The main factor driving markets higher despite so many roadblocks

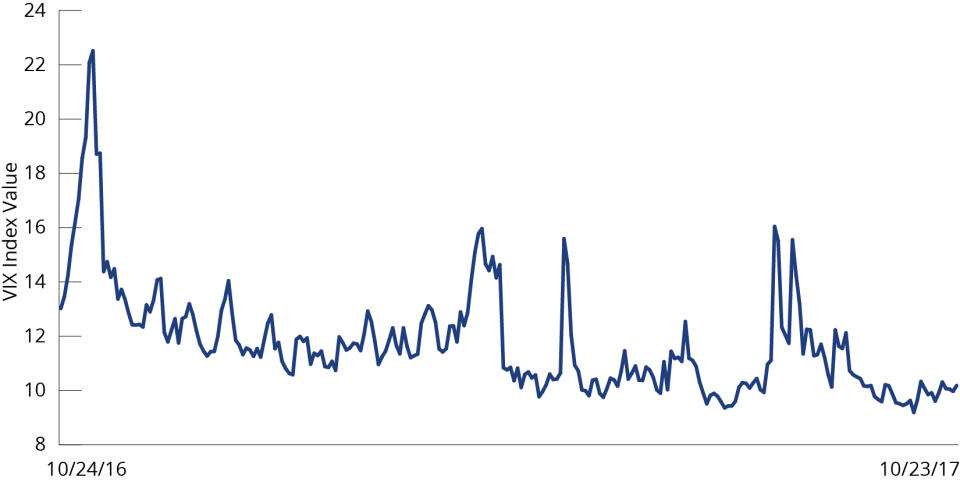

In a word: resilient. Global stock markets have so far been able to shake off event after event that has been thrown at them from a surprise Brexit vote, to global geopolitical tensions, to natural disasters. Spikes in stock market volatility have proven to be short-lived, and 2017 has been a year of low market volatility on average and higher global stock prices.

VIX Index has bounced along one year lows

So what’s driving markets higher in the face of what many perceive as numerous roadblocks? There are likely many factors (and theories) but one factor in our mind seems at the root of it: global GDP growth is positive throughout the world.

Of the 51 economies the Organisation for Economic Co-Operation and Development (OECD) tracks, all 51 registered positive GDP in 2Q17. In addition, 40 of those economies, or 78%, had GDP growth that accelerated from 1Q17 levels.

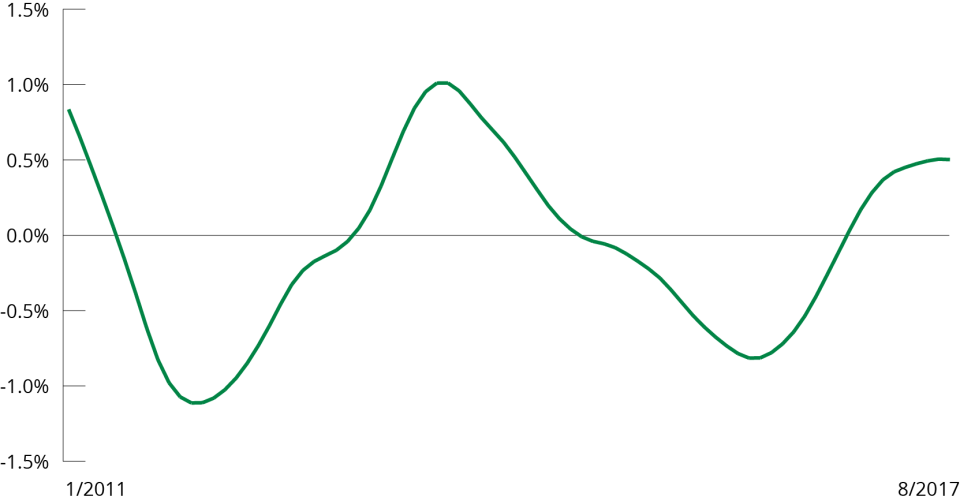

The OECD’s more recent monthly Composite Leading Indicators show that momentum from the end of June seems to be sustaining itself through August (most recent data point). On a year-over-year basis, the indicator shows a positive reading for the tenth straight month. These are powerful backdrops for corporate earnings throughout the world and thus stock prices. The roadblocks have proven to be just bumps in the road versus global economic growth so far.

OECD Year over Year Leading Indicators Have Accelerated

The views expressed are as of the date specified and are subject to change based on changes in market, economic and other conditions. These opinions are not intended to be a forecast of future events, a guarantee of future results or legal, tax or investment advice.

All data referenced are from sources believed to be reliable but cannot be guaranteed. Forward-looking statements are subject to uncertainties that could cause actual developments and results to differ materially from the expectations expressed. Forecasts and model results are inherently limited and should not be relied upon as indicators of future performance. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies should consult their financial professional.

References to specific securities are not intended and should not be relied upon as the basis for anyone to buy, sell or hold any security.

Earnings growth is not representative of the Funds’ future performance.

Mutual fund investing involves risk. Principal loss is possible.

INVESTORS SHOULD CONSIDER THE FUND’S INVESTMENT OBJECTIVES, RISKS, CHARGES AND EXPENSES CAREFULLY BEFORE INVESTING. THE PROSPECTUS OR THE SUMMARY PROSPECTUS CONTAIN THIS AND OTHER INFORMATION ABOUT A FUND. TO OBTAIN A FREE PROSPECTUS, PLEASE CONTACT YOUR FINANCIAL ADVISOR OR VIEW THE PRODUCT SPECIFIC PAGE ON WWW.ALPINEFUNDS.COM. AN INVESTOR SHOULD READ THE PROSPECTUS CAREFULLY BEFORE INVESTING

Alpine Woods Capital Investors, LLC is the adviser to the Alpine open-end and closed-end Funds. The Alpine open-end Mutual Funds are distributed by Quasar Distributors, LLC. Quasar Distributors, LLC provides filing administration for Alpine’s closed-end funds. The Funds are not bought or sold through Quasar Distributors, the Alpine closed-end funds are bought and sold through non-affiliated broker/dealers and trade on nationally recognized stock exchanges. Like other public companies, closed-end funds have a one-time initial public offering. Thus, once their shares are first issued, shares are not continually offered by the closed-end fund, but trade in the open market through a stock exchange. Also, like other common stocks, share prices of closed-end funds will fluctuate with market conditions and, at the time of sale, may be worth more or less than your original investment. Shares of closed-end exchange-traded funds may trade at a discount or premium to their original offering price, and often trade at a discount to their net asset value (a price that reflects the value of the fund’s underlying portfolio plus other assets, less the fund’s liabilities divided by the number of shares outstanding). Investment return, price and net asset value will fluctuate with changes in market conditions.

Alpine Woods Capital Investors, LLC is the adviser to the Alpine open-end Funds. The Alpine open-end Mutual Funds are distributed by Quasar Distributors, LLC. © 2017 Alpine Woods Capital Investors, LLC. All rights reserved.