Kansas House overrides governor’s veto of tax cut bills despite gloomy five-year forecast

- Oops!Something went wrong.Please try again later.

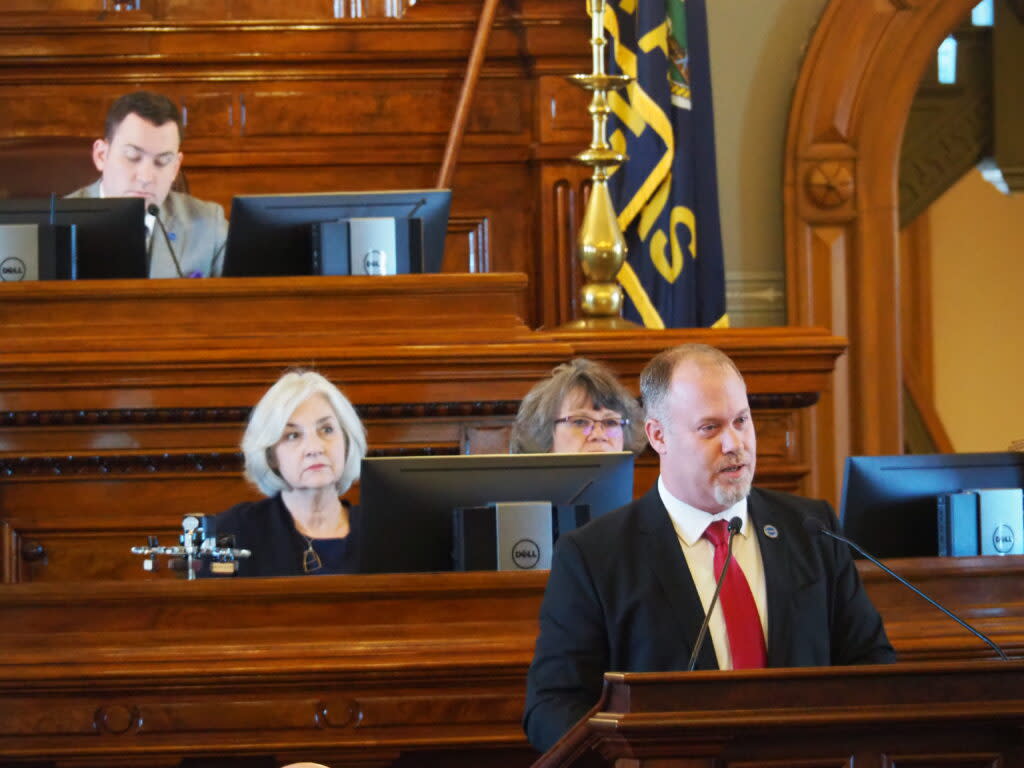

Rep. Adam Smith says he is drawing "a line in the stand" and refusing to back down on plans to reduce tax collections by $520 million per year. (Tim Carpenter/Kansas Reflector)

TOPEKA — Rep. Adam Smith doesn’t care for five-year financial projections.

The Weskan Republican wants big tax cuts — and he wants them now. He’s even willing to “draw a line in the sand” to get them.

Financial forecasts are unreliable, he argued Friday before House members voted to override Gov. Laura Kelly’s vetoes of income, property and sales tax cuts that would lower state revenue by about $520 million per year. Combined with other legislation that increases spending and lowers revenue, the state would burn through its $3 billion surplus and face a budget shortfall by 2029.

But five years ago, Smith said, the Chiefs hadn’t won a Super Bowl in 49 years. They have hoisted the Lombardi trophy three times since then. And five years ago, the United Kingdom was still part of the European Union, X was still Twitter, and 66 of the chamber’s 125 members weren’t in office.

Also five years ago, he said, the University of Kansas football team hadn’t won a conference championship since 1968 — so some things never change. But his point remained: “A lot can change in five years.”

Even a three-year financial outlook is pretty hazy, Smith said. That’s why financial experts convene twice a year to produce new revenue estimates for the state.

“I’m not worried about that. We’ve got plenty of time,” Smith said. “If the economy’s moving along, doing great, we’ll be fine. If the economy takes a downturn, we’ve got plenty of options. This isn’t locking things in for five years. We can make adjustments. We can make adjustments in our spending, we can make other adjustments in different tax incentives that we provide. There’s plenty of chance.”

The House voted 104-15, with Democrats divided, on whether to override the governor’s veto on House Bill 2036, which features a dramatic overhaul of income tax rates and a reduction in the statewide mill levy. The House then voted 99-20 to override the veto of House Bill 2098, which provides sales tax relief on vehicle sales, as well as sales tax exemptions for telecommunications, meat processing, State Schools for the Deaf and Blind, Kansas Fairgrounds Foundation, Exploration Place in Wichita, Kansas Children’s Discovery Center in Topeka, and Doorstep Inc. in Topeka.

The bills await action in the Senate, where 27 out of 40 members are needed to override a veto.

Kelly proposed an alternative package this week that would provide about $430 million in annual tax relief. Her plan would lower income tax rates for existing brackets to 5.65%, 5.2% and 3%, raise standard deductions, and increase the residential property tax exemption from $40,000 to $125,000.

“We must cut taxes for Kansans, but we have to do so in a fiscally responsible, sustainable way,” Kelly said. “The plan I unveiled this week ensures we can continue fully funding our essential services and puts more than $430 million back in Kansans’ pockets each year.”

The House gave no consideration to the governor’s plan before moving to override the veto of HB 2036, which had passed in the final hours of the regular session by a 119-0 vote.

Rep. Stephanie Sawyer Clayton, D-Overland Park, said in posts on X that her constituents have repeatedly asked her for tax cuts.

“When I see a responsible tax cut, I support it,” Sawyer Clayton wrote. “And I continue to support it. I’ll do so today. I owe you consistent behavior and complete honesty. I’ll also gladly support the Governor’s tax plan.”

She voted to override the veto on HB 2036 and against the override of HB 2098.

Rep. Mari-Lynn Poskin, D-Leawood, said she second-guessed the vote she had made “in the wee hours of the night” in early April, when she supported the tax cut package. Now, after confirming that “information available to me at the time was incomplete at best and purposely false at worst,” she opposed the package.

Rep. Patrick Penn, R-Wichita, made a procedural motion to strike Poskin’s comments from the record because, he alleged, she had impugned Smith’s motives, legislative speak for a breach of chamber decorum. But House Speaker Dan Hawkins, R-Wichita, overruled Penn because Poskin hadn’t named names. She was allowed to continue.

Poskin said her constituents don’t complain about income taxes, but they fill her inbox with pleas for relief when they get their property tax notices.

“We have room to trim this overall package and deliver on the most demanded tax cuts,” Poskin said.

Rep. Linda Featherston, D-Overland Park, said legislators shouldn’t be working at 2 a.m., which is when they finished an overnight marathon of votes on April 6.

“It is disrespectful to our constituents and irresponsible for our state,” Featherston said. “I am thankful that the governor and her team had plenty of time to examine this bill in the light of day.”

The post Kansas House overrides governor’s veto of tax cut bills despite gloomy five-year forecast appeared first on Kansas Reflector.