Keysight's (KEYS) 5G NR Test Solutions to Be Utilized by SGS

Keysight Technologies, Inc. KEYS recently announced that its conformance and carrier acceptance test solutions have been adopted by SGS to comply with 5G new radio (NR) certification criteria set by 3GPP as well as mobile operators in the United States and Asia-Pacific (APAC).

SGS will leverage Keysight’s solutions to address 5G radio frequency (RF) and protocol test requirements in sub-6GHz (FR1) and mmWave (FR2) frequencies. This will enable customers to enjoy enhanced experiences, while using 5G services on a mobile operator’s network.

Notably, Keysight’s portfolio of 5G test solutions enable test labs like SGS to verify the performance of 5G devices by providing cost-effective options for testing on a single solution platform. They also aid in the end-to-end development process of 5G devices.

The SGS deal win highlights the strength of Keysight’s test solutions. Moreover, growing clout of the company’s offerings amid accelerated deployment of 5G and is expected to bolster revenues in the quarters ahead.

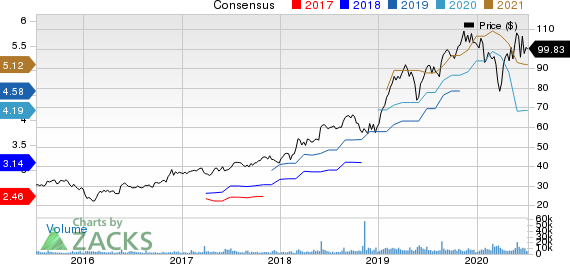

Keysight Technologies Inc. Price and Consensus

Keysight Technologies Inc. price-consensus-chart | Keysight Technologies Inc. Quote

Solid Traction for 5G Solutions Bodes Well

Keysight’s 5G test and emulation solutions are witnessing robust demand.

Recently, Keysight’s solutions were selected by Taiwan-based broadband provider Arcadyan, to certify consumer premises equipment (CPE) for fixed wireless access applications (FWA). The solutions will help Arcadyan rollout advanced fixed broadband services in urban, suburban and rural environments.

Moreover, the company’s offerings were adopted by Sporton, a testing lab in China, to comply with 5G new radio (NR) certification criteria per the latest 3GPP, PTCRB and CTIA standards. Sporton will leverage Keysight’s solutions to validate 5G devices that operate in FR2 frequencies.

The company is also witnessing higher adoption of the latest LoadCore offering, a 5G core network testing solution that simulates complicated real-world subscriber models.

The strong momentum for Keysight’s 5G test solutions holds promise for the company’s growth prospects over the long haul. This can be attributed to higher infrastructure investments in the deployment of 5G mobile networks due to growing need for high-speed data, increased implementation of automation technologies and rising adoption of IoT devices.

Further, the stay-at-home trends owing to resurgence in COVID-19 are driving demand for high-speed connectivity. As a result, Keysight’s 5G test solutions are likely to witness improved rate of adoption in the upcoming days.

Per Allied Market Research data, the global 5G technology market is anticipated to record a CAGR of 122.3% between 2020 and 2026. Also, investments in 5G new radio (NR) network infrastructure is expected to comprise 12% of the total wireless infrastructure revenues of CSPs (or communications service providers) in 2020 compared with anticipated 6% in 2019, per Gartner data.

Negative Impact of COVID-19 Pandemic

In spite of growing momentum for Keysight’s solutions, supply chain disruptions and market uncertainties stemming from the pandemic are dampening the company’s performance. In second-quarter fiscal 2020, Keysight’s commercial communications (CC) revenues declined 5% year over year to $468 million.

Moreover, lower international spending amid the ongoing crisis is expected to hurt the company’s prospects in the aerospace, defense & government (ADG) end-markets.

Zacks Rank & Key Picks

Keysight currently carries a Zacks Rank #5 (Strong Sell).

A few better-ranked stocks worth considering in the broader sector are Alteryx, Inc. AYX, Microchip Technology Incorporated MCHP and Nice Ltd. NICE. All the three stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Alteryx, Microchip and Nice is currently pegged at 41.8%, 14.5% and 10%, respectively.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

Nice Ltd. (NICE) : Free Stock Analysis Report

Alteryx, Inc. (AYX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research