What makes up a credit score? Here are the basics to building yours

Let’s break down credit and answer these three questions: What is it, how do you get it and why does it matter?

What is credit?

Credit is when you borrow money with the agreement to repay it later, often with interest, according to NerdWallet.

The most used types of credit are credit cards and home, car and student loans.

How do you get credit?

How do you get it? You have to apply. Lending institutions will determine how much you can get.

They look at your credit report and credit score.

What is a credit score?

Credit scores estimate how likely you are to pay bills and repay borrowed money, according to the Consumer Financial Protection Bureau. And your report has a history of your behavior with money, such as how many accounts you have open and your payment history.

There are three major credit reporting bureaus: Equifax, Experian and TransUnion.

Why do credit scores matter?

Well, they help determine if you can get a loan or credit card and what interest rate you will pay, according to NerdWallet.

Generally, the lower your credit score, the more you’ll pay in interest on home and car loans, for example. Credit scores can even determine whether or not you qualify for an apartment.

How to improve your credit score

Pay your bills on time.

Credit card balances should be at least under 30% of your limit.

Try not to apply for several accounts all at once.

Don’t close old credit accounts.

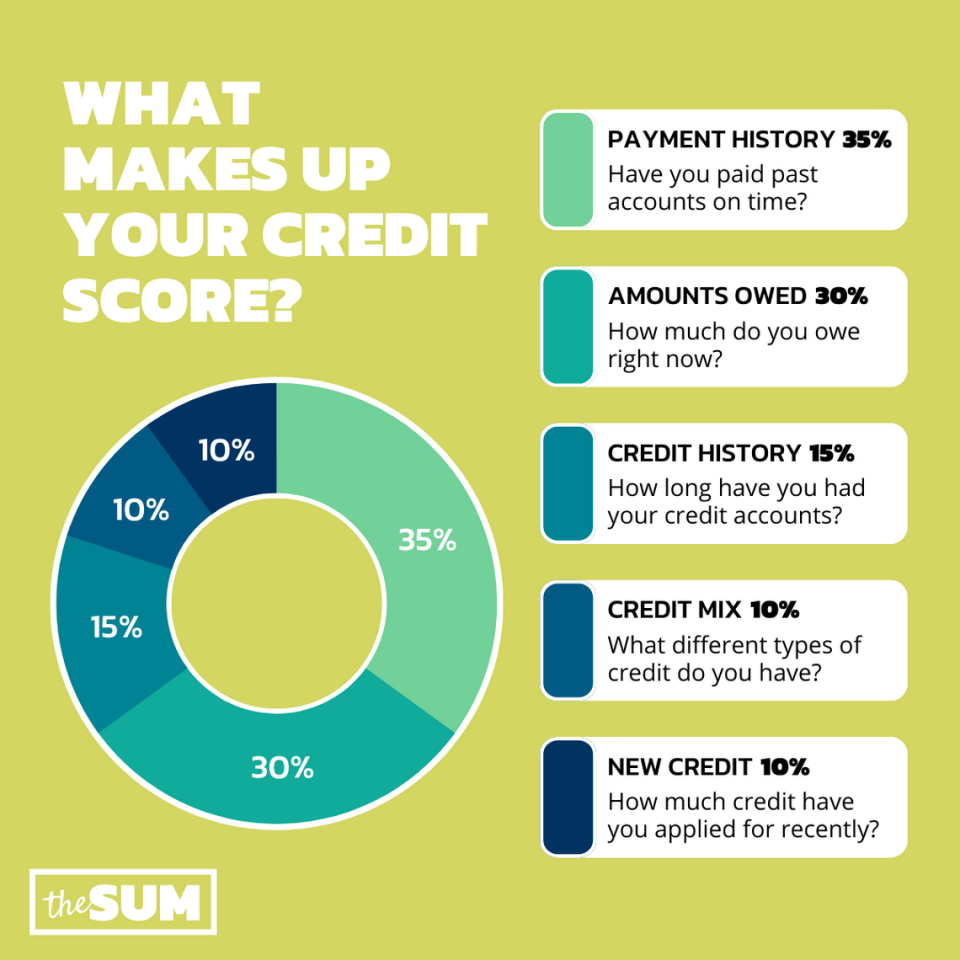

What makes up your credit score?

What is The Sum?

The Sum is your friendly guide to personal finance and economic news.

We’re a team of McClatchy journalists cutting through the financial jargon so you know how these issues impact your life. We verify information from diverse sources and keep the facts front-and-center, making finance and economic news add up for you.

You can follow The Sum on Instagram and TikTok.

Ready to take the first step to getting your finances under control? You can sign up for our five-week budgeting newsletter at thesum.news.