With markets on a wild ride, is gold a safe haven?

If you’re an athlete at the 2018 Pyeongchang Games, gold is pretty much all you care about. But if you’re looking for a safe haven for your money, it’s not quite that simple.

As the Dow Jones industrial average experiences two of its worst weeks in years (and the Toronto Stock Exchange isn’t far behind), many investors are starting to wonder if their money would be better spent on a “safe” investment like gold.

The last year has been a bit of a roller coaster for gold, and Scott Clayton, Senior Analyst at TSINetwork.ca, isn’t confident that gold is the safe haven it’s always been portrayed as.

“It seems as though all bets are off as to whether gold is, or ever really was, a safe harbour in times of stock market volatility,” says Clayton.

Stephen Lingard, Portfolio Manager with Franklin Templeton Multi-Asset Solutions, says that his firm isn’t currently including gold in its portfolio, as they think there are other options that better balance out equity investments.

“Gold is not a good defensive investment,” says Lingard. Instead, Lingard says his firm’s portfolio focuses on other investments that are valuable in times of high volatility. He recommends that people looking for defensive investments consider bonds, cash, or defensive currencies like the Swiss franc, Japanese yen, euro, or even the U.S. dollar instead.

“The real interest rate dropped as we entered the financial crisis, and gold spiked,” says Lingard. He says gold doesn’t perform as well in environments where interest rates are three per cent or higher, so investing in gold is hedging a bet that interest rates will also stay low.

But Ryan McKay, Commodity Strategist at TD Securities, disagrees, and thinks that gold still remains a worthwhile investment, especially if you’re looking to invest for the long term.

“Gold is likely to lose a couple of dollars, but it’s going to get stronger going forward,” says McKay.

McKay says TD has pinned the price of gold to stay relatively low until mid-2019, making now a good time to buy and wait for the price to eventually go up.

The market is only one piece of the puzzle when it comes to why McKay thinks gold is worthwhile to buy now. He points to lower interest rates, strong U.S. financial data and the expectations of the U.S. Federal Reserve as being more reasons why gold is an appealing investment.

“Gold isn’t correlated to other factors like the stock market and the debt market, which are both at pretty high levels historically,” says McKay.

“If things get really bad, we could see gold head higher.”

Lingard says that if interest rates stay low, gold could be a worthwhile investment, but as those rates go up, gold becomes less attractive.

“We’re not at two to three per cent real interest rates right now, so it may offer a nice complement to a portfolio full of equity assets, because market volatility has come back,” says Lingard. He adds that it’s all about looking for how you can balance out your portfolio, and gold is certainly one way investors may choose to do that.

Gold stocks vs. physical gold

While holding gold bullion is one way of investing in the precious metal, a better alternative may be to look at gold stocks.

“Gold miners and producers have had to tighten their belts in this more difficult environment in the last three to four years,” says Lingard, explaining that this had led to increased efficiencies and productivity. With gold prices still relatively high, and the leanness adopted by the miners and producers still in place, it’s an opportunity for investors to get a better return on their money.

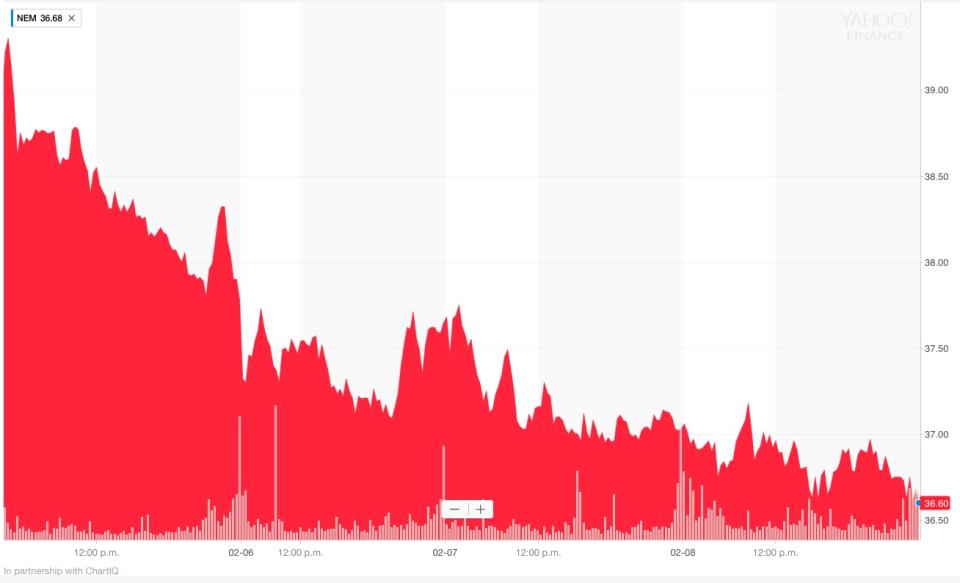

Clayton says that some popular gold stocks, like Newmont Mining, have taken a significant hit in the last few days of turmoil, following the rest of the market down.

But he says he still generally prefers to hold gold through gold-mining stocks, even if the prices do go down. While gold stocks will be influenced by the market, those stocks will pay dividends when the market conditions are favourable. Buying physical gold, on the other hand, requires the buyer to pay for carrying costs.

“All in all, gold prices are very unpredictable,” says Clayton. “and we think it’s better to invest in high-quality dividend-paying stocks.”

Download the Yahoo Finance app, available for Apple and Android.