Meet the Goldman Sachs-Backed Fintech Startup Aiming to Take Over North America

Consumers who have ever used an app to manage any aspect of their finances have most likely used Plaid—even if they didn’t know it.

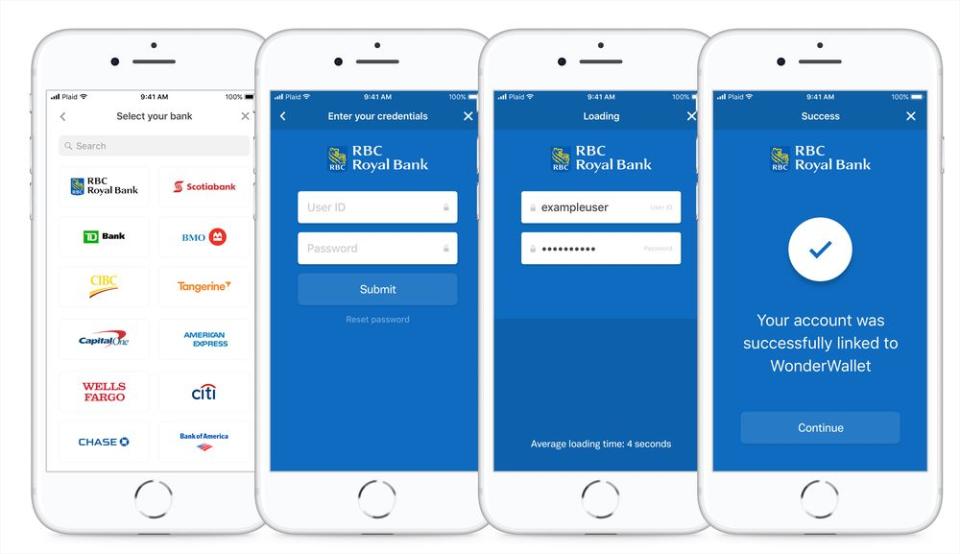

Fintech companies from robo-advisors to budget trackers to lenders all depend on the little-known startup. Based in San Francisco, Plaid provides the technology that allows consumers to connect their bank accounts to a plethora of mobile apps, including Venmo (for free payments), Robinhood (no-commission stock-trading), robo-advisors Betterment and Wealthfront, and Coinbase (a Bitcoin and cryptocurrency exchange).

Now Plaid, which raised $44 million in a funding round led by Goldman Sachs Investment Partners nearly two years ago, is looking to expand internationally. The company announced Tuesday that Plaid is available in Canada for the first time—and compatible with both U.S. and Canadian dollars—a move designed to both support current clients’ Canadian expansions as well as attract new Canadian fintech players.

Plaid has become “indispensable” to a wide swath of the financial technology industry, says Christopher Dawe, co-head of Goldman Sachs Investment Partners venture capital and growth equity team: “They’re powering thousands of applications, and millions of users rely on Plaid every day.”

Canada is an opportunity to grow Plaid’s reach further.

“We think about making money easier for everyone, allowing people to live the financial life they want to live,” says Zach Perret, CEO and co-founder of Plaid. “And that’s not just a U.S.-only mission.”

Companies use Plaid’s APIs (or application programming interfaces) as a foundation for building their own fintech products, depending on that secure way to link customers’ bank accounts. Its extension into Canada is a sign that the nascent fintech industry is gaining traction in more parts of the world. TransferWise, a London-based cross-border payments startup that uses Plaid, recently expanded into Canada as part of a global push. And Toronto-based Drop, a loyalty rewards app, is one of Plaid’s first Canadian clients.

“It’s crazy to see the expansion of fintech generally. As we look just at the U.S. market, we saw a lot of excitement over the last two years and that excitement is ramping, not slowing down,” Perret says. “But we were up in Toronto, and there’s a great burgeoning fintech community in Toronto as well, and more broadly across the entire country.”

Plaid’s clients already represent a broad spectrum of the financial technology industry, including payroll startups such as Zenefits and Gusto, and, says Perret, the majority of American cryptocurrency companies—a young but booming market.

As new products continue to proliferate for various financial tasks, Plaid is likely to grow as well, adds Dawe, who calls Plaid the “data layer” in the fintech ecosystem. Says Dawe, “The benefit of Plaid is it works across all of them.”