Lee Ka-Shing: Market Worst in 20 Years; Beware of Slower Sales and Higher Rent

In the US, investors would look at the “Oracle of Omaha”, Warren Buffett for advice on the economy, market sentiments and even politics. Though we do not have an “oracle” in Asia, we have our very own “Superman”, Lee Ka-Shing. As usual, in the annual earnings brief of CK Hutchison Holdings (CKH), reporters asked more questions ranging from the US economy to his thoughts on Brexit.

Below, we summarised the points that may be of interest to investors in Singapore.

The Western Economy

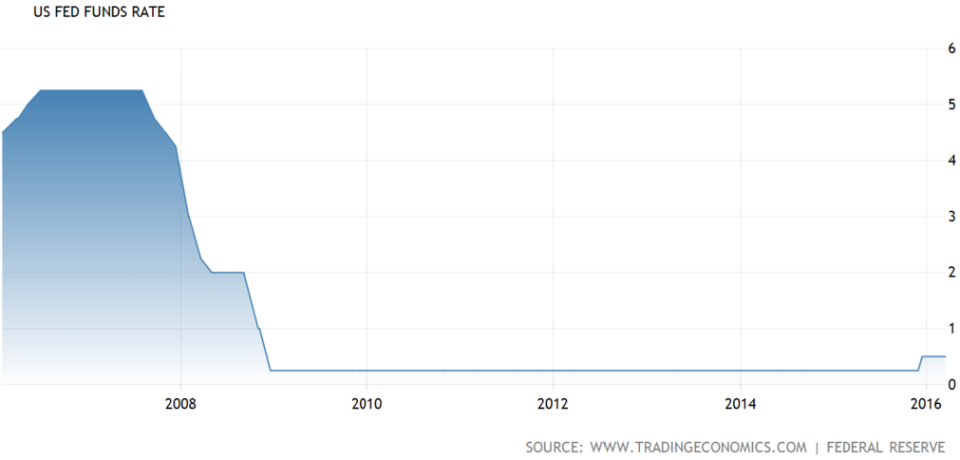

Source: 10 Year Graph of US Federal Funds Rate, Trading Economics

Last year, the Federal Reserve (Fed) gave its indication for four increments in its interest rate. However, it proved to be tough given the persistent challenges in the global economy, as well as negative interest rates in Europe and Japan. In the recent Fed meeting, the raise was further pushed back. Lee Ka-Shing felt that the challenges in the global economy will persist and expects for Fed to raise its rates only once this year.

Towards the UK, Lee Ka-Shing felt that the potential for a Brexit is minimal. He expressed that the UK will not exit the European Union (EU) for its own good, as the cons of exiting would outweigh the good.

Weak Domestic Consumption in China?

Reporters were concerned about CKH’s decision to pull out their supermarket chain from mainland China. Is this a sign that even the “superman” feels bearish towards the world’s number two economy?

Lee Ka-Shing explained that the decision to pull out of China has nothing to do with sales but with the rental of the shops. The rental market for retail space is too crazy in China that business is not viable to operate there–rental reversion there is by folds and not by percentage like in other countries.

