Kansas lawmakers talk tax cuts with no movement

TOPEKA, Kan. (AP) — Kansas legislators' tax cut negotiations quickly halted Tuesday when senators realized that the best offer they could get from the House was one they've already seen.

Three senators and three House members reviewed a new proposal from the Senate, with the House rejecting the offer. Negotiators are trying to draft an alternative proposal that would replace one approved last week and sent to the governor.

The previous plan cuts individual income tax rates and eliminates income taxes for 191,000 partnerships, sole proprietorships and other businesses. Republican Gov. Sam Brownback, who's pushed the GOP-controlled Legislature to lower income taxes, has encouraged lawmakers to keep negotiating in hopes of getting a plan that would be less costly.

It was unclear Tuesday evening when negotiations would resume.

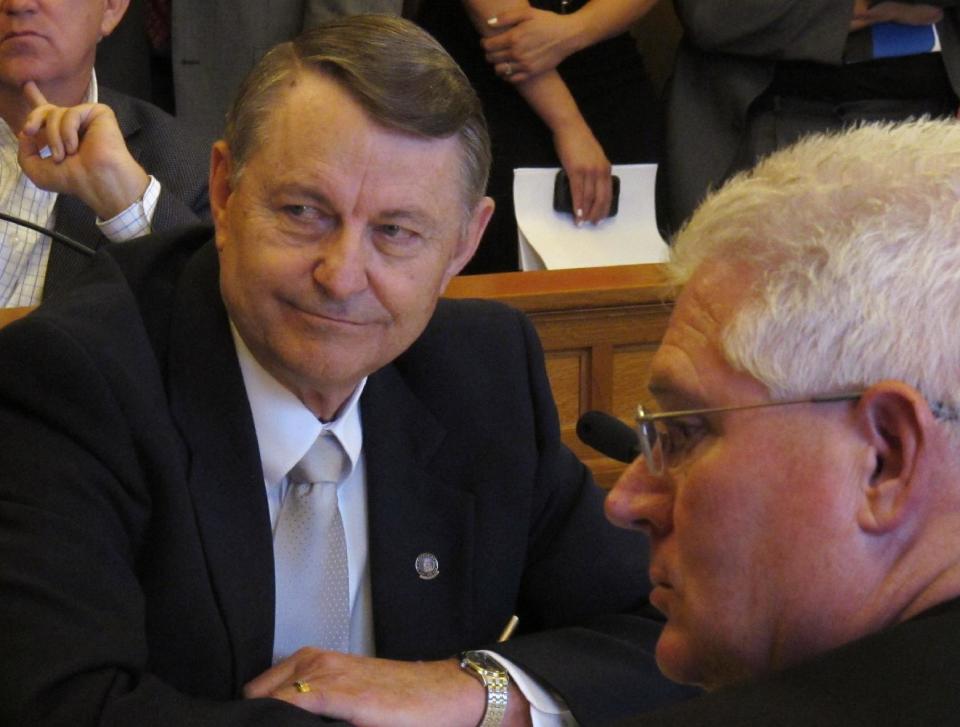

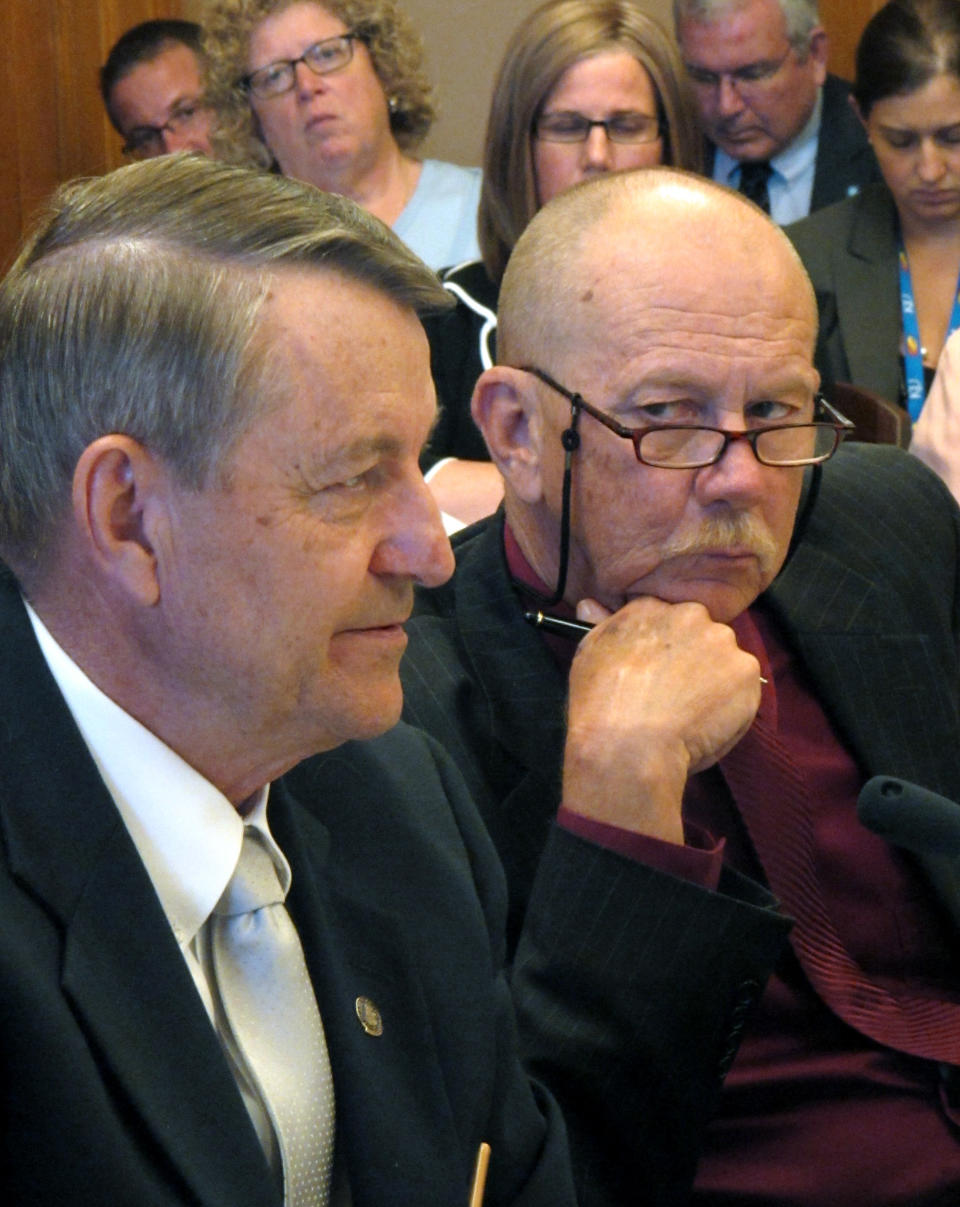

"We're not making progress," lead Senate negotiator Les Donovan, a Wichita Republican, told his colleagues just before the chamber adjourned for the night. "We've kind of hit a snag."

Brownback's fellow conservatives adopted the cuts after they feared the Senate would reject a less aggressive plan drafted previously by negotiators that blocked all tax cuts. But the Legislature's research staff predicted the more aggressive plan on its way to Brownback would create a budget shortfall by mid-2014. That shortfall could grow to almost $2.5 billion by July 2018.

