Pound extends rally above $1.22 as MPs back Brexit delay bill: as it happened

Pound holds strong gains above $1.22 versus dollar

Carney admits impact of worst case no-deal Brexit now less severe

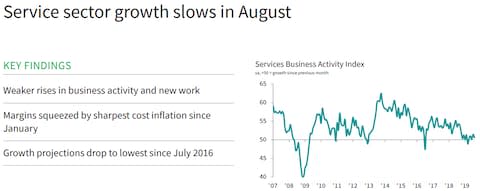

Sluggish services-sector data puts UK on track for second quarterly contraction

Global banks see Corbyn the lesser of two evils as no-deal looms

The pound is down in the dumps, and there could be worse to come

Markets wrap: Sterling rallies to new intraday highs

Sterling is hitting fresh intraday highs on currency markets after MPs rejected the motion for an early election. Labour will not back a snap vote until the Brexit delay bill gains Royal Assent.

The pound is finishing the day 1.4pc higher against the dollar at $1.2250, one of its best rallies this year. Can sterling continue its surge higher tomorrow?

Join us for more live coverage from business and markets tomorrow morning. Have a good evening.

The double shock of global recession and a no-deal Brexit may be more than Europe can withstand

The latest column from our international business editor Ambrose Evans-Pritchard is now up on our website. It's gloomy reading for the battered eurozone economy.

He warns that Europe is facing the twin threats of a no-deal Brexit and global downturn while having little ammunition to fight off a recession. Here is a snippet from his piece, which can be read here.

Britain’s constitutional crisis has hit before the next great spasm of Europe’s intractable monetary crisis. But they are in close competition.

The eurozone faces a category five economic storm. It is structurally defenceless as the world slides into recession. This will not be an ordinary downturn because central banks no longer have the instruments to fight it.

If there is an October election in the UK - and if it delivers a bigger Tory majority as polls suggest - EU leaders will have to decide whether to risk adding the shock of a no-deal Brexit to all the other shocks hitting their industries.

Sterling barely budges as MPs back Brexit delay bill

Sterling has barely budged on currency markets this evening despite MPs backing the Brexit delay bill.

While it is a rather unremarkable reaction to the latest dramatic development in the Brexit saga, sterling has been building on its strong gains throughout the day.

After sinking to its lowest level in more than three decades yesterday morning (when excluding the October 2016 "flash crash"), it has recovered back above $1.22 this afternoon. surging 1.1pc.

It's a small dent in its huge losses in recent weeks but sterling appears to have finally regained some upward momentum. Holidaymakers rejoice!

#GBP intraday ⬆️ after the House of Commons passed the Hilary Benn #Brexit Bill. @businesspic.twitter.com/QtDP8yn3T3

— Kieran Joseph Morgan (@KJM_Lawyer) September 4, 2019

The best from today's economics news

It has been another busy day on the economics team with Chancellor Sajid Javid's spending review and Mark Carney's grilling from the Treasury Select Committee.

Fear not, our economics team has the best stories and analysis from the day here on the Telegraph website.

Our economics editor Russell Lynch has provided his insight on the spending review, writing that Javid's magic money tree is the ultra-low interest rates that governments can currently borrow at.

Finally, we have latest services sector PMI, which suggests that the economy could be sliding into recession.

Sterling rebounds back to $1.22

Sterling has enjoyed one of its best days of trading of 2019 as MPs move to block a no-deal Brexit.

Sterling has jumped 1.1pc against the dollar to burst back over the $1.22 mark, a strong recovery from the 34-year low it dropped to yesterday.

Jane Foley at Rabobank has the latest on why sterling has surged:

"The boost stems from the increased likelihood that the UK Opposition supported by Tory rebels will be able to push legislation through parliament to stop a no deal Brexit on October 31. While this reduces political risk, the pound remains a very vulnerable currency."

Stocks surge as relief sweeps markets

Traders' computer screens are awash with green this afternoon as a relief rally sweeps global stock markets.

Why the sudden jump in stocks? Three key risks that have been threatening to boil over have been calmed in the last 24 hours.

First, MPs made a stride towards blocking a no-deal Brexit in Parliament last night. Second, tensions in Hong Kong have been dialed down by its leader Carrie Lam withdrawing the extradition bill. And finally in Italy, members of Five Star Movement approved its new coalition with the Democratic Party, meaning far-right leader Matteo Salvini will not get the chance to seize power in new elections.

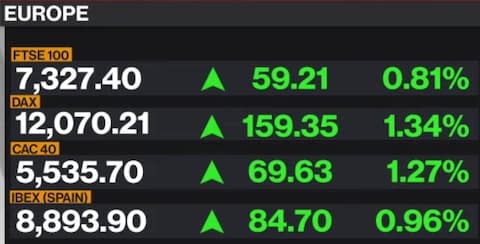

That has triggered a 0.6pc rise in the FTSE 100, a 1.6pc jump on Italy's FTSE MIB index and a 4pc surge on Hong Kong's Hang Seng.

Bank revises Brexit doomsday scenario but Carney strikes gloomy tone

With Mark Carney's grilling from MPs over, let's look at the best bits from the Treasury Committee hearing.

The Bank of England making its worst-case Brexit scenario much less severe than first feared will grab the headlines but Mr Carney still struck a rather gloomy tone.

The peak-to-trough drop in GDP is now expected to be around 5.5pc in the Bank's doomsday scenario, compared to its previous estimate of 8pc.

On the current performance of the economy, the Governor said that "the underlying pace is weak" and "close to zero"

He also believes that the global economy is struggling, saying that the trade tensions have "shifted into an actual trade war". Click below if you want to read the Bank's latest analysis.

