Earnings are outpacing stock prices in just 2 sectors

The market’s move higher has been fueled almost exclusively by multiple expansion, according to RBC’s Jonathan Golub.

In other words, investors are willing to pay a higher price (“P”) for essentially the same earnings (“E”), making for a more stretched price to earnings, or “P/E” multiple.

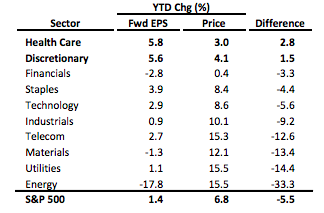

With earnings season wrapped up as of Friday, the S&P 500 (^GSPC) has advanced 6.8% year-to-date, or up 8.4% including dividends. This comes despite a more modest improvement in the earnings outlook, which only rose 1.4%.

However, Golub points out that this trend hasn’t permeated all sectors. The health care and discretionary sectors saw improvements in earnings outlook relative to price, while the rest of the sectors declined, led down by the energy and utilities sectors.

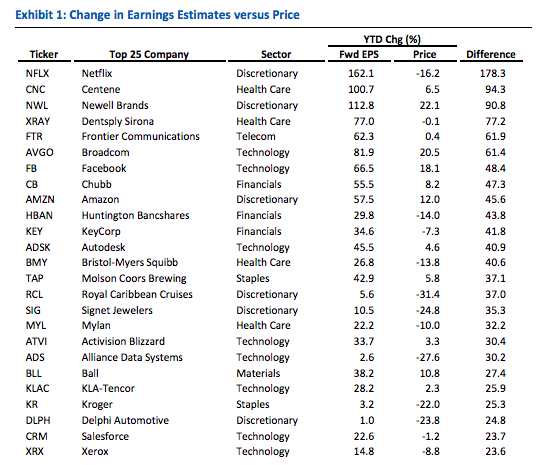

A handful of stocks across sectors have also seen improvement in earnings outlook relative to price.

Top names include high-flying “FANG stocks”—Netflix (NFLX), Facebook (FB) and Amazon (AMZN); gaming company Activision Blizzard (ATVI); and financial companies Huntington Bancshares (HBAN) and KeyCorp (KEY).

With earnings season over, focus has shifted to the Jackson Hole symposium, where Federal Reserve Vice Chairman Stanley Fischer gave a speech over the weekend and Janet Yellen will speak on Friday.