Kan. Senate moves tax bill, rejects gov.'s plans

TOPEKA, Kan. (AP) — Legislation cutting Kansas' sales and individual income taxes gained first-round approval Tuesday in the state Senate, but the bill differs dramatically from Gov. Sam Brownback's plan to overhaul the individual income tax code.

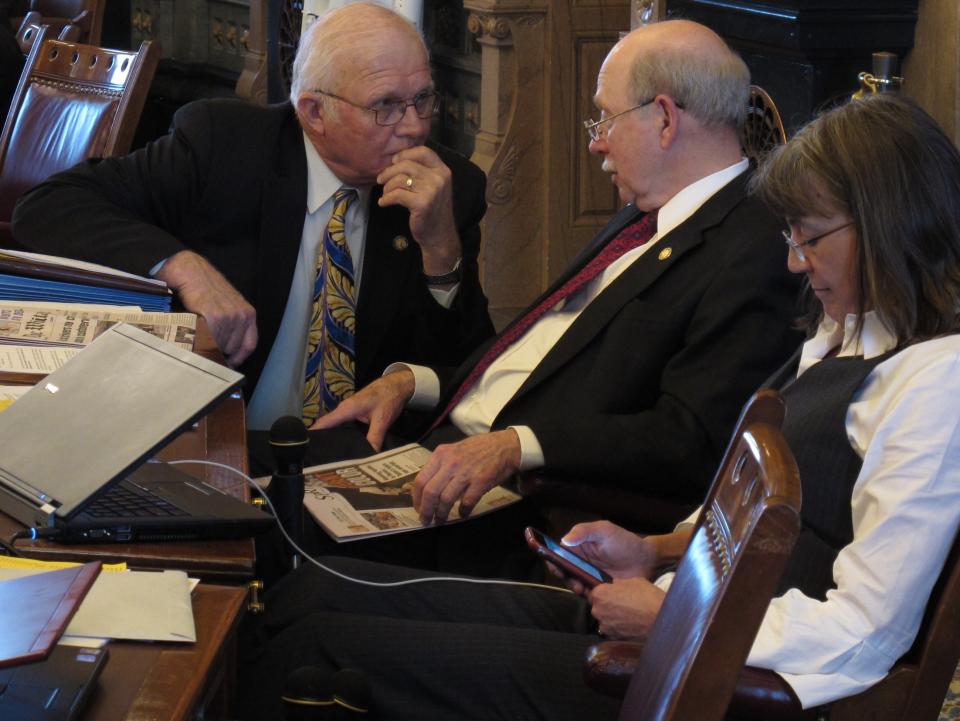

The Senate advanced the bill on a voice vote, and a final vote expected Wednesday will determine whether it passes. A coalition of Democrats and moderate Republicans, including the chamber's top GOP leaders, rewrote legislation that had contained most of Brownback's recommendations.

Senators embraced Brownback's proposals to cut the state's top individual income tax rates and eliminate income taxes for 191,000 partnerships, sole proprietorships and other businesses. But they rejected his proposals to eliminate a long list of income tax deductions, including ones for charitable contributions and interest payments on home mortgages. They also added a provision to drop the state sales tax from 6.3 percent to 5.7 percent in July 2013, a move the governor opposes.

There wasn't a firm estimate on how much tax relief the bill would provide, but officials thought it could be $800 million a year, which would force large budget cuts. Overall, Brownback's plan would provide $90 million in tax relief during the fiscal year that begins July 1.

But many senators saw the results of their three-hour debate over the bill Tuesday more as a repudiation of Brownback's plan than as something close to the final version of a tax bill. The Senate has a large GOP majority, but it is divided between moderates and Brownback's fellow conservatives over whether overhauling the income tax code would stimulate the economy.

"It's kind of lying, bleeding on the side of the road," said Sen. Pete Brungardt, a Salina Republican who was part of the bipartisan coalition. "I don't think there's a widespread belief that an income tax reduction changes the basics of the economic recovery."

The House has already approved a bill that includes income and sales tax reductions, and the final version of the tax legislation is likely to be drafted by House and Senate negotiators.

"There may be enough of this carcass left for us to get to conference to salvage something out of it," said Senate Assessment and Taxation Committee Chairman Les Donovan.

Some conservatives feared that the bipartisan coalition is preparing to kill the bill and move away from income tax cuts. Top Senate leaders in both parties have said previously that high property taxes are a bigger concern for many of their constituents.

Brownback has argued that cutting income taxes is the most effective way to boost the economy, pointing to the long-term growth experienced by states without income taxes, including Florida and Texas.

"We have here before us a plan that will grow the economy," Sen. Susan Wagle, a Wichita Republican, said of the governor's plan. "The long-term effects of these amendments are essentially that it kills the bill."

Brownback argued that his plan makes the individual income tax code simpler and fairer. But his proposals to eliminate deductions drew strong opposition, particularly from real estate agents who opposed eliminating the one for home mortgage interest payments.

The Senate tax committee jettisoned Brownback's plan to eliminate a tax credit for poor workers, but it endorsed his recommendations to eliminate many deductions. The Senate voted 21-19 to preserve them.

Brownback also wanted to keep the state's sales tax at 6.3 percent to offset proposed income tax cuts. Legislators raised the sales tax in 2010 — before Brownback took office — to balance the budget but promised then that the tax would drop to 5.7 percent after three years.

Senators voted 29-11 on Tuesday to drop the sales tax to 5.7 percent as scheduled. The House has approved the same proposal.

"I think if there were any great surprise to the people of Kansas, it would be that we would break our word, as opposed to keeping our word," said Senate Minority Leader Anthony Hensley, a Topeka Democrat who supported the 2010 sales tax increase.

___

The tax legislation is Senate Sub for SB 2117.

___

Online:

Kansas Legislature: http://www.kslegislature.org