KraneShares CSI China Internet (KWEB) Bucking Trend Of Chinese Outflows

Yesterday we covered the carnage that was Chinese equities on Monday’s session where FXI (iShares China Large-Cap, Expense Ratio 0.74%) was slammed right down to its 50 day MA before a subsequent bounce, putting it well off of 52-week highs that were registered just four trading sessions ago.

Market participants seem to believe that the impetus for the sell-off could be looming concern over potential outcomes of the October 18th slated meeting of the National Congress of The Communist Party of China. Year-to-date, in spite of largely promising performance in 2017, FXI has struggled with asset growth and has in fact seen net outflows to the tune of about $150 million during this time frame.

Head to head with some smaller China Equity focused ETFs, the fund, being large cap in nature has notably underperformed smaller funds in the segment, and perhaps some of these names are catching attention amid the recent volatility as well. MCHI (iShares MSCI China, Expense Ratio 0.64%, $2.5 billion in AUM), in spite of showing out-performance to the tune of approximately 1600 basis points to FXI, has actually seen net asset outflows year-to-date as well, with $430 million leaving the door via redemptions.

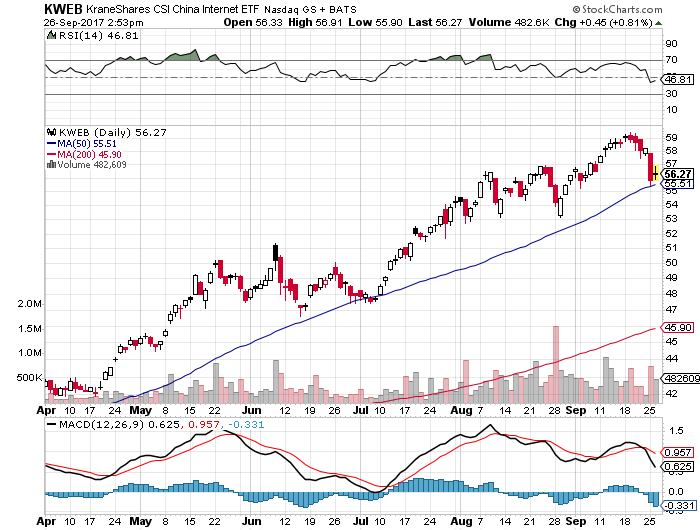

MCHI happens to be the second largest fund in the “China Equity” space behind FXI with its asset base of $2.5 billion in AUM. In contrast, the third largest fund in the space is KWEB (KraneShares CSI China Internet, Expense Ratio 0.72%, $1.1 billion in AUM), which has bucked the trend in 2017 and reeled in impressive assets this year to the tune of over $685 million. Top holdings in KWEB are notables as follows: 1) Tencent Holdings Ltd (11.24%) 2) BABA (10.12%), 3) BIDU (8.98%), 4) JD (6.21%), and 5) TAL (5.63%).

KWEB will be very interesting to watch in the very short term since “FANG” stocks have been under pressure, particularly during yesterday’s session and this group of Internet related Chinese companies tends to trade with the FANG group.

The fourth largest fund in this segment is the $1 billion GXC (SPDR S&P China, Expense Ratio 0.59%) which has seen mild outflows year-to-date of about $47 million. It is clear to us that this entire group, and there are forty-five China Equity related ETFs in the U.S. listed landscape presently, will remain active and volatile throughout October and perhaps for the rest of the calendar year.

The KraneShares Trust (KWEB) was trading at $56.24 per share on Tuesday afternoon, up $0.42 (+0.75%). Year-to-date, KWEB has gained 61.93%, versus a 12.51% rise in the benchmark S&P 500 index during the same period.

KWEB currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #3 of 33 ETFs in the China Equities ETFs category.

Disclaimer: The content of this article is excerpted from a daily newsletter from Street One Financial. While ETF Daily News may edit the contents and add a relevant title to the piece, the author, Paul Weisbruch, does not endorse or recommend any issuer or security mentioned herein.

About the Author: Paul Weisbruch

Paul Weisbruch is the VP of ETF/Options Sales and Trading at Street One Financial. Prior to joining the team at Street One, Paul served as the Director of RIA and Institutional ETF Sales at RevenueShares ETFs from December 2007 until November of 2009. Before RevenueShares, Paul was employed by Susquehanna International Group from 2000 until 2007 serving in roles including OTC/NYSE Institutional Block Trading, Nasdaq/OTC Market Making, ETF/Derivatives Intelligence and Strategy, Algorithmic Trading, as well as acting as the PHLX Floor Specialist in the ETFs, SPY and DIA.Paul has been actively involved in the ETF space from both a product and trading standpoint since 2000. Additionally, Paul has well forged relationships with national RIAs, institutional pension fund managers and consultants, mutual fund and hedge fund managers, and also the ETF media. Co-authoring the “S1F ETF Daily” since 2009, the daily piece has become a must for many portfolio managers in the ETF space, with segments regularly appearing in the likes of Barron’s, WSJ, and ETFTrends.com for instance.

He holds his Series 4 (Registered Options Principal), 6, 7, 55 (Equity Trader), 63, and 65 licenses. He graduated from the University of Pittsburgh (B.S. – Economics), graduating magna cum laude, and has an MBA from Villanova University.