JPMorgan and Citi — What you need to know in markets on Thursday

Big bank earnings will get underway on Thursday.

JP Morgan (JPM) and Citi (C), the first and fourth largest U.S. banks by assets, are set to report results before the market open.

Investors are looking for earnings per share of $1.65 on revenue of $25.6 billion from JP Morgan. Commentary from the bank’s CEO Jamie Dimon, who has been outspoken in recent months about the U.S. economy, Washington, D.C., and bitcoin will also be closely tracked by markets.

Wall Street is looking Citi to report earnings of $1.32 per share on revenue of $17.86 billion.

On the economic data side, investors will get the weekly report on initial jobless claims as well as the September reading on producer prices.

Donald Trump loves the stock market

One of President Donald Trump’s favorite things to brag about has been the stock market.

All three major averages closed at record highs again on Wednesday, and right now the stock market looks set to have its best year since 2013 and perhaps even since the bull market of the 1990s.

And on Wednesday morning, Trump took to Twitter to outline how much better he thinks the market would be doing if only tax reform could get through the house.

“Stock Market has increased by 5.2 Trillion dollars since the election on November 8th, a 25% increase,” Trump said on Twitter Wednesday morning.

Trump added that the U.S. economy has the lowest unemployment rate in 16 years and, “if Congress gives us the massive tax cuts (and reform) I am asking for, those numbers will grow by leaps and bounds.”

Of course, missing in this is the fact that neither the White House nor the House Ways and Means Committee has released a detailed plan on tax reform with only broad strokes still being discussed. And this as just about 30 working days remain on Congress’ schedule for 2017.

And yet leaving aside for a second whether tax reform is likely to pass this year — the answer is no — Trump’s contention that this would be good for the stock market is probably right.

This year’s hottest debate on Wall Street has been whether or not tax reform is “priced in” to the market, meaning have stock prices fully reflected investor belief about the benefits that would accrue to corporations if the U.S. corporate rate was lowered.

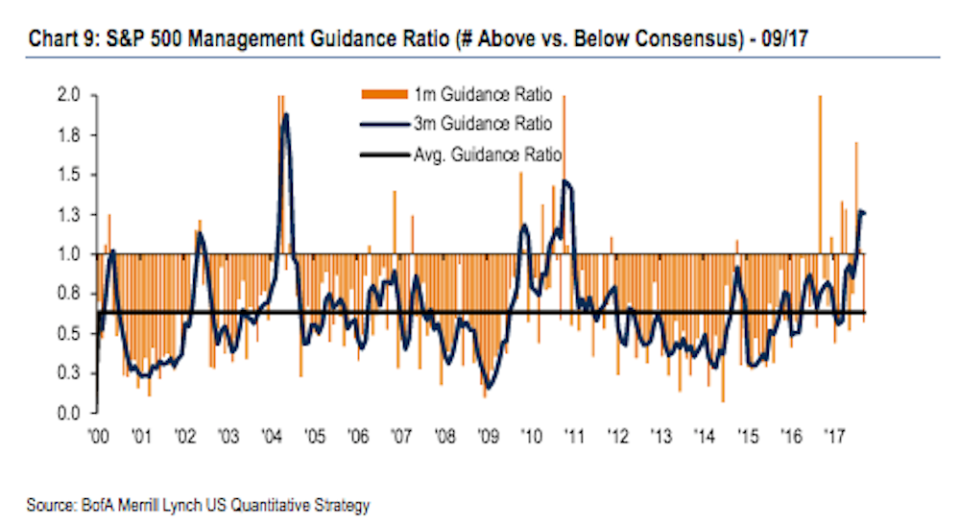

Some would say yes, some would say no, but the answer likely lies somewhere in the middle. Earlier this week we highlighted work from Bank of America Merrill Lynch which showed that corporate optimism, as reflected by earnings guidance, is near its best level since 2010. But the chart we highlighted showed a huge spike in 2005, right after the Bush tax cuts of 2004 had been passed.

On this basis, then, there is still a ways to go for tax reform to get “priced in” to markets and, to Trump’s point, there would likely be a further rise in the stock market if something were passed.

And as some analysts have noted, a change in the corporate rate certainly has implications for earnings in 2018, but the longer-term impact of a permanently lower U.S. tax burden for corporations is a huge change. It potentially puts billions of dollars onto the bottom line of U.S. corporate balance sheets indefinitely.

Which is why Wall Street has been fairly unwavering in saying that while the chances of tax reform getting through have ebbed and flowed during 2017, the chances of some bill getting passed haven’t really been taken to zero. Analysts at Goldman Sachs wrote earlier this week, for instance, that “Our political economist assigns a 65% likelihood that tax legislation will be passed in 2018, which is consistent with market pricing.”

Even if the political reality points to the chances of major legislation getting passed as just about nothing. In a sense, then, Wall Street has remained loyal to Trump, believing in the benefits of tax reform, and hoping that something will get done.

And there’s nothing Trump loves more than loyalty.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: