Long-Term Signal Says Buy This Biotech

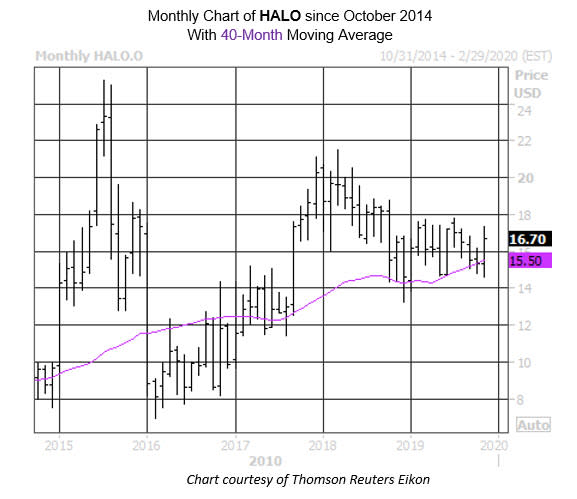

Halozyme Therapeutics, Inc. (NASDAQ:HALO) is trading 1.2% lower today at $16.70, taking a breather after a 10.5% gap higher on Tuesday following corporate restructuring news. Despite today's pullback, the shares could be flashing a long-term buy signal right now, if past is precedent.

More specifically, data from Schaeffer's Senior Quantitative Analyst Rocky White highlights a recent pullback to the 40-month moving average. The previous 13 meet-ups with this long-term trendline have yielded an average three-month gain of 8.1%, with 75% of the returns positive.

From its current perch, a move of similar magnitude would have HALO sitting in fresh annual high territory by January 2020. Year-to-date, the biotech stock is up 14%, yet three analysts still rate it a "hold" or "sell."

The mood in the options pits heavily favors puts lately. Data at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows Halozyme Therapeutics stock's 10-day put/call volume ratio of 0.86, which ranks in the 91st percentile of its annual range. While the ratio indicates calls outnumber puts on an absolute basis, the lofty ratio shows the heavy preference for puts.

There's also pessimism to be unwound among short sellers. A healthy 5.9% of HALO's total available float is sold short, and at the stock's average pace of trading, it would take shorts over two weeks to buy back their bearish bets.

Looking ahead, Halozyme is slated to report third-quarter results after the close on Tuesday, Nov. 12. The equity has closed higher the day after reporting just 50% of the time over the past two years. This time around, the options market is pricing in a 4.7%post-earnings swing for HALO, regardless of direction.