The Math On Exploration & Production Stocks Doesn’t Add Up (XOP)

From Invesco: In my more than 20 years in the investment business, I have seen many companies and industries lose their focus and discipline for a variety of reasons.

Today, the exploration and production (E&P) sector fits squarely into that category. The compensation plans laid out by E&P corporate boards encourage these companies to grow production at almost any cost — which builds the personal net worth of the chief executive officers (CEOs), but does nothing for the shareholders for whom they are legally fiduciaries.

There are actions that boards and CEOs can take to rectify this situation, however. In my view, such changes could present a unique opportunity for the E&P sector to generate returns not only above current levels, but higher than their historical norms.

As a value investor, I know energy companies have generally not offered a high level of cash flow return on their invested capital (CFROI). The average E&P stock has delivered an annual CFROI of about 3% on average since 1955.1 That pales in comparison to the average stock in the S&P 500, which has delivered a 9% CFROI on average over the same period.1 This is an important statistic for stock investors — since 1955, companies with higher CFROIs have outperformed those with lower CFROIs.1

Within this long-term trend, there have been times when — at the bottom of an energy cycle — value investors could identify a few E&P stocks that were selling at deep discounts to their reserve values, and could make money for a few years in spite of the industry’s lack of capital discipline. That is, until this cycle. Today, E&P companies have reached a new level of capital irresponsibility, and most are actually generating negative returns and losing money for their shareholders — making that historical 3% return actually look good in comparison.

Many investors may not realize the extent of the problem. Why? Because companies like to talk about their stellar returns on individual wells but never want to discuss why their overall corporate returns are so low. One anomaly in the calculation of individual wellhead returns is that E&P companies don’t include the purchase price of the property in their return calculations. They only count the ongoing expenses of running a well, which is how they come up with their high, but misleading, wellhead returns. How can a company make any investment — such as a house, a business or, in this case, acreage containing oil and gas — but not include the purchase price? Why is this allowed? As they say, it always starts at the top. For E&P companies, that means the boards of directors that are constructing compensation programs to incentivize CEO strategy.

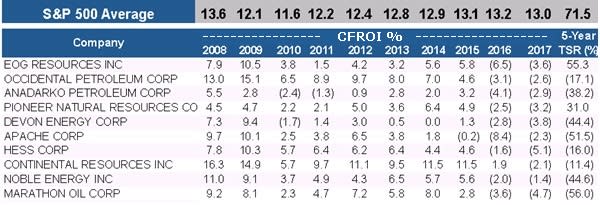

When I dig through the proxies of these companies, I see a distinct pattern of paying senior managements for short-term production growth without regard to the impact of weak cash flows and, in many cases, negative earnings. Within these companies’ long-term incentive plans, which represent the bulk of most CEOs’ annual compensation, there is a strong focus on how total shareholder return (TSR) compares with that of other E&P stocks. This means that CEOs can attain the long-term goals set by the boards simply by having their stock depreciate less than the stocks of other E&P companies.

You can see from the chart below that focusing on production growth without regard to corporate-level returns has led the industry to a sustained period of lower CFROIs (and subsequently weaker stock prices) versus the overall market even before oil prices dropped in 2014.

Sources: Credit Suisse HOLT, Bloomberg L.P., as of Aug. 21, 2017

The E&P industry is clearly at a crossroads, and boards and management teams need to be held accountable for creating shareholder value over a cycle if they want long-term investors to buy their stocks. As I stated earlier, I believe there is truly a unique opportunity for the E&P sector to generate returns not only above current levels, but higher than their historical norms — if the proper actions are taken by the boards and CEOs of these companies. We all like growth, but it must be profitable growth.

Because of the advent of technologies that have expanded access to shale gas, the E&P industry has visibility into reserves that will allow them to balance production growth and cash flow growth while distributing cash to shareholders in the form of buybacks and dividends. Hopefully in the upcoming year, the boards of these companies will question the value proposition they owe their shareholders and start incentivizing management teams to generate 1) incremental rates of return on total corporate capital, 2) free cash flow, and 3) less issuance of debt and equity. This would lead to lower — but more pragmatic — levels of production growth.

Investors and management teams can all win if these companies start to be managed more responsibly from a capital standpoint. If these steps are taken, I believe this is an industry that can become investable over a full market cycle and offer investors attractive returns.

1 Sources: Credit Suisse HOLT, Bloomberg L.P., as of Aug. 21, 2017

The SPDR S&P Oil & Gas Exploration & Production ETF (XOP) was trading at $34.18 per share on Friday afternoon, down $0.02 (-0.06%). Year-to-date, XOP has declined -17.12%, versus a 13.35% rise in the benchmark S&P 500 index during the same period.

XOP currently has an ETF Daily News SMART Grade of C (Neutral), and is ranked #24 of 36 ETFs in the Energy Equities ETFs category.

This article is brought to you courtesy of Invesco.