Loeb Sees American Express 35% Higher

- By Bram de Haas

On Nov. 9, Dan Loeb published his third-quarter letter. The letter included a very interesting investment idea, American Express (AXP).

Loeb and Third Point do much activist investing, although this idea doesn't seem to fall into that bracket. There is no event-driven angle or a potential catalyst to unlock value as there often is. Below, I have highlighted the key quotes explaining why he likes American Express. Third Point foresees big earnings-per-share growth in the next 18 months, does not fear the firm is taking too much risk and appears to take a liking to the new leadership:

Warning! GuruFocus has detected 1 Warning Sign with C. Click here to check it out.

The intrinsic value of V

"New CEO Stephen Squeri is re-energizing Amex by focusing on topline growth and under-appreciated structural opportunities in Commercial and International - efforts we think will lead to more sustainable double-digit EPS growth going forward," the letter read.

But even more so, Loeb likes the aggressive top-line growth trajectory Squeri is pursuing:

"Amex is just beginning to inflect after years of under-investing. Proprietary card acquisitions hit 3 million last quarter and total cards rose 7% Y/Y - the strongest user growth in a decade. Merchant acceptance is growing at a high single-digit pace, twice that of Visa (NYSE:V)/MasterCard (MA), and Amex aims to reach virtual parity with the latter networks by the end of 2019."

The problem with fast growth for credit card companies is that often they are running themselves into trouble. That is what American Express did prior to the financial crisis. But for now, revenue growth is accelerating and drawbacks are not showing up yet.

Third Point also believes American Express will make big inroads with small and medium enterprises in the U.S:

"Amex has relationships with >60% of the Global Fortune 500; in SME, Amex is larger than the next five players in the US combined (by spend). While Wall Street tries to find the next high-multiple stock to monetize the shift in B2B payments - an area with ~$20 trillion of addressable spend and ~10% penetration - they are missing a more obvious beneficiary in American Express, where B2B already makes up 2/3 of commercial spend. No one is better equipped to monetize the opportunity than Mr. Squeri, who previously ran Amex's Commercial division. The recent partnership with Amazon to offer co-brand cards to small businesses is testament to Amex's positioning in the commercial market."

Third Point is acutely aware of the fact that credit card businesses can get themselves into trouble with big procyclical bets. But they do not see undiscriminatory credit growth:

"Finally, the growth is less about cyclical tailwinds than greater operating focus: both Commercial and International are growing proprietary cards-in-force at more consistent levels (up 3% and 6%, respectively) and at higher average spend per card than has been seen before."

If the firm is indeed able to accelerate a path to scale that is very attracitve. Credit card companies benefit from scale and network effects on a global basis. Scale results in operating leverage, which results in earnings-per-share growth outpacing revenue growth. This is a very attractive proposition given the revenue-growth trajectory embarked upon.

Loeb made one extremely compelling point:

"Amex's spend-centric model, where fees are 80% of revenue, about 3-4x the level of a "traditional" card company, and credit costs are just 1/5 the cost of total customer engagement spend (marketing, rewards, service) with the latter providing an important lever to throttle back and help sustain earnings in tougher times."

Because of its fee-driven earnings model, the business is not as vulnerable to credit risk.

"With shares trading at just 12.5x our 2019E EPS, and 11x 2020E EPS, we think markets under-appreciate the strategic pivot

....and see shares trading above $135 over the next 18 months for a total return of 30% upside."

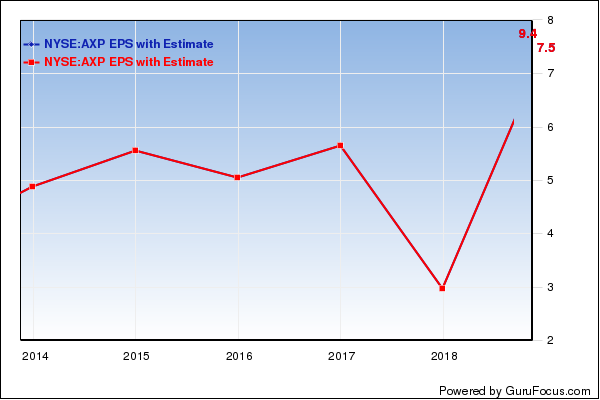

Third Point's estimates are aggressive compared to the consensus, which is $7.50.

We will need to see at least $11.25. If we see that level of earnings from American Express, it is highly unlikely that it will hit only $135. American Express is potentially a very interesting investment in a well-known firm with a clear durable competitive advantage.

Disclosure: Author has no positions in stocks mentioned.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 1 Warning Sign with C. Click here to check it out.

The intrinsic value of V