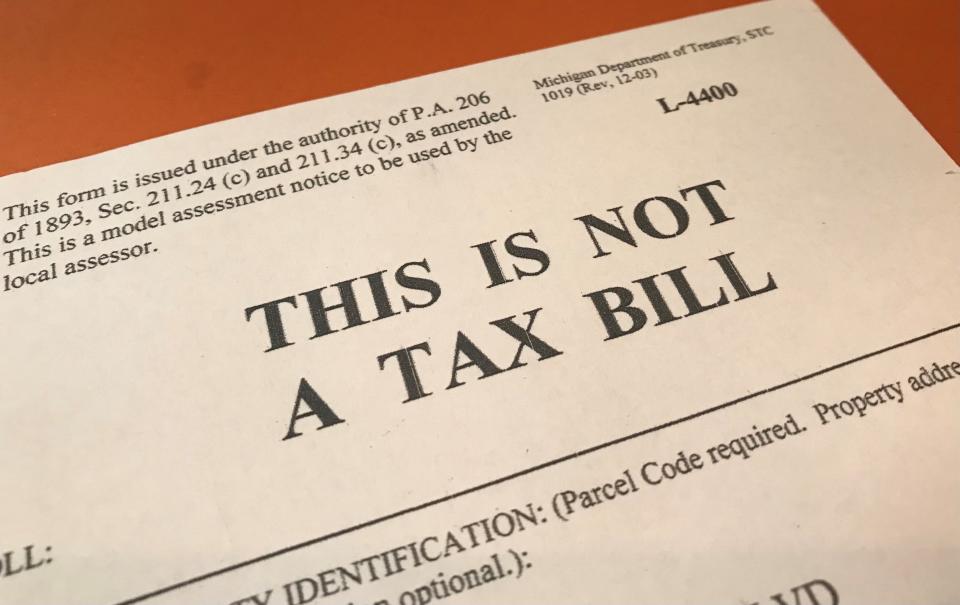

Each year, homeowners first get an inkling of what the inflation adjustment will be for the upcoming year when property tax assessment notices are mailed each January.

If you dig out your assessment notice you'll spot words in bold print on the left side of the page, about halfway down. That section shows approximately how much the change in taxable value will increase your 2022 tax bill based on last year's tax rates.

The inflation-rate multiplier for property taxes in Michigan is based on the consumer price index for a trailing 24-month period. It is computed and published by the Michigan Department of Treasury.

Bigger bills to follow

But watch out, higher inflation now means an even bigger spike in property taxes next year. Many expect that the next increase in taxable values that homeowners see in 2023 could hit 5%, given that inflation has been extraordinarily high for the past year. May's data reflected the largest one-year gain in nearly 41 years.

"Next year, we're going to see an even bigger increase," Anderson predicted.

"Basically, we're baked in at 5% next year," he said. "I don't see any way how we're going to come in under 5%."

Others tend to agree.

Based on previous data for inflation, the 5% is possible but three more months of future data will factor into that final calculation for inflation adjustment for the 2023 tax year, so nothing is conclusive at this moment, Vandermergel said.

Oakland County Management and Budget Director Kyle Jen agreed that it is a reasonable assumption that the 5% level could be hit in the 2023 tax year, based on the inflation data that already has been reported.

If so, Michigan homeowners are looking at two straight years of significant inflationary increases in property taxes that many people probably didn't even consider.

How does this adjustment work?

If you own a home and it is the primary place where you live, increases in the taxable value in Michigan for your home are limited to the change in the inflation rate or a maximum of 5% — whichever is less. That's true if there are no additions to the property. Building a $40,000 family room onto a home would contribute to a higher taxable value.

New homeowners beware: The limit or cap on the growth in the taxable value would not apply to a property the year after it is sold. When that happens, the taxable value resets to the market value, which is often the sales price paid when the property changed hands.

In Oakland County, for example, the total taxable value for residential property in the county increased by 6.2% for 2022. In addition to the inflation-capped increases for existing properties that didn’t change ownership, this increase reflects properties that were sold and new construction. For 2021, the increase was 4%.