Donovan outlined new proposals providing for income tax cuts that are even less aggressive than the ones that emerged previously from the talks. Lead House negotiator Richard Carlson, a St. Marys Republican, balked, saying the plan that emerged previously from the negotiations is the minimum GOP House leaders will accept.

"We want true tax reform, not a watered-down proposal that won't meet the goals of really changing the dynamics of the economy of Kansas and grow jobs," Carlson said.

In addition to income tax cuts, the state's sales tax is set to drop to 5.7 percent from 6.3 percent in July 2013. Legislators promised it would decline two years ago when they boosted the rate to fix a budget shortfall. They've decided not to change that policy.

Together, the tax cuts would lower taxes by $231 million for the fiscal year beginning July 1. The annual figure would climb to $934 million after six years.

"If we do nothing — we can't reach agreement at a level that is more palatable to more people — we're going to get what the governor has on his desk, and that's what we're trying to avoid right now," Donovan said.

The plan that previously emerged from tax negotiations would phase out income taxes for the 191,000 businesses over six years and cut individual income tax rates less aggressively. It was worth $61 million during the next fiscal year, growing to $597 million annually after six years.

Donovan offered a plan Tuesday that would provide $108 million in tax cuts during the next fiscal year but only $230 million annually after six years. His proposal cuts individual income tax rates even less aggressively and drops — not eliminated — income taxes for the 191,000 businesses.

___

Online:

Kansas Legislature: http://www.kslegislature.org

___

Follow John Hanna on Twitter at www.twitter.com/apjdhanna