‘I’m disabled and can’t work – can I cash in on my deceased mother’s pension?’

Write to Pensions Doctor with your pension problem: pensionsdoctor@telegraph.co.uk. Columns are published weekly

Dear Becky,

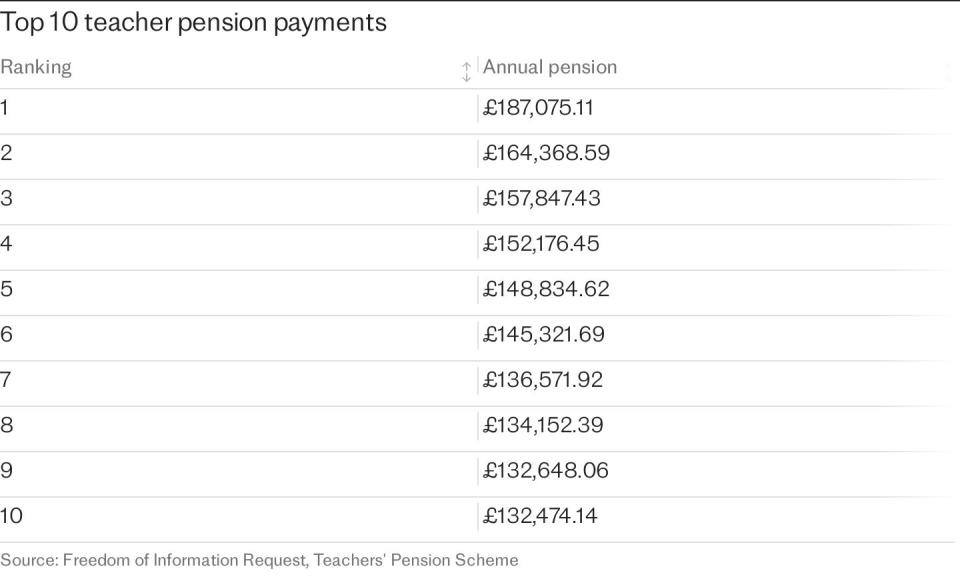

My mother, a former special needs teacher, passed away unexpectedly in January 2022. Her income came through her occupational pension from Teachers’ Pensions (about £600 per month), her state pension and disability benefit, amounting to 70pc of our joint household income.

Disabled myself and unable to work while nursing my mum, my disability benefit amounted to the other 30pc.

I nursed Mum 24/7 for 12 years through her recovery first from a stroke, then a spinal injury and latterly cancer between March 2010 and January 2022. Prior to this, she’d been my carer.

Due to my disability, I’d been financially dependent on my mum since at least 1997.

After my mum’s death, thinking I was doing the right thing, I rang Teachers’ Pensions to notify them. They immediately stopped all payments (despite their own online documentation stating they will continue to pay into someone’s estate for three months).

As a result, I haven’t even been able to pay for my mum’s funeral – I had to apply for a handout from the Government. Even then I still owe £1,200!

More significantly, Teachers’ Pensions also denied having ever received the paperwork from my mum circa 2008-09, making me her nominee. I’m her surviving child, as well as next of kin. Teachers’ Pensions have offered no proof they have no such paperwork. Yet I remember my mum completing it and sending it off.

I’m struggling to survive on PiP, Universal Credit and the generosity of friends.

Can you help?

Yours sincerely,

Chris

Dear Chris,

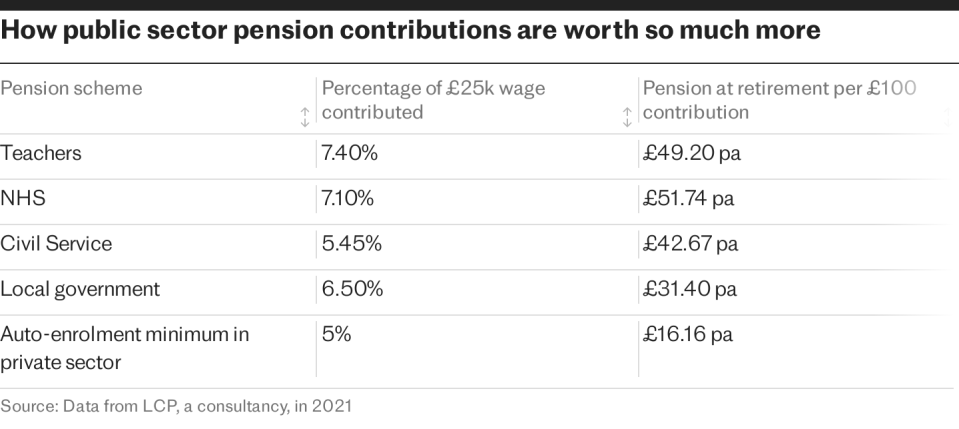

There is an overriding principle applying to Teachers’ Pensions that the pension is intended to support the individual member in their later years, and therefore that the payments should stop when they pass away.

There can be death grants that are payable to nominees when a member of the scheme has received their benefits for less than five years when they die, but beyond this five-year period the grants do not apply.

The additional three months of provision when someone dies that you say you were expecting applies only when someone dies in service.

However, it is possible that an adult child may qualify for a dependant’s pension if they are incapacitated and unable to earn a living due to ill health at the time of the member’s death. It certainly sounds like these circumstances apply to you.

Information on applying for dependant’s pensions is usually provided with the paperwork for dealing with a member’s death. You don’t mention having received this paperwork or filling it out. If you didn’t receive this paperwork or no longer have it, it’s worth letting them know.

I suggest contacting Teachers’ Pensions to inform them if you didn’t receive the relevant paperwork at the time for applying for the dependant’s pension.

You also don’t mention if you have formally started the process of appealing the Teachers’ Pensions’ decision – there’s more information about that here.

But before you do this, you need to try and get hold of that information about how you can apply for the dependant’s pension, as it sounds like this may have been missed. If you are able to get hold of it and follow the process, you may get a clearer picture about what you might be entitled to.