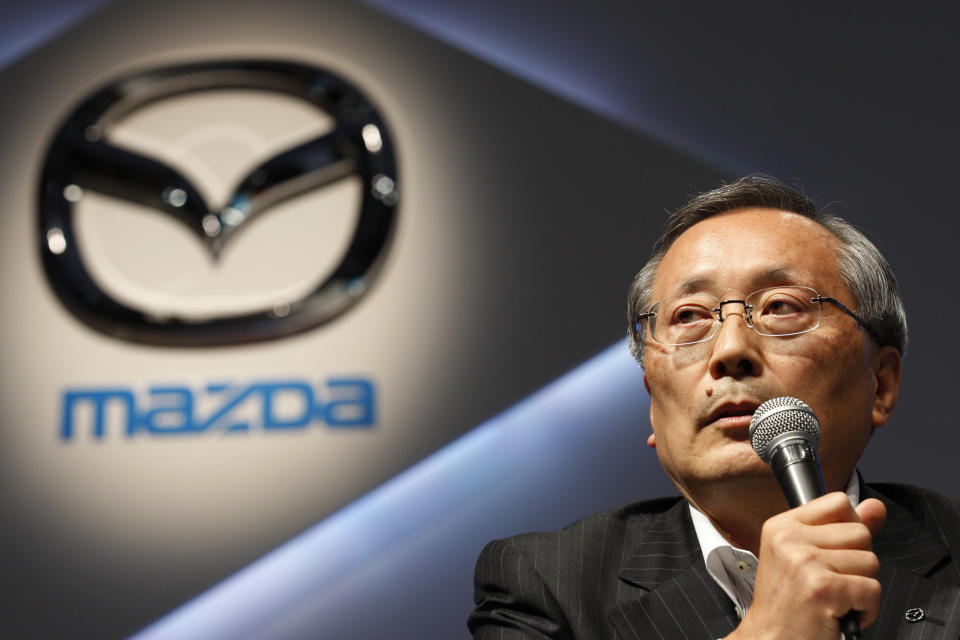

Mazda shares dive on plan to raise $2 billion

TOKYO (AP) — Mazda stock dived nearly 7 percent Thursday after the struggling car maker said it will raise about $2 billion from selling new shares to invest in assembly plants and developing new vehicle technologies.

The Japanese company, which makes the Miata sports car, said in a statement it aims to have half of its vehicle production based overseas by early 2016 as part of plans to make its business more competitive.

Mazda's earnings have been hurt by the yen's sharp rise, the tsunami disaster last year in Japan, flooding in Thailand and the European debt crisis. Its shares closed down 6.8 percent at 37 yen in Tokyo.

Of the 163 billion yen ($2 billion) it hopes to raise from the share sale, some 93 billion yen will be allocated to developing auto technologies focused on fuel efficiency and safety.

The rest will go toward building new car and engine assembly factories in Mexico and upgrading existing assembly lines in Russia, China, Japan and Southeast Asia.

The automaker plans to introduce eight new vehicles by early 2016 using its "Skyactiv" technology that improves fuel efficiency by 20 percent to 30 percent compared with older models.

It said it continues to seek alliances with other automakers overseas.

Mazda, which has lost money for the last three fiscal years, is struggling to assert its brand as the relationship with longtime partner Ford Motor Co. withers.

Dearborn-based Ford bought 25 percent of Mazda in 1979, raising it to 33.4 percent in 1996. But Ford began cutting ties in 2008, and in 2010 lowered its ownership to 3.5 percent.

Mazda does not have flashy green technologies in its lineup that its bigger Japanese rivals do — such as the hybrids at Toyota Motor Corp. or electric vehicles at Nissan Motor Co.

Apart from the share sale, Mazda is planning to borrow 70 billion yen to repay existing loans.