We're just published the Bank of England's updated economic analysis of #Brexit ➡️https://t.co/G8SjLfJWWI

Our evidence session with the Bank of England on Brexit and the latest Inflation Report is just about to start. Watch it live here:��https://t.co/RCT89ZcwGepic.twitter.com/qKOMmB92x0— Treasury Committee (@CommonsTreasury) September 4, 2019

Handover

With another evening of Westminster excitement ahead of us, I’m handing over to economics correspondent Tom Rees, who will steer the live blog through the next few hours. Thank you everyone who has followed along today — stay tuned for the latest business, markets and economic news — Louis

Back to Westminster...

...Mark Carney has been taking questions for over and hour and a half now, including a discussion of the difference between shocks meaning strong, fast movements, or unexpected movements (The Bank favours the former definition in its forecasting).

Mark Carney explaining the taxonomy of economic "shocks": "They call it the dismal science for a reason"

— Oscar Williams-Grut (@OscarWGrut) September 4, 2019

Mr Carney says the monetary conditions heading towards the October Brexit deadline are less slack than those leading up to the referendum in June 2016 — reducing the Bank’s ability to impact events. He has repeated he would be more likely to ease rates in the event of a no-deal Brexit.

Round-up: Green’s Arcadia loses second boss in a week, Barratt says it doesn’t fear Corbyn, Just Group constricted by regulation

Here are some of this afternoon’s big stories:

Sir Philip Green’s Arcadia loses second boss in a week: Sir Philip Green lost a second senior executive a day after one of its key lieutenants resigned from his retail empire. Jamie Drummond-Smith stepped down as interim chairman of Arcadia, which owns Sir Philip’s stable of brands, after he was drafted in six months ago to help with the company's restructuring plan.

Barratt boss says housebuilder is not worried by a Corbyn government: The boss of Barratt Developments, Britain’s largest housebuilder, has said he has no concerns about Jeremy Corbyn coming to power in a possible general election.

Just Group profits fall as stricter regulation bites: Just Group shares took a hit after the life insurer said first-half profits fell by more than a quarter to £114m as it seeks to comply with new rules forcing it to hold more capital behind its lifetime mortgage products.

Spending Review reaction round-up

In the chamber of the Commons, debate is now underway ahead of tonight’s key vote, which would be a major step towards forcing Boris Johnson to seek a Brexit delay in the event it appears Britain is heading for no-deal. Here’s some of the reaction coming in from business groups to Chancellor Sajid Javid’s SPending Review plans.

The Federation of Small Businesses’ Mike Cherry says:

This Spending Round marks a welcome — if brief — return to the domestic agenda. While parliament has long-been absorbed by Brexit, the issues of crime, derisory broadband and skills shortages that millions of small firms face day in, day out have been overlooked.

It’s important to stress that what small firms really want is a return to an environment where they can plan for the long-term, and policymakers consistently tackle domestic challenges head on. With the latest UK economic data painting a bleak picture, small businesses urgently need tangible support on the ground.

The FSB welcomed Mr Javid’s statements on crime and infrastructure, but said the Chancellor should not neglect apprenticeships.

The Federation of Master Builders’ Brian Berry (I promise not all the business groups’ leaders’ names will rhyme) says:

If we are to increase productivity and improve our competitive edge on the world stage, then building more new homes must form part of the Government’s campaign to upgrade our infrastructure... Today’s Spending Round set the scene for a positive outlook for builders, but we need more details about how more new homes will be delivered.

The FMB welcomed commitments to spending on towns, but said more details and a better sense of the Treasury’s long-term strategy were needed.

The Institute of Directors’ Tej Parikh says:

The Spending Round saw the Chancellor turn on the taps, but the under-pressure business community still needs more direct support...

...many firms may still be left wanting an emergency Budget soon, whatever happens with Brexit. One-off reliefs to business rates would support margins in a challenging period, and a moratorium on the implementation of potentially disruptive regulations would help cut down business to-do lists and get directors focusing on adjusting to Brexit and investing in their firms.

Earmarking departmental spending is a vital exercise, but firms would much rather see longer-term outlines to inform their own investment plans. The accelerated process also afforded little space for businesses to feed in their priorities. Meanwhile, there is concern that, without official forecasts alongside, the money allocated may eat into future funding.

Carney: Brexit could create ‘supply shock’

The Governor is describing the possibility of a “supply shock” to UK manufacturers and exporters in the event of an unruly Brexit, saying not amount of monetary policy can soften the “disruption element”.

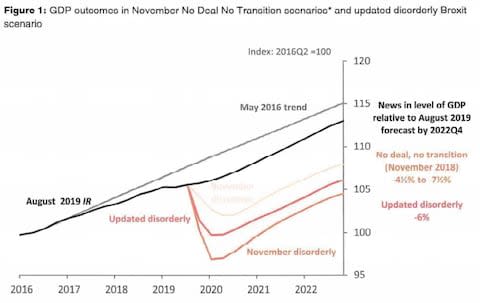

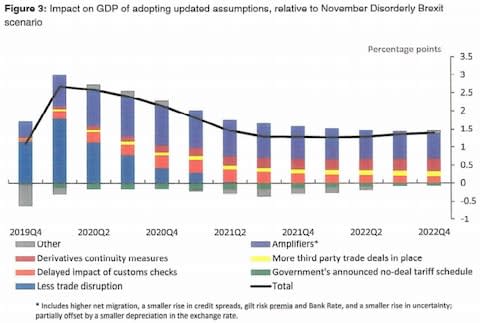

The Bank’s GDP impact model, visualised

Here are the graphs Mark Carney shared with the Treasury Select Committee to demonstrate its shifting forecasts for a no-deal Brexit:

More key points:

Mr Carney says the world has not yet shifted towards a global recession, but that a manufacturing recession is close. He says a trade-war induced slowdown could take 1pc off the UK economy.

Mr Haskel says Brexit uncertainty has started having a more persistent impact on the economy

Mr Carney says there is still space for monetary policy to provide easing

Mr Haldane says interest rates should be held until fog of Brexit has passed

Mr Carney says the Bank does not need new powers currently

Pressed on whether he would stay on beyond the end of his tenure, which is set to finish on January 31, Mr Carney said he has already served two extensions and said the governorship is a matter for the government of the day.

UK bonds bounce back for yesterday’s drop

One key measure of sentiment about the UK economy is the yield on government 10-year bonds, which hit an all-time low yesterday at the same moment the sterling hit a 34-year low.

They’re bounced back strongly since then however, and are now standing closer to their average over the past month. Obviously though, that jump looks a little less impressive in a long-term view:

Carney: Key answers so far

Questions from John Mann were fairly broad. Mr Carney and Mr Haldane have so far said:

The Bank won’t commit to a monetary response to Brexit

Mr Carney can’t see the Bank ever intervening over foreign-exchange prices

The impact of Sajid Javid’s spending review can’t yet be known

As a reminder, you can watch live here.

Mark Carney: Impact of worst-case scenario Brexit has been reduced

Speaking to the TSC, Mark Carney has confirmed that the Bank of England’s latest assessments suggest the impact of a worst-case-scenario Brexit has been somewhat reduced because of recent efforts to prepare companies.

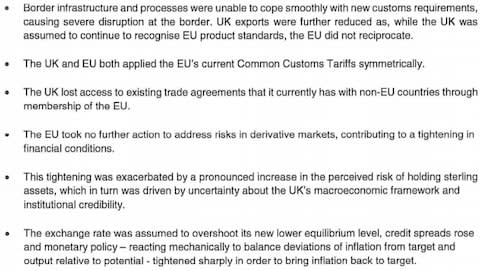

Here is an outline of the worst-case scenario envisaged by the Bank during its planning efforts:

Mr Carney is now outlining — as he has at several points recently — that the UK’s financial sector is well-prepared for Brexit, whatever form it takes, and has plans in place to offers support depending on the outcome of negotiations.

“That policy response would not be automatic,” he says, saying the Bank would need to be reactive to maintain price stability.

As blow are traded in the Commons...

...we’re going to move into a (hopefully slightly quieter) atmosphere at the Treasury Select Committee hearing on the UK’s economic relationship with the EU, and the Bank of England’s Inflation Reports. Heading over from Threadneedle Street are:

Mark Carney, Governor of the Bank of England

Andy Haldane, chief economist and executive director, Monetary Analysis & Statistics

Professor Jonathan Haskel, external member, Monetary Policy Committee, Bank of England

Dr Gertjan Vlieghe, external Member of the Monetary Policy Committee, Bank of England

A live video will be showing here.

Ahead of Mr Carney’s appearance, the TSC has published a letter the Governor sent to new acting committee chair John Mann MP. It can be viewed here. In it, Mr Carney says:

The worst-case Brexit scenarios are now less severe than in 2018 because of preparation activities

The initial ‘peak-to-trough’ drop in GDP during a worst-case scenario Brexit would now be 5.5pc, not 8pc, with a rise in unemployment to 7pc, and inflation rise to 5.5pc

The core of the UK’s financial system is prepared for Brexit

Ultimate Performance sale means big payday for former City boy

Nick Mitchell, who owns the majority of the high-end personal training business Ultimate Performance, is in line for a big payday from the partial sale of the company. My colleague Vinjeru Mkandawire reports:

The fitness chain, which charges as much as £150 an hour for one-on-one time with a personal trainer and tailored workout regimes, has been approached by private equity investors, City sources said.

It took on a $10m investment three years ago from Hong Kong private equity firm Cassia Investments, which focuses on consumer businesses.

You can read her full report here: Former City worker set for big payday from Ultimate Performance stake sale

Spending review in full

You can read the full details of the Spending Round on the government’s website here.

The Treasury has summed up some of the key points here (bear in mind that the Treasury does not contextualise most of its numbers in terms of real-terms increases and long-term cuts).

Shadow Chancellor John McDonnell has labelled the plans the a “sham”, and accused the government of “failing to deliver a real end to austerity”.

Wowsers. Boris Johnson was shouting at John McDonnell. McDonnell: “The last time he was shouting at someone they had to call the police”. A joke at the expense of the PM’s row with his partner.

— Kate McCann (@KateEMcCann) September 4, 2019

US trade deficit narrowed in July despite trade truce

The United States’ trade deficit narrowed to $54bn in July, less than the expected drop. Goods exports from the US to China continued to shrink, despite the truce between the countries that was still in place then (how things have changed).

Here’s how tariffs now stand:

Sterling holds steady as Javid announces spending plans

The pound has been pretty level since PMQs started an hour and a half ago, and is currently up around 0.9pc against the dollar. The Chancellor is running through the specifics of intra-departmental budgets currently.

You can follow the latest details on the specifics on our politics live blog, with my colleague Danielle Sheridan:

Here’s Telegraph deputy political editor Anna Mikhailova’s take:

Chancellor's first major statement is painful to watch.

Reprimanded repeatedly by Ken Clarke and Bercow for talking politics

Heckled as he tries to tell personal story about how public services helped him

Heckled as finally gets to announcements after 15 minute intro— Anna Mikhailova (@AVMikhailova) September 4, 2019

Javid: ‘We can now turn the page on austerity’

Details are starting to come out now...

The Chancellor has announced plans for extra day-to-day spending of £13.8bn next year.

The UK must focus on improving productivity.

A “new economic plan” will be developed

Investment can increase due to low present cost of borrowing

Javid will review fiscal framework ahead of budget later this year “to ensure it meets the economic priorities of today, not a decade ago...”, in coordination with Bank of England

Infrastructure will be a key focus, from “the motor highway to the information superhighway”

Telegraph business editor Ben Wright tweets...

Sajid Javid's inner credit trader getting an airing here with a long section of the speech dedicated to interest rates #spendingreview

— Ben Wright (@_BenWright_) September 4, 2019

Six minutes into the speech, we have no details on spending plans...

...and Mr Bercow is once again telling off the Chancellor for “veering into matters... unrelated to the spending round”. So far, the Chancellor’s speech has primarily been talking about Britain’s prospects post-Brexit.

Sajid Javid getting a telling off for electioneering in a financial statement. Old School.

— Mikey Smith (@mikeysmith) September 4, 2019

Bercow really winding up Tory MPs by suggesting that @sajidjavid can't make political attacks on Labour during financial statement. Surely every Chancellor does that? Albeit stimes with the polite convention of 'I've had representations from...[cue ridicule of Lab policy]'

— Paul Waugh (@paulwaugh) September 4, 2019

Javid interrupted

Mr Javid was just interrupted after saying: “A strong economy can only be built on a strong democracy”.

After an point of order by Kenneth Clarke — who was ousted from the Conservatives yesterday — Speaker John Bercow has criticised the Chancellor, saying his speech’s political frills were “out of order”.

Javid: ‘A new economic era needs a new economic plan’

The Chancellor is speaking now. He has promised “the fastest increase in day to day spending in 15 years”. He said:

...after a decade of recovery from Labour’s great recession we’re turning the page on austerity and beginning a new era of renewal

Boris Johnson forgot about his government’s spending round and tried to leave the chamber at the end of PMQs. Matt Hancock pointed it out and told him to go back

— Henry Zeffman (@hzeffman) September 4, 2019

The Prime Minister gets up to leave after PMQs, but is reminded by the Health Secretary Matt Hancock that it might be a good idea if he sticks around. He returns to his seat

— Chris Mason (@ChrisMasonBBC) September 4, 2019

Sajid Javid up now...

It looks like the Spending Review will start late...

...as questions remain in full flow in the Commons.

I think it’s fair to say PMQs today has produced more heat than light. Hopefully we’ll be dealing slightly more with solid numbers soon.

The force of Trump’s Twitter

It’s probably still a while until the US command-in-chief awakens, but in meantime, here is a fascinating analysis of an apparent correlation between his tweets and underperformance on Wall Street:

Trump tweet analysis taken to the next level by BAML: 90th and 10th percentile of the number of tweets (quite why they think this is a normal distribution who knows but fun) pic.twitter.com/T38c77uyqM

— James Mackintosh (@jmackin2) September 4, 2019

Here’s more on that phenomenon: Can investors protect themselves from Trump’s Twitter tirades?

Full report: Services slowdown shows UK ‘slipping into recession’

Deputy economics editor Tim Wallace has a full report on this morning’s PMI figures, which indicate Britain is spiralling towards a recession. He writes:

Services companies, which make up the biggest part of the private sector, stalled last month, while the manufacturing and construction industries contracted.

This puts the economy on track to shrink by 0.1pc in the third quarter of the year, according to the purchasing managers’ index (PMI), a survey of businesses compiled by IHS Markit.

You can read his full report here: UK ‘slipping into recession’ as businesses clam up before Brexit

Cathay Pacific chair exits amid Hong Kong protests

Airline Cathay Pacific — caught in severe turbulence due to its exposure to events in Hong Kong — has lost another senior leader, with the exit of chair John Slosar. The Telegraph reports:

The Hong Kong-based airline has become the biggest corporate casualty of anti-government protests after Beijing demanded it suspend staff involved in or supporting demonstrations that have plunged the former British colony into a political crisis.

John Slosar, 63, will be replaced by Patrick Healy, a long-time executive at the airline's biggest shareholder Swire Pacific.

You can read a full report here: Cathay Pacific loses chairman as well as chief executive in wake of Hong Kong protests

PMQs is about to begin...

...you can keep up with all the fun here (BBC Parliament) or here (Parliament TV).

Pound sentiment stays strong

Sterling’s cheer is showing little sign of abating, up 0.85pc against the dollar in today’s session, and 0.43pc against the euro. As a reminder, the boost is also being helped by a knock to the dollar on the past day following poor US manufacturing data.

Tweet: Corbyn will not support election until ‘threat of no-deal has been removed’

Here’s the clearest line yet on what to expect from the Rebel Alliance’s strategy:

Corbyn hosted opposition leaders in the Commons office this morning, including LibDems, SNP and Plaid, saying Labour will only support a general election when “the threat of no deal has been removed”.

— Jessica Elgot (@jessicaelgot) September 4, 2019

Corbyn has just had another meeting with opposition leaders this morning - concluded they wouldn’t support election until confident no deal threat has gone ... suggestion watering down position from last night?

— Laura Kuenssberg (@bbclaurak) September 4, 2019

Javid may need to rely on tax cuts to stimulate economy

Sajid Javid’s Spending Review, details of which the Chancellor will announce to the Commons from 12:45pm (about an hour from now), is likely to include some big spending commitments as the Government tries to offset the current downturn.

Royal Bank of Canada analysts have looked at Mr Javid’s options, and concluded he may find it easiest to focus on tax cuts as a means of injecting money into the UK economy without breaking rules on spending limits. They write:

Given the backdrop, it came as no surprise to us that the UK government was also said to be preparing a package of fiscal measures to be rolled out in the event of a no-deal Brexit. Nor were we surprised that a VAT cut was under consideration as part of any fiscal stimulus package.

