Mapped: Brexit’s Aftermath

The United Kingdom’s decision to leave the European Union sent world markets spiraling downward Friday. Across the globe, nearly every major stock index turned red.

Shockwaves from the so-called Brexit were evident in Asia, Europe, and the United States. Not only did stocks suffer; currency in Europe did as well. On Friday, the pound sterling plummeted to its lowest levels since 1985. In the United States, the dollar surged, surpassing the demand for American products around the world because they become more expensive, meaning that U.S. companies will lose money. And that’s bad news for the U.S. economy.

Now markets face two years of incertitude as London renegotiates its relationships with its former EU partners. The messy divorce proceedings — two years of negotiations under the terms set out in Article 50 of the Lisbon Treaty — mean sustained uncertainty, which is something that investors abhor.

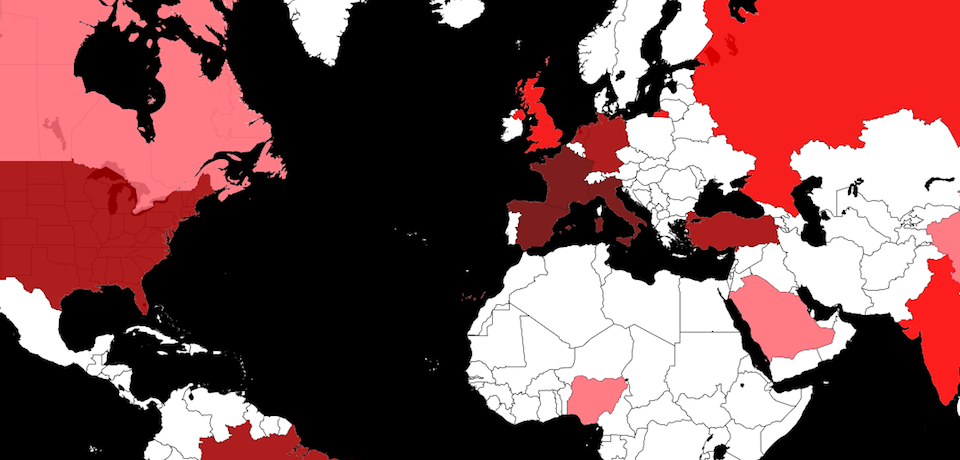

On Friday, however, investor concern in the immediate aftermath of the referendum results manifested itself primarily in stock markets. The map below shows how the benchmark equity indices in major global economies fared after Britain’s historic decision. It’s not a pretty picture. Red indicates a loss. The darker the red, the more severe the drop:

“Markets like certainty, and they do not want nor expect this kind of change,” Aaron Klein, a fellow in economic studies at the Brookings Institution and former U.S. Treasury official, wrote earlier this month. “Economic relationships within the EU and the rest of the world will change, affecting rates of return and asset prices, but no one knows how and by how much; it is simply unknown how long it will take to redefine these relationships, and that’s what’s being reflected in markets — uncertainty.”

London’s primary index, the FTSE 100, closed Friday with a loss of 3.2 percent. Many European markets saw losses worse than London’s, as lucrative trade relationships came into doubt.

Within the EU on Friday, Italy’s FTSE MIB and Spain’s IBEX both fell by more than 12 percent, with Spain’s benchmark posting the largest same-day drop in its history. Analysts told the Wall Street Journal that Spain, like other European countries, could see its companies’ revenues in Britain suffer over the coming months as earning there in the falling pound are transferred to euros.

The DAX in Germany and the CAC in France turned sharply downward as well. Both African and Asian markets sank.

For their part, leaders of the EU’s core institutions were swift to react to the vote, saying that they want Britain out “as soon as possible,” so that politics and markets can return to normal. There will be “no renegotiation,” Donald Tusk, Jean-Claude Juncker, and Martin Schulz — the respective heads of the European Council, Commission, and Parliament — and Dutch Prime Minister Mark Rutte, whose government currently holds the rotating presidency of the Council of the European Union, said in a joint statement on Friday, as reported by the Guardian. Any delay would serve only to “unnecessarily prolong uncertainty,” they said.

Some ripple effect of the Brexit will fade with time. Others won’t. “Many of these market reactions are not short-term fluctuations, but rather reflect permanent changes, assuming that the U.K. moves forward with Brexit,” Klein said in an email to Foreign Policy.

“Trade between Britain and the European Union will likely be reduced. The pound will lose some of its luster as a global currency,” he wrote. “Uncertainty over the future of the composition of the U.K. is likely to last for a while given that Scotland and Northern Ireland voted to remain.”

Image by C.K. Hickey/Foreign Policy. Do not reproduce without permission.

Correction, June 24, 2016: Prime Minister Mark Rutte signed the joint statement to represent the government of the Netherlands, which currently presides over the Council of the EU. An earlier version of this article mistakenly said that Rutte signed in his capacity as the EU president, a position which does not exist.