Inflation rates had been mild for many years since March 1994, when Michigan voters approved the constitutional amendment, known as Proposal A, which put a limit or cap on rising property taxes for many homeowners.

Proposal A cut property taxes but also raised the state’s sales tax rate to 6%. Anderson was a deputy budget director for Michigan when the measure was being proposed, and helped implement the new constitutional provisions.

When inflation was low, its impact on property tax bills had been small for many homeowners who lived in the same house. That's changing somewhat ahead.

The consumer price index has been rising dramatically, making inflation more of an issue. Over the 12 months through May, the consumer price index jumped 8.6% before a seasonal adjustment. June data is expected to be released at 8:30 a.m. July 13.

New homeowners face different hikes

New homeowners might not realize that they're often looking at higher property taxes than the previous owner in a super-hot real estate market.

When the home is sold in Michigan, the so-called "cap" on property taxes is lifted. Many new homeowners don't realize how much their property taxes will go up, compared with what a longtime owner was paying.

After a sale, the taxable value on that home is reset to equal the state equalized value — which is half of the property's cash value. New homeowners, as a result, can pay far more in property taxes than someone who had lived in the home for 25 years and then sold it.

More: Complaints say majority-Black and Hispanic cities, including Detroit, overtax homeowners

More: Biggest rate hike in decades to fight highest inflation in 40 years expected Wednesday

More: Fed issues steepest interest rate hike since 1994 in effort to battle inflation

More: Think homes in Michigan are overpriced? You might be right.

Each year, homeowners receive a notice of the upcoming change in taxable value of their property in January. But many people, of course, overlooked the real impact of those changes.

The paperwork states on the top right-hand corner in bold letters: "This is not a tax bill."

It's important to take a look at those assessments, even now, to gauge how much property taxes might go up in the future.

"These are one of those warnings that you should never ignore," Anderson said.

"Your property tax assessment notice is affecting this year's taxes and all future year's taxes."

In Michigan, the assessed value is equal to 50% of the market value. But the taxable value is often lower than the assessed value if you've been living in the home for many years.

Many homeowners who remained in their homes would have seen an even bigger tax hike after a robust housing market in the past year, if the Proposal A cap wasn't in place.

In Wayne County, across all local communities and all classes of property, for example, Vandemergel said the average assessed value increased by 8.56% from the 2021 tax year to the 2022 tax year.

That compares with the 4.56% increase from the 2020 tax year to the 2021 tax year.

"Inflation is going to directly kick up the value of land and buildings," Anderson said. "What will happen is the assessed value in many places will likely grow even faster than 5%."

Some smaller homes in southern Oakland County, for example, saw assessed values go up nearly 11% in the past year.

The taxable value is capped by inflation or 5% for one year — again whichever is lower. But the market value is still out there, Anderson said, and taxable values will go up in future years.

"People for years are going to be playing catch-up." Anderson said, predicting higher taxable values and property taxes ahead for Michigan homeowners for a few years at least.

"They're going to have baked-in property tax increases."

When inflation was a problem in the 1980s and early 1990s — before Proposal A put caps on the growth in taxable values — Michigan homeowners saw their taxes go up more directly at the pace of inflation. "That's why you had property tax revolt in Michigan," Anderson said.

"The idea was we're going to prevent people who have been in homes for a long time from being literally taxed out of their homes for things they have no control over. But it didn't prevent eventually reassessing. When you sell a home, it goes right up to the market value."

The caps in place under Proposal A will continue to limit the pain of inflation for long-term homeowners. But inflation-adjusted tax hikes are likely to be worse than they were in the past, if inflation continues.

Contact Susan Tompor: stompor@freepress.com. Follow her on Twitter @tompor. To subscribe, please go to freep.com/specialoffer. Read more on business and sign up for our business newsletter.

This article originally appeared on Detroit Free Press: Inflation to drive up Michigan property taxes now — and next year