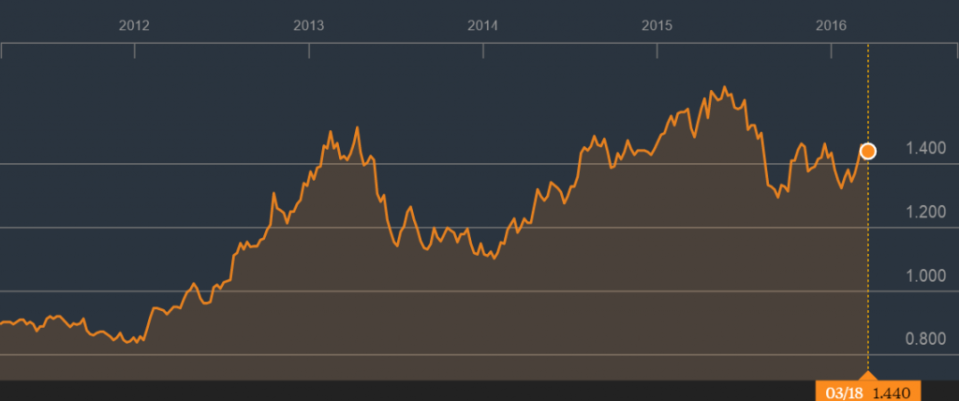

Source: 5 Year Graph of CapitaRetail China Trust, Bloomberg

CapitaRetail China Trust (CRCT) offers Singapore investors a pure play in the retail sector of China. Although we have not seen the upward reversion in rents as described by Lee Ka-Shing, it is still a good exposure to have in an investor’s portfolio. Despite the slowing economy, rental for CRCT is expected to continue its upwards trend. Analysts from DBS Research reiterated their “Buy” call and gave it a target price of $1.69.

Retail Sector in Hong Kong

The retail sector in Hong Kong has been under strong pressure in recent months and CKH was not spared either. When asked about the prospect of Hong Kong’s economy, Lee Ka-Shing expressed that 2016 will be the toughest in the recent 20 years. As compared to the SARS period, the economy will face stronger headwinds and will persist longer this year.

Source: Sales of Dairy Farm International by Geographic, Dairy Farm International

Looking at the poor global economic conditions and lower tourist arrivals, Lee Ka-Shing predicts that the retail sector in Hong Kong will not do well. Investors might want to reduce holdings with exposure to Hong Kong’s retail market.

Take Dairy Farm Internation (DFI) for example. The greater China region accounts for more than 50 percent of DFI’s total revenue. Given the slower sales in Hong Kong and higher rents in China, DFI is expected to face higher sales and margin pressure.

Property as an Investment

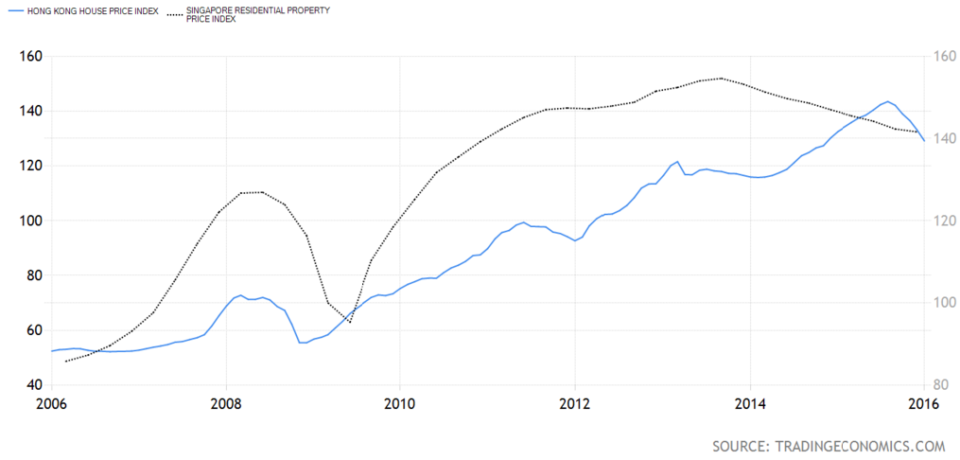

Source: 10 Year Housing Index of Singapore vs Hong Kong, Trading Economics

Looking at the residential property market of Hong Kong, Lee Ka-Shing expects further softness in the market. He is echoed by fellow billionaire, Lee Shau-Kee, the second richest man in Hong Kong who is dubbed as Hong Kong’s Buffett. Currently, Hong Kong’s residential properties has fallen approximately 15 percent from its peak and is estimated by Lee Shau-Kee to fall around 30 percent by the end of this year.

Lee Ka-Shing has an advice for youngsters starting a family: Buy a house for your own occupancy. He explained that if you occupy the real estate, you will have little worry over the price fluctuations. However, he advises investors against investing in property at the current moment.