Materials Dividend Stocks Of The Month: Centralia Metals And More

The materials industry is deeply cyclical with producers benefiting highly during an economic boom and many players going bankrupt in a bust. Thus, there is ample opportunity to take advantage of improving economic conditions which has led to strong demand for commodities. These materials stocks are also well-positioned to take advantage of rising commodity prices while offering an attractive dividend yield. If you’re a long term investor, these high-dividend materials stocks can boost your monthly portfolio income.

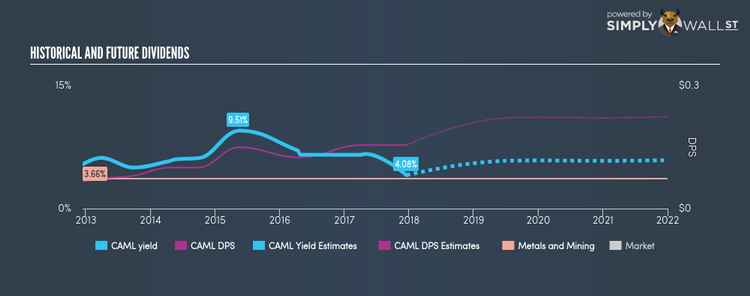

Central Asia Metals Plc (AIM:CAML)

CAML has a large dividend yield of 4.08% and pays 73.46% of it’s earnings as dividends . Besides capital gain prospects, just the yield is higher than the low risk savings rate – enticing for investors with goals of beating their bank accounts. Plus, a 4.08% yield places it amidst the market’s top dividend payers. The company’s future earnings growth looks promising, with analysts expecting earnings growth over the next three years to reach 88.51%.

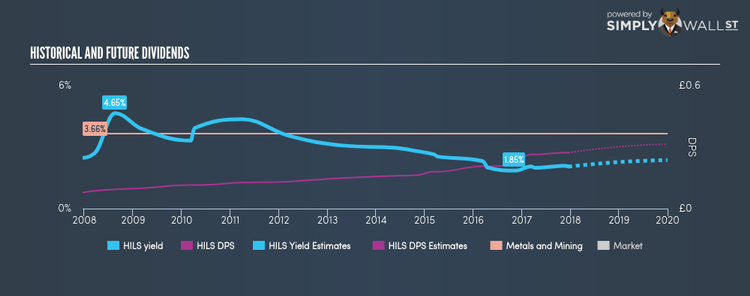

Hill & Smith Holdings PLC (LSE:HILS)

HILS has a nice dividend yield of 2.05% and pays out 46.62% of its profit as dividends . HILS’s dividends have increased in the last 10 years, with DPS increasing from £0.078 to £0.273. They have been consistent too, not missing a payment during this 10 year period.

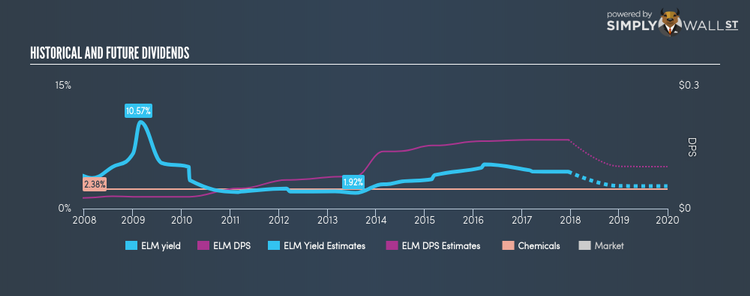

Elementis plc (LSE:ELM)

ELM has an appealing dividend yield of 4.50% and their payout ratio stands at 52.95% . ELM’s DPS have risen to $0.168 from $0.026 over a 10 year period. The company has been a dependable payer too, not missing a payment in this 10 year period. Elementis is a strong prospect for its future growth, with analysts expecting the company’s earnings to increase by 52.79% over the next three years.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.