U.S. economy creates fewer jobs than expected in August

The August jobs report is out and it’s a miss.

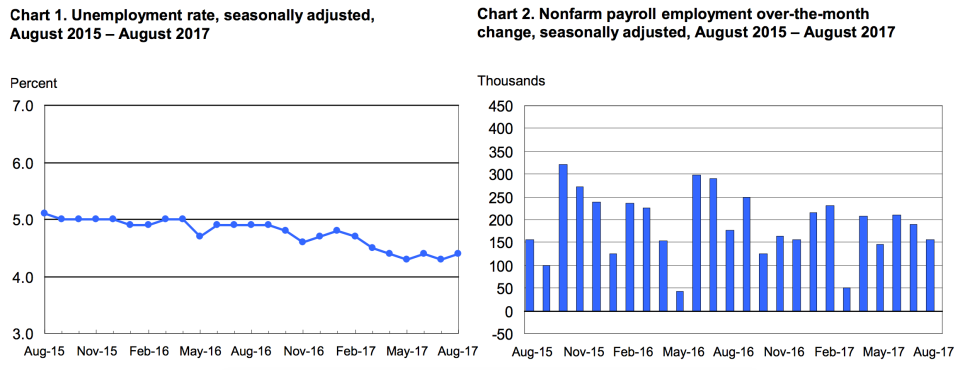

The U.S. economy added 156,000 nonfarm payrolls in August while the unemployment rate rose slightly to 4.4%, according to the latest figures from the Bureau of Labor Statistics.

Economists were looking nonfarm payrolls to grow by 180,000 in August while the unemployment rate was expected to hold steady at 4.3% near a post-crisis low. The BLS noted in its report that Hurricane Harvey had “no [discernible] effect” on the employment data for August.

Wage growth was also a disappointment, with average hourly earnings rising 0.1% over the prior month and 2.5% over last year. Earnings were expected to rise 0.2% over the prior month and 2.6% over the prior year. A rise in wages is seen by economists as portending an uptick in inflation, which has disappointed this year.

The labor force participation rate held steady in August at 62.9%, while the underemployment rate, which tracks folks out of work and those who would like full-time work but are working part-time, also held steady at 8.6%.

July’s strong jobs report also revised down slightly, with nonfarm payrolls rising by 189,000 during the month, below the 209,000 that was initially reported by the BLS.

Following this report, stock futures remained higher with Dow futures up about 61 points, S&P 500 futures up 6 points, and Nasdaq futures up 22. U.S. Treasury yields were a bit lower after the numbers, with the 10-year yield down to 2.11%, near its lows for the year, the 2-year at 1.31%, and the 30-year Long Bond at 2.73%.

By industry, manufacturing payrolls topped expectations, rising by 36,000 in August, more than the 8,000 that was expected by economists. Professional and business services saw the biggest gains in August, with payrolls in this sector rising by 40,000.

Friday’s report follows Wednesday’s private payrolls report from data processing firm ADP, which indicated that 237,000 jobs were created in the private sector during August.

In recent years, August has been one of the weaker months for the jobs report relative to expectations due to seasonal adjustment issues. It appears this trend continued in 2017.

Ian Shepherdson, an economist at Pantheon Macroeconomics, noted Friday that over the last several years, August’s initial jobs print has been revised higher a number of times, adding that, “given the very strong survey evidence, that seems a good bet for this year too.”

In a note to clients ahead of the report, Spencer Hill, an economist at Goldman Sachs, said he expected the report would show 160,000 jobs were created in August. Hill said this forecast, “reflects somewhat more mixed labor market fundamentals and a drag from residual seasonality, as first-reported August payroll growth has been consistently weak in recent years.”

Bespoke Investment Group noted ahead of Friday’s report that along with September and March, August has had the lowest percentage of job report “beats” — that is, reports which top Wall Street estimates — during the current economic expansion.

And while the seasonal adjustment process appears to have potentially hampered headline numbers on Friday, Bespoke notes that secondary indicators of labor market strength have been “overwhelmingly positive” in August.

Friday’s report, then, does not show a change in character for the U.S. labor market, which still remains robust.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: