Is Magellan Midstream Partners, L.P. a Buy?

Midstream industry stalwart Magellan Midstream Partners, L.P. (NYSE: MMP) has turned lower this year, falling around 11% since Jan. 1. From their early year highs, however, the units of this partnership are down nearly 18%. With a distribution yield of about 5.4%, is it time for income investors to buy Magellan Midstream Partners?

Fee-based revenues and distribution growth

Magellan certainly has a wonderful story, particularly if you are an income investor. For example, roughly 85% of its revenue is fee-based, making its collection of pipelines and storage facilities a fairly steady business. This, in turn, has supported 17 years' worth of annual distribution increases.

Image source: Getty Images.

That, however, isn't the full story when it comes to the distribution. Magellan has actually increased the payment every single quarter since going public in 2001. That's over 60 consecutive quarterly hikes. The annualized rate of increase over that span is an impressive 12%. A current yield that's more than twice what you'd get from investing in an S&P 500 index fund is great, but a distribution growth rate that has trounced the historical growth rate of inflation (3% or so) is even better.

And Magellan has done all of this while maintaining a fairly modest amount of leverage. For example, the partnership's debt-to-EBITDA ratio is currently around 3.5, with a goal of keeping that metric below 4. In comparison, midstream industry bellwethers Enterprise Products Partners LP (NYSE: EPD) and Kinder Morgan, Inc. (NYSE: KMI) have debt-to-EBITDA ratios of roughly 4.5 and 6.5, respectively.

Equally important, Magellan hasn't issued material amounts of new units since 2009. Enterprise expanded its unit count by nearly 18% between 2012 and 2016 alone, a move which dilutes current unitholders. For reference, Magellan's unit count was roughly flat over that time period.

Solid future

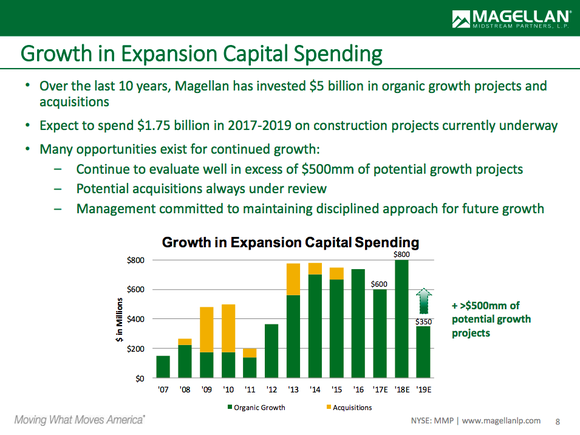

As a partnership, however, Magellan's growth generally comes from building new assets or acquiring them. Over the past decade it has spent $5 billion on organic growth projects and acquisitions. The regular quarterly hikes prove that its growth efforts were successful. But that's the past; what about the future?

Magellan is projected to spend around $600 million on growth projects in 2017. It has another $800 million lined up for 2018, and $350 million in 2019. It's evaluating an additional $500 million worth of projects that could add to that total. Many of these projects already have customers lined up or they are at existing facilities where Magellan can see that demand is sufficient to support the spending. These figures don't include potential acquisitions. This midstream partnership clearly has plenty of opportunity to grow.

Magellan's spending history and its future plans. Image source: Magellan Midstream Partners, L.P.

The current goal is to increase the distribution by 8% in both 2017 and 2018. The distribution coverage goal is a solid 1.2 times, with leverage continuing to sit below the 4 times level. The developing investment plans for 2019 suggest more distribution growth is to come, as well. In other words, the future looks pretty solid -- and a lot like the past.

So what's going on with the unit price? The answer is that it's an industrywide downturn, with the downdraft at Magellan roughly tracking the downturns at Enterprise and Kinder Morgan. It looks like this is an opportunity to buy one of the most conservative midstream players while the entire industry is on the sale rack.

Worth the risk

There's no denying that it could get worse before it gets better at Magellan since the entire midstream industry is currently in the doldrums. But with a price that's roughly 18% off its highs, a lot of damage has already been done at this steady performer. And with a hefty 5.4% yield, Magellan appears to be a compelling buy today if you are looking to generate a steadily growing stream of income while you build your nest egg.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Kinder Morgan. The Motley Fool recommends Enterprise Products Partners and Magellan Midstream Partners. The Motley Fool has a disclosure policy.