Why? Casting our mind back to 2008, the last time the UK undertook a fiscal stimulus to counter an economic shock, there was a broad consensus that any stimulus should meet three broad principles; namely, that it should be timely, temporary and targeted.

Against those criteria, government spending has a couple of potential drawbacks. Increasing spending quickly, particularly in the middle of a fiscal year can be difficult in practice (‘shovel ready’ projects don’t tend to be that plentiful and those that are tend not to have been given the go-ahead for reasons other than a lack of funding). In addition, it can be difficult to bring government spending, particularly day-to-day spending, back down once it has been increased.

Therefore, any large fiscal stimulus has to rely on tax cuts to a large degree. Tax changes have the advantage that they can be made relatively quickly, can be time limited and can be targeted at certain individuals and/or firms.

They’ve shared the following table, based on HMRC data, showing the impact different cuts could have:

The analysts conclude:

Obviously, if the UK parliament does block a no-deal Brexit this week then discussions of a fiscal stimulus will recede. However, for the reasons outlined above, should it fail to do so expect VAT changes to feature prominently in any possible fiscal response.

Meanwhile, in Westminster...

We are just over half an hour away from what is likely to be a fairly painful session of PMQs for Boris Johnson, who dramatically lost his majority yesterday.

The question-and-answer session marks the beginning of an afternoon of heavy Parliamentary activity, which could well end with a General Election being called.

For now, Labour leader Jeremy Corbyn is saying he would block an attempt to call an election. Mr Corbyn’s fear — and that of many other members of the so-called Rebel Alliance — is that an Mr Johnson would stall an election until after Britain exit the EU at the end of October.

You can follow the latest updates here:

Initial reaction to bill reversal suggests problems are not over

Carrie Lam just made a video address to the people of Hong Kong, in which she announced the extradition bill would be withdrawn.

The initial reaction has not been overwhelming positive, not least because the Hong Kong chief executive only agree to one of the pro-democracy protesters’ five key demands.

Most significantly, she rejected a call for an independent investigation into police actions during the protests, something both businesses and civic groups have supported.

Futures trading on the Hang Seng index, which closed up 3.9pc, are currently indicating a 0.9pc drop when trading re-opens.

Breaking: Extradition bill withdrawn

JUST IN: Hong Kong leader Carrie Lam says controversial extradition bill has been fully withdrawn pic.twitter.com/Jm5g4T26gC

— Reuters Top News (@Reuters) September 4, 2019

Hong Kong leader Carrie Lam formally withdraws legislation that would have allowed extraditions to China https://t.co/gafHsWZ42apic.twitter.com/L52pSNIPOA

— Bloomberg (@business) September 4, 2019

Hong Kong-exposed stocks charge forward on expectations of bill withdrawal

Reports that Ms Lam will announce the formal withdrawal of the controversial China extradition bill have put a fire under Hong Kong-exposed stocks.

Prudential, which conducts around half its business in Asia, is up 5.3pc

Standard Chartered is up 3.6pc

Burberry, which does well in the territory’s luxury markets, is up 3.5pc

Tweet: Hong Kong leader Lam to announce withdrawal of extradition bill shortly

Wire reports suggest Carrie Lam, chief executive of Hong Kong, will at 6pm Hong Kong time (11am London time) announce plans to withdraw the extradition bill that has sparked months of large-scale protests in the country.

SOURCE SAYS CARRIE LAM WILL ANNOUNCE THE DECISION TO WITHDRAW THE BILL IN A SIX TO SEVEN-MINUTE PRE-RECORDED MESSAGE ON ALL TV STATIONS AT 6PM

— First Squawk (@FirstSquawk) September 4, 2019

An expectation that the bill will be dropped sent the Hang Seng Index to close 3.9pc up, but has also raised worries over Beijing’s response.

Oanda’s Edwards Moya said:

Violence might ease in Hong Kong, but the protests are likely to continue until we see the other four demands met; Beijing accepting of Lam’s resignation, an inquiry into police brutality, the release for those who have been arrested and more democratic freedoms. Today’s withdrawal is quite the pivot from yesterday’s comments from China’s top office that hinted they could unilaterally declare a state of an emergency.

Hong Kong protesters seem focused on a September 8th rally that will petition US congress to pass the Hong Kong Human Rights decency, a possible major complication that could derail longer-term solution. Beijing’s concession here appears to have happened too late and we may just see temporary reprieve with Hong Kong assets.

Scottish judge rejects legal challenge to block shutdown of Parliament

Last week feels like a very long time ago, but as a reminder: opponents of the PM’s plan to shut down Parliament launched a series of legal challenges against the prorogation attempt. The second of them, lodged in Scotland, has been rejected by a judge — meaning the move has been deemed lawful. The Guardian reports the judge as saying:

In my opinion, there has been no contravention of the rule of law. Parliament is the master of its own proceedings. It is for parliament to decide when it sits. Parliament can sit before and after prorogation

An appeal is expected.

Dunelm shares drop despite fresh rise in profits

Despite those upbeat results, Dunelm shares are having a bit of a mare this morning, reversing early gains currently to languish 7pc down at the bottom end of FTSE 250 movers.

My colleague Yolanthe Fawehinmi reports:

Chief executive Nick Wilkinson said the strong growth demonstrated the “breadth and depth of our specialist customer offer”.

However he warned the business remained “cautious about the full-year outlook due to increased Brexit uncertainty and specifically the impact it may have on consumer spending as we enter our peak period”.

That warning seems to have chimed with analysts and investors.

