Kinder Morgan Is Set to Ride This Massive Wave

Kinder Morgan (NYSE: KMI) is ideally positioned for one of today's most significant secular trends -- rising natural gas consumption.

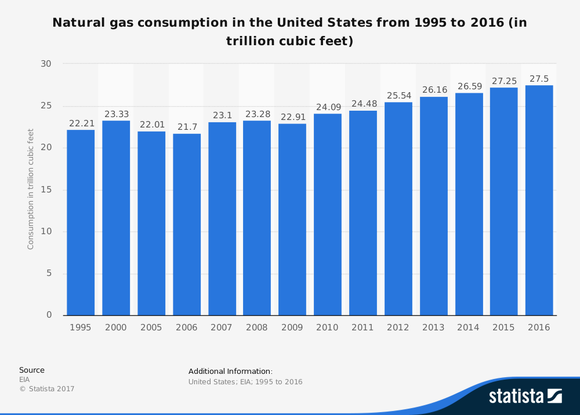

It's not often that investors can ride a huge economic wave. The use of natural gas for electricity generation and the heating of homes has risen by 2.4% over the past decade. The U.S. Energy Information Administration projects this pace to continue through 2020.

Better, total production is expected to continue rising through 2040. This excess natural gas is expected to be exported abroad as the US becomes a net energy exporter around the year 2026.

Natural gas consumption in the U.S., 1995-2016. Image source: Statista.

This is big.

The merits of renewable energy are self-evident but, at the very least, natural gas serves as the ideal stopgap. It is widely acknowledged as the least objectionable fossil fuel (its carbon emissions are estimated to be 40% lower than coal's per unit of heat), and the United States has bountiful reserves. This leads us to the perfect stock to take advantage of this massive trend: Kinder Morgan.

Image source: Getty Images.

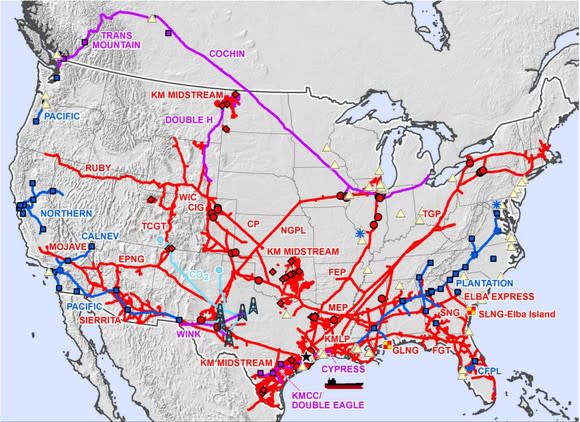

Kinder Morgan is one of the largest energy infrastructure companies in North America. It has tens of billions invested in midstream energy assets (think pipelines and terminals). The value of these assets, and the cash flow they generate, is secure thanks to the continued growth of natural gas consumption in the U.S.

Image source: Kinder Morgan investor presentation, Nov. 16, 2017..

Bulls rightly point out that Kinder Morgan's energy infrastructure assets are vital: It is among the few options for those looking to transport natural gas over long distances. Rising consumption means Kinder Morgan's natural gas pipelines and storage facilities will always be in demand. Natural gas needs to get to market, and KMI is the toll collector.

However, despite its obvious merits amid increased natural gas usage, all has not been rosy at Kinder.

Tough choices

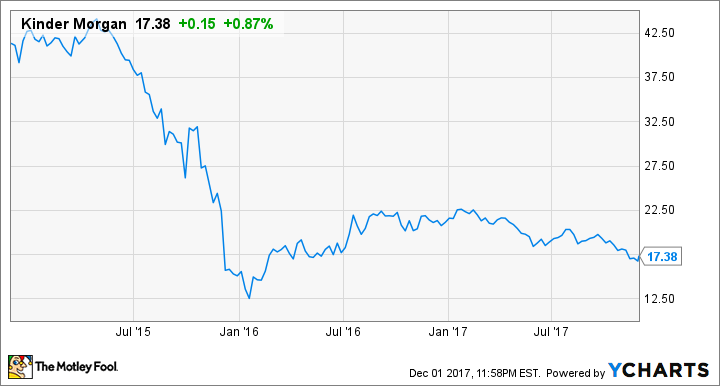

Kinder Morgan's shares have been out of favor ever since it cut its dividend in October 2014. Simply put, KMI's dividend investors got burned. Now they're rightly nervous that history could repeat itself. The company's 75% dividend cut back in 2015 stung, and investors have punished its shares in kind:

Ironically enough, the dividend cut that left investors so jaded immediately solved KMI's financial problems. Just a week after the fateful announcement, ratings agency Moody's moved KMI's outlook up from "negative" to "stable."

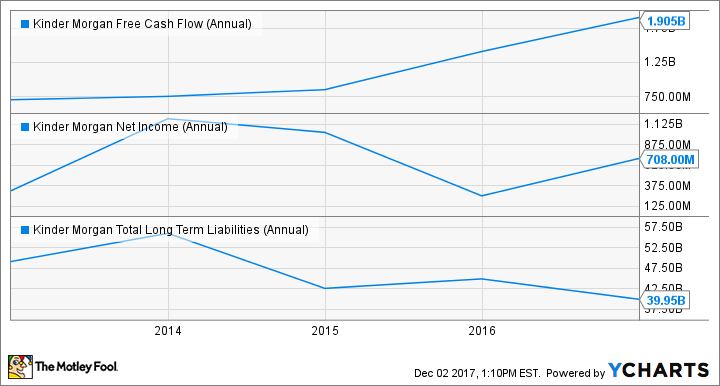

On top of all this, KMI's business has remained exceptionally strong even through the energy downturn:

KMI Free Cash Flow (Annual) data by YCharts.

Thanks to its fee-based structure and vast geographic reach, Kinder Morgan is now sitting pretty. The cash saved by not paying a dividend went to good use: debt reduction and growth-project investments.

What you need to know

Increasing natural gas usage was no doubt on the minds of KMI's management when they decided to cut its dividend. The energy sector was in the midst of a significant downturn, and the capital markets weren't touching anything energy-related. Through the end of 2014, KMI paid out the vast majority of its distributable cash flow: Distributable cash flow for 2014 came to $2.62 billion, whereas total dividends paid for the year were $1.76 billion. Stock and bond sales funded its multibillion-dollar growth projects.

As hard as it was, the company's future growth couldn't be sacrificed to the dividend needs of the present. KMI's debt rollovers (as a percentage of total assets) alone were enormous:

Financial Metric | FY 2016 | FY 2015 | FY 2014 | |||

|---|---|---|---|---|---|---|

Issuances of debt | $8.63 billion | $14.3 billion | $24.6 billion | |||

Payments of debt | $10.06 billion | $15.12 billion | $17.8 billion | |||

Total assets at year-end | $80.3 billion | $84.1 billion | $83 billion | |||

Data source: Kinder Morgan FY 2016 annual report.

Kinder Morgan had to make a choice -- fund its growth projects and cut its dividend, or fail to capitalize fully on this massive secular trend. It made the right decision. And investors are about to reap the rewards.

This summer, management announced its intention to increase the dividend in fiscal year 2018 to $0.80 per share, 60% higher than 2017's $0.50 per share annual payout. Not only that, but thanks to the increased profits from investments in new projects, executives also went on record stating that they plan to increase the payout further by 25% per year through the fiscal year 2020.

Bottom line: Kinder Morgan is now in a much healthier position, and primed for the natural gas wave.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Sean O'Reilly owns shares of Kinder Morgan. The Motley Fool owns shares of and recommends Kinder Morgan and Moody's. The Motley Fool has a disclosure policy.