LSE Dividend Stock Picks

A great investment for income investors with a long time horizon is in dividend-paying companies like Restaurant Group. Dividend stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. Dividends play a key role in compounding returns over time and can form a large part of our portfolio return. I’ve made a list of other value-adding dividend-paying stocks for you to consider for your investment portfolio.

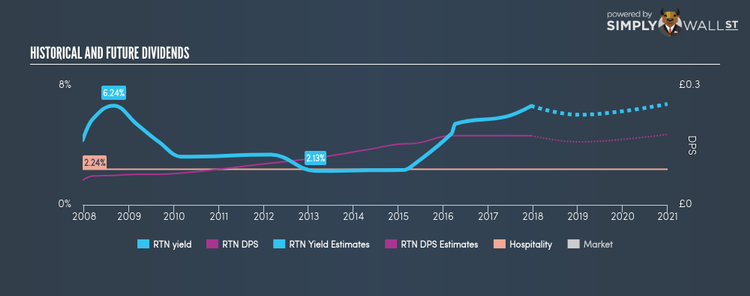

The Restaurant Group plc (LSE:RTN)

The Restaurant Group plc operates restaurants and pub restaurants in the United Kingdom. Started in 1954, and now run by Andy McCue, the company provides employment to 15,700 people and with the company’s market cap sitting at GBP £560.46M, it falls under the small-cap category.

RTN has an alluring dividend yield of 6.22% and is distributing -211.18% of earnings as dividends , with analysts expecting this ratio to be 68.29% in the next three years. RTN has increased its dividend from £0.0621 to £0.174 over the past 10 years. The company has been a reliable payer too, not missing a payment during this time. Analysts are expecting strong shareholder returns over the next three years, estimating XYZ’s ROE in three years to be 0.2%.

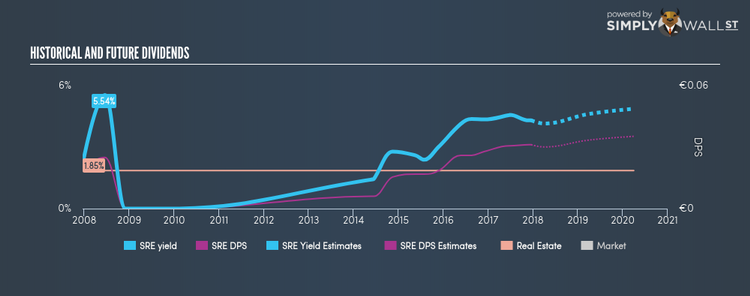

Sirius Real Estate Limited (LSE:SRE)

Sirius Real Estate Limited, a real estate company, engages in the investment, development, and operation of commercial properties in Germany. The company size now stands at 224 people and with the company’s market capitalisation at GBP £592.74M, we can put it in the small-cap category.

SRE has a substantial dividend yield of 4.31% and the company has a payout ratio of 31.59% , with the expected payout in three years hitting 69.10%. Despite there being some hiccups, dividends per share have increased during the past 10 years. The company recorded earnings growth of % in the past year, comparing favorably with the GB Real Estate industry average of 0.29876%.

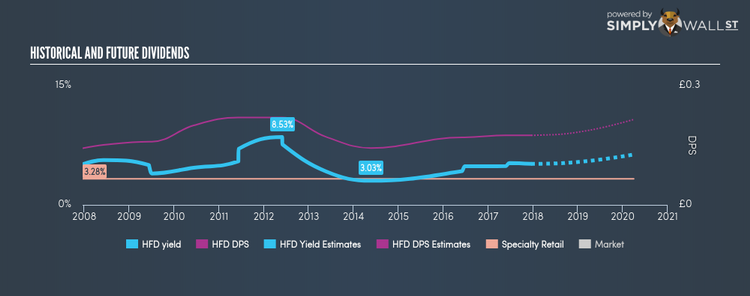

Halfords Group plc (LSE:HFD)

Halfords Group plc, through its subsidiaries, retails automotive, leisure, and cycling products. Founded in 1892, and run by CEO Jonathan Mason, the company currently employs 10,000 people and with the market cap of GBP £665.48M, it falls under the small-cap group.

HFD has a great dividend yield of 5.16% and pays out 64.07% of its profit as dividends . Despite there being some hiccups, dividends per share have increased during the past 10 years.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.