RBC analysts Richard Chamberlain and Wassachon Udomsilpasaid:

Dunelm has made an effort to refocus its offer on the core, resulting in a consistent core performance over the past year following the Worldstores acquisition. Despite this, we still have reservations regarding Dunelm’s medium-term sales target of £2bn and think it will be challenging to achieve this without sacrificing margin.

Peel Hunt analysts held their recommendation on the stock, adding:

Were it not for the macro and political uncertainty, we would be upgrading this morning.

Round-up: Dunelm continues winning spree, late PPI purge bites RBS, Goldman Sachs cuts Marcus rate

Here are some of this morning’s top business and money headlines:

Dunelm defies high street gloom as sales surge in store and online: Home furnishing retailer Dunelm shrugged off the doom and gloom of the high street to post a rise in profits of more than a third last year.

Late surge in PPI claims forces RBS to put aside nearly £1bn: Royal Bank of Scotland has warned over a hit of up to £900m for payment protection insurance after a last-minute surge in claims ahead of the August deadline.

Goldman Sachs cuts rate on former best-buy Marcus account: Goldman Sachs has cut the rate on its once market-leading Marcus savings account for new savers. The decision comes less than a year after the launch of the account, which made headlines for offering a sign-up rate of 1.5pc for the first year, dropping to 1.35pc thereafter.

Reaction: Stockpiling shift could still let Britain swerve recession

Pantheon Macroeconomics’ Samuel Tombs says the recession signalled by August’s activity data should not be taken “too literally”, with the expectation remaining that pre-Brexit stockpiling will mean companies will start spending quickly over the coming month.

The chances of a second consecutive drop in GDP, however, are remote, given that inventories will shift from dragging on GDP growth in Q2 to boosting it in Q3. In addition, the PMIs are excessively influenced by business sentiment and have given a misleadingly weak steer during the past 12 months of heightened political uncertainty. Note too that they exclude the retail and government sectors, which still are growing.

That pattern — of growth ahead of a Brexit deadline, followed by a winding down process after a delay — is what we saw in the first part of the year.

There’s some reason to take solace from this morning’s figures, especially as the services sector, which is the biggest and most important part of the UK’s economy, stayed above contraction levels.

But there’s also good reason not to prejudge what companies will thinking currently. With Boris Johnson’s major defeat in the Commons last night, several (now former) Tories have taken their gloves off.

If it looks likely that Parliament can steer the country away from a no-deal Brexit, companies might not bother stockpiling, so a wait-and-see attitude on investment would be the prevailing wind.

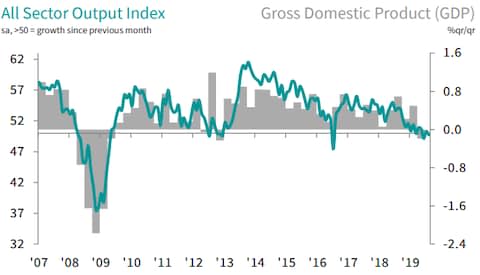

Here’s how PMI data trends versus UK GDP

Might the second Brexit-preparation boost not arrive? That’s what sluggish PMI data may suggest. Here’s how index’s measurements (which track orders and purchases to indicate activity) look versus UK GDP, the overall measure of economic growth:

Forward-looking indicators continue to hint at the malaise persisting or even intensifying in coming months. Inflows of new orders fell for the sixth time this year in August, dropping at one of the steepest rates seen over the past decade. pic.twitter.com/fL1RdJXois

— Chris Williamson (@WilliamsonChris) September 4, 2019

Recession fears grow Brexit-related worries underpinned service-sector fall

Analysts say those lukewarm August figures put the UK on track for a 0.1pc contraction in the third quarter, which would mean Britain enters a technical recession.

The IHS report says:

At 49.7 in August, the seasonally-adjusted All Sector Output Index dropped from 50.3 in July and registered below the 50.0 no-change mark for the second time in the past three months.

The fractional decline in UK private sector output reflected a sharp drop in construction work and another fall in manufacturing production, which more than offset a marginal rise in service sector activity.

Chris Williamson, IHS Markit’s chief economist, says:

Business activity in the service sector almost stalled in August as Brexit-related worries escalated, curbing spending by both businesses and consumers. So far this year the services economy has reported its worst performance since 2008, with worrying weakness seen across sectors such as transport, financial services, hotels and restaurants, and business-to-business services.

After surveys indicated that both manufacturing and construction remained in deep downturns in August, the lack of any meaningful growth in the service sector raises the likelihood that the UK economy is slipping into recession. The PMI surveys are so far indicating a 0.1pc contraction of GDP in the third quarter.

Duncan Brock, group director at the Chartered Institute of Procurement & Supply, adds:

The services sector clung on by its fingertips this month remaining just above the no-change mark as domestic and export clients abandoned spending in favour of a wait-and-see approach and the political environment became increasingly murky.

Business activity lost momentum during August, confidence hits three-year low

Here’s what the services PMI figures look like over the longer term:

IHS Markit and CIPs say:

UK service providers indicated that business activity growth lost momentum during August and remained subdued in comparison to the trends seen over much of the past decade. The latest survey also revealed slower increases in new work and staffing levels, which was often linked to sluggish underlying economic conditions.

Service sector firms meanwhile indicated a sharp drop in optimism towards the business outlook. Confidence regarding activity during the next 12 months hit its lowest since July 2016, primarily reflecting concerns about the impact of domestic political uncertainty on client decision-making.

I suppose soggy services pmi is better than collapsing construction but it’s rather like the weather - dispiriting

— Kit Juckes (@kitjuckes) September 4, 2019

Some growth at least for UK Services athough it means overall that we are flatlining in the UK at best #GDPhttps://t.co/8Fzre9dAh4

— Shaun Richards (@notayesmansecon) September 4, 2019

BREAK: UK misses forecasts for services activity, narrowly misses overall contraction

Ouch! A double miss, with the UK’s composite purchasing managers’ index data dropping just above flat following weak services data, It follows weak numbers across construction and manufacturing.

Services PMI: 50.6 (prev. 51.4, surv. 51)

Composite PMI: 50.2 (prev. 50.7, surv 50.5)

A score over 50 indicates growth. Here’s an explanation of what PMIs mean:

Sterling stays bullish

Poor PMI data could rattle the pound shortly, but for now sterling is holding strong gains against the dollar, and a solid but slightly more muted rise against the euro.

The currency’s long term decline, couple with recent events in the Commons, has inspired several photoshop-savvy market watchers to make the same jokes:

— Paul Mason (@paulmasonnews) September 3, 2019

— Paul Mason (@paulmasonnews) September 3, 2019

Eurozone growth looks muted despite expectation-beating result

Composite purchasing managers’ index data for the eurozone indicates activity in the bloc grew narrowly during August, rising to 51.9 from 51.8 in July (where a score above 50 indicates growth).

That’s pretty sluggish, but after some shock drops in US manufacturing and UK construction, it will come as a relief that pollsters (who thought activity would be flat), were at least too pessimistic for once.

A deep manufacturing downturn, fueled by deteriorating exports and most intensely felt in Germany, continued to be offset by resilient growth in the service sector, the latter in turn propped up to a large extent by solid consumer spending in domestic markets pic.twitter.com/sUBXOuQxf2

— Chris Williamson (@WilliamsonChris) September 4, 2019

UK services and composite PMI data is coming up in about 10 minutes...

UK PMI up next... pic.twitter.com/LvhLKUI3KI

— Rupert Seggins (@Rupert_Seggins) September 4, 2019

Europe markets post solid gains

As yesterday’s lacklustre session, blue-chip indices are looking strong across Europe, with a strengthening pound pushing the FTSE 100 into slightly lagging its continental peers at 0.9pc up.

Italy’s FTSE MiB is leading risers, up 1.7pc, on hopes that a new government will be able to form after Five Star party (M5S) supporters showed apparent approval for its proposed coalition with the Democratic Party (PD).

If the parties can form a government, they will avoid an election — putting paid, for now, to Matteo Salvini’s power grab.

Sterling is making strong gains against the dollar: a combination of traders’ hopes that a no-deal Brexit will be averted, and negativity over the dollar after shock data yesterday showed the US manufacturing sector underwent a contraction in August, raising fears about the health of the world’s biggest economy.

Spreadex’s Connor Campbell said:

The complicating factor here, and the reason that sterling’s gains, while notable — it’s up 0.5pc against the dollar and 0.4pc against the euro – aren’t even greater, is the potential for a general election. Boris Johnson is seeking a snap vote, while Labour will only back a trip to the polling booth once the no-deal-blocking bill is successful.

CMC Markets’ Michael Hewson adds:

After hitting its lowest levels against the US dollar since the flash crash lows of 2016 the pound has rebounded strongly on the expectation that MPs will succeed in forcing the PM to ask the EU for a Brexit extension. This may well be premature if we do get a subsequent new election before the Brexit date and any new government reverses the legislation.

Marks & Spencer’s final day in the FTSE 100

It was almost swept up by yesterday’s Brexit excitement, but yesterday’s trading confirmed that Marks & Spencer will be demoted from the FTSE 100 today for the first time since the index was created.

The company was the 116th-largest on the All-Share index at the end of trading yesterday — putting it in line for automatic demotion.

To avoid volatility, shares must have made significant inroads into another index to be shifted. For a movement to occur, either a non-FTSE 100 company must surpass the market cap of the 90th-placed blue-chip or a current FTSE 100 company must drop below the 111th-ranked company by the deadline.

Here’s who will be moving today based on last night’s figures (which will be confirmed by the LSE today):

Promoted

Gold and silver miner Polymetal (market cap: £5.66bn)

Pharmaceutical company Hikma (market cap: £4.94bn)

Engineering firm Meggitt (market cap: £4.78bn)

Demoted

Retailer Marks & Spencer (market cap: £3.64bn)

IT firm Micro Focus (market cap: £3.77bn)

Insurer Direct Line (market cap: £3.86bn)

Staying in the FTSE 100 is about more than just prestige. Several funds track the blue-chip index, investing in all its constituents, and would have to dump their M&S stocks if the company falls.

Here’s our full report on the series review:

And here’s some advice for investors who are now casting a worried eye at other FTSe 100 retailers, from my colleague Jonathan Jones:

Jeremy Warner: ‘No-deal will prolong Brexit uncertainty’

With legislation to block the Government from crashing the UK out of the EU without a deal looking like a real possibility, Telegraph Business columnist Jeremy Warner has taken a look at what the fallout could be. He writes:

It is also undeniable that the full-blown variety of Brexit now quite evidently being planned by the Johnson Government - the chances of a deal that significantly differs from the Withdrawal Agreement are slim to non-existent - would open the door to a number of opportunities that cannot be properly pursued while a member of Europe’s single market and customs union. Given the right policy response, it is certainly possible for Britain to thrive anew once outside the EU.

All the same, the idea that getting it over and done with would provide the finality and certainty everyone so much craves, automatically ushering in a period of economic rebirth, is sadly misguided.

You can read his full thoughts here: No-deal will just prolong the economic uncertainty — not end it

What’s coming up in Westminster

Though there’s a decent spread of economics and markets news today, all eyes in Britain will undoubtedly be on Westminster. Here’s what we have coming up:

Prime Minister’s Questions (12pm) — Boris Johnson is set for a further grilling from MPs in the early afternoon.

Spending Review (12:45pm) — After Mr Johnson steps down, Sajid Javid will be presenting a spending review that is set to be pretty austerity-lite.

Mark Carney at Treasury Select Committee (2:15pm) — Mr Carney and leading lights of the Bank of England’s Monetary Policy Committee will give evidence to MPs on the Brexit and inflation.

Anti no-deal legislation (3pm to 9pm) — The ‘Rebel Alliance’ of MPs opposed to a no-deal exit will vote on legislation that would compel the government to seek an extension if Britain is set to crash out.

General election vote (9pm) — Boris Johnson has sworn to call a ballot if the Government is defeated again.

More details are available here.

Anti no deal bill to be debated until 7pm followed by vote(s) and then 90 minute debate on general election then vote pic.twitter.com/jLGbtt38LI

— Emily Ashton (@elashton) September 4, 2019

Amid all the Westminster drama, here’s what was possibly yesterday’s greatest moment:

Did this guy in the background cycle into the water? pic.twitter.com/8ir4Or1BXt

— Katie Martin (@katie_martin_fx) September 3, 2019

Hong Kong to withdraw controversial bill — reports

We’ll turn to Brexit shortly but before that there is big news in Hong Kong.

Carrie Lam, Hong Kong’s leader, plans to formally withdraw a controversial bill that would have allowed extraditions to China, according to a report from the South China Morning Post citing unidentified sources.

The formal withdrawal of the bill is one of the key demands of pro-democracy protesters who have demonstrated against the government for almost three months. Lam had already said the bill was "dead" - a move that failed to appease protesters - but had not merely suspended it rather than withdrawing the draft law entirely.

Markets have reacted positively with the Hang Seng trading 3.3pc higher as of about 15 minutes ago.

Markets steel themselves for further Westminster turmoil

Good morning. After another night of drama in Westminster, the UK could be facing into an early election. Currency traders will barely have time to catch their breath this morning before attention turns to the Government’s spending review.

Chancellor Sajid Javid is expected to splash the cash when he allocates Government departments their funding as part of the one-year spending review.

He has already pledged to boost spending on schools, police and health but has also insisted there will be no “blank cheque”. Can Mr Javid pull off the tough balancing act in his first major announcement at the Treasury?

5 things to start your day

1) Is anti-capitalism Corbyn now the lesser of two evils for the City? Jeremy Corbyn, the scourge of bankers and avowed opponent of capitalism, is winning support from unexpected new quarters: two of the biggest global banks operating in the City of London are warming to the Labour leader. “Is Corbyn as bad as no-deal? Perhaps no longer,” said Christian Schulz at Citi.

2) GKN to cut 1,000 aerospace jobs as Melrose steps up turnaround. GKN’s aerospace division is to axe 1,000 jobs, amounting to around 5.5pc of its total workforce, in what the chief executive called a “fundamental transformation” to make it a “coherent” business. Melrose acquired GKN last year after a bitter £8.1bn takeover battle.

3) Ferguson heads for break-up as chief executive steps down. Ferguson, the FTSE 100 plumbing company formerly known as Wolseley, will break up its business and review its listing in London just months after an activist shareholder revealed a 6pc stake in the company.

4) Why has the pound fallen through $1.20 and where will it go next? The pound is in trouble. Foreign holidays just got more expensive as sterling fell below $1.20 and looks set to stay there, making this the weakest sustained level since 1985. Where could this latest slide end?

5) Google investigations pile up as US states prepare monopoly probe. Google faces further pressure over the search giant's dominance after multiple US states joined forces to investigate whether the company has behaved anti-competitively. The monopoly probe is expected to be announced in Washington on September 9.

What happened overnight

Hong Kong shares surged after reports the city’s chief executive Carrie Lam would withdraw a contentious extradition bill, which has been at the centre of the territory's weeks-long protests. The Hang Seng is up 3.3pc.

Asian stocks were mixed after a disappointing US manufacturing report reignited concern about global economic growth. The yuan edged up after a stronger-than forecast daily currency fixing.

The Shanghai Composite index rose 0.5pc. In Japan, the Topix index declined 0.3pc.

In the US, the Institute for Supply Management’s US purchasing managers index fell below 50 in August, indicating a contraction in US manufacturing alongside other weak readings for factories around the world.

That data has caused traders to boost bets on deeper rate cuts by the Federal Reserve this year.

S&P 500 futures edged up with Treasury yields after US equities retreated and bonds rose overnight, while the dollar remained largely unchanged.

Elsewhere, the pound remained steady, even as Boris Johnson was defeated in a Parliament vote by 328 to 301 and said he would vote for an election if Parliament opts today to delay Brexit until Jan 31.

Oil was around $54 a barrel amid concern an economic slowdown from the trade war may dent demand.

Coming up today

A Brexit malaise is hanging across the whole UK housebuilding sector and Barratt Developments is no safer than its peers. Underlying profit is likely to suffer from any slowdown of the last few months.

It has revealed it is on course for record profits after choosing to focus hard on improvements to its margins. The company has also avoided the slowdown in completion rates and customer satisfaction fall that has afflicted rival Persimmon.

“Given the industry has been repeatedly rocked by quality scandals, we’ll want some reassurance that this continues to be the case,” said Hargreaves Lansdown’s Laith Khalaf.

Full-year results: Barratt, Dunelm Group, Frontier Develop

Trading statement: Halfords

Interims: Ferroglobe, Just Group, GCP, Oxford Biomedia, Secure Inc Reit

Economics: Services PMI and composite PMI (UK and eurozone), Mortgages and trade balance (US)