Jose Uribe flipped. Here's why he bribed Bob Menendez with a new Mercedes

- Oops!Something went wrong.Please try again later.

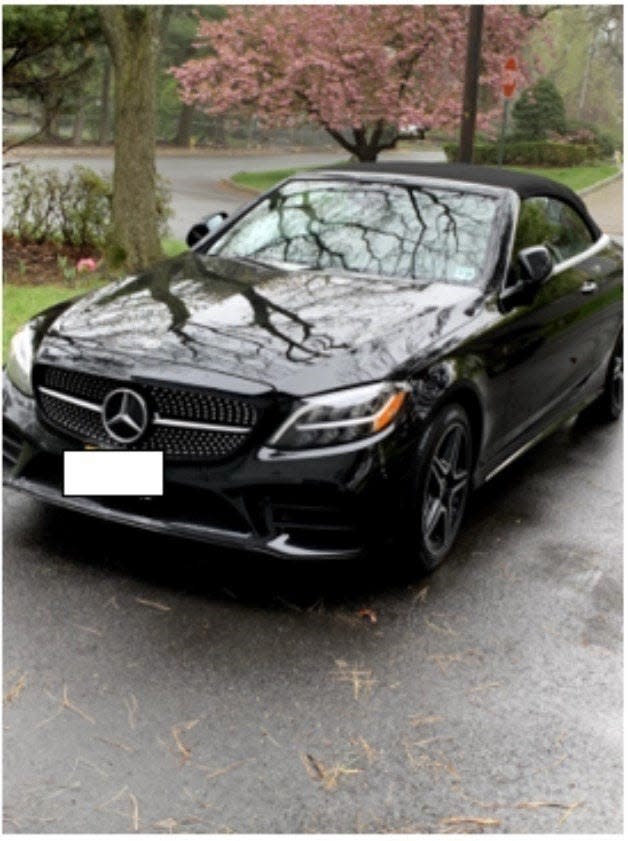

It’s one of the more startling accusations in the federal bribery case against Sen. Bob Menendez — that he traded his influence for a new Mercedes-Benz convertible for his wife after she totaled her own Mercedes in a crash that killed a pedestrian.

The North Jersey businessman who admitted making concealed payments on the $60,000 luxury car, Jose D. Uribe, is the least known of the five people indicted in the sweeping corruption scandal that extends to Egypt and Qatar — but he’s potentially the most significant.

Uribe is the only one to flip — pleading guilty to seven counts, including conspiracy to commit bribery and tax evasion — making him a likely key witness at the trial now underway in lower Manhattan.

Story continues below photo gallery.

The Mercedes was allegedly a payoff in exchange for the senator's aiding two of Uribe’s associates, including Menendez’s disruption of the prosecution of a person the indictment does not name.

But a NorthJersey.com review of court and other records shows how the timing and other details in the indictment match the case of Elvis Parra, a Closter resident who was charged with insurance fraud related to a trucking company he owned.

The trucking company’s insurance broker was Phoenix Risk Management — a cleverly named Hudson County business created in 2011 soon after Uribe himself pleaded guilty to insurance fraud and a judge ruled that his license — and the license of his insurance agency, Inter-America — should be revoked.

The formation papers of Phoenix Risk Management list the address of a Jersey City property that Uribe then owned and the names of his stepchildren. One of them stayed on state filings even after his license expired and he moved to the West Coast.

And more recently the agency has been accused in lawsuits of issuing documents that indicate insurance coverage existed when it did not. Those court records show, too, that Phoenix was reported to state authorities, alleging fraud.

Uribe, 57, had a two-decade run in the insurance business before his license was pulled, prohibiting him from owning an agency or working for one.

Prosecutors said he has maintained a network of businesses in other people’s names, earning income he didn’t report. He has worked in the trucking business, and records show he has invested in real estate, losing properties to lenders and tax liens.

He hadn’t made a payment in nearly a decade when a Union City property he owned was sold in a 2017 sheriff’s sale. He still owes more than $23,000 in state fines for violations at a Jersey City rental property he lost.

The more than $90,000 in fines and penalties imposed on Uribe when his license to sell insurance was revoked is still listed as unpaid more than a decade later, and some of the victims from his insurance fraud case say they were never made whole.

Despite those issues, Uribe has no recorded mortgage on his Clifton residence, purchased for $752,000 a couple of years ago. It is the same house being used to secure his $1 million bail in the federal bribery case.

Uribe made payments on the new Mercedes for Nadine Arslanian Menendez, the senator’s wife, until search warrants were executed in 2022 — he admitted that he tried to cover his tracks by saying the payments were loans. The senator made two contacts with a senior state official at Uribe’s behest, according to the indictment. That state official was identified in opening statements Wednesday as former New Jersey Attorney General Gurbir Grewal.

In addition to seeking a favorable outcome for one associate, Uribe wanted to stop a related investigation involving an employee.

“I knew that giving a car in return for influencing a United States senator to stop a criminal investigation was wrong,” Uribe told a judge when he pleaded, “and I deeply regret my actions.”

The Elvis Parra case

Parra, then-president of E&K Trucking, was indicted by a state grand jury in 2016 on multiple charges, including insurance fraud, for allegedly providing false and misleading information to obtain workers' compensation insurance, court records show.

The state said Parra cheated Liberty Mutual out of nearly $389,000.

He claimed that E&K had three drivers who were paid a total of $75,000 annually. He actually paid more than $2.9 million in annual wages to dozens more drivers who were owner-operators. He also denied that his company used drivers who owned their own tractors.

The initial application was signed by Parra and submitted in 2012 to the New Jersey Compensation Rating & Inspection Bureau, the agency that sets the rates for workers' compensation insurance in the involuntary market and designates an insurance company to provide coverage.

During a subsequent audit by Liberty Mutual, Parra created the false impression that E&K employed only six truck drivers in documents submitted.

Note the parallels in timing and detail between the Parra case and the details in the Menendez indictment:

Parra’s E&K Trucking policy was renewed in 2013, and a copy of it obtained by NorthJersey.com names Phoenix Risk Management as the producer. According to the Menendez indictment, an unnamed associate of Uribe’s was charged with insurance fraud related to a trucking company — and the insurance was brokered by a company controlled by Uribe. An employee of the company was involved in submitting the insurance applications at issue.

Story continues below photo gallery.

Parra had tried to get his insurance fraud case dismissed. But a judge denied the motion in November 2018, and in December — a few days after Nadine Menendez wrecked her Mercedes — the judge scheduled it for trial in the new year. In January 2019, Menendez and the other defendants in his case agreed that the senator would intervene in the prosecution of Uribe’s unnamed associate in exchange for a car, according to the indictment. Menendez called a senior state prosecutor in the state Attorney General’s Office that month and tried through “advice and pressure,” to resolve the matter favorably.

Parra ultimately signed a guilty plea to insurance fraud on April 29, 2019; three other charges were dropped. The prosecutors agreed to recommend probation. The Menendez indictment says the associate of Uribe resolved his criminal prosecution in April 2019 with a guilty plea. The plea agreement did not recommend jail time — a resolution more favorable than the prosecutors’ initial plea offer earlier in the case.

Parra declined to comment when asked about Uribe, the alleged Menendez bribes and his criminal case, referring all questions to attorney Geoffrey Rosamond, who did not return calls.

Michael Critchley, the defense attorney who handled Parra’s insurance fraud case, also did not return calls.

Menendez’s legal team, meanwhile, has served subpoenas on Uribe and his current and former counsel seeking, in part, documents and communications with the Southern District and the FBI related to a number of people, including Parra.

While prosecutors have not yet named Parra in court, Menendez attorney Avi Weitzman said in his opening statement Wednesday that Parra got a probationary sentence because there were holes and problems in the case.

“The evidence will show that. It had nothing to do with Senator Menendez whatsoever,” he said.

Suits accuse Phoenix Risk Management of fraud

Parra was sentenced to two years of probation, community service and $75,000 restitution to Liberty Mutual. The state Attorney General’s Office declined to comment on the outcome of the Parra case, but the indictment says the official whom Menendez contacted did not tell the prosecution team about the senator’s contact.

Liberty Mutual canceled the E&K policy before its expiration date, when the company failed to make its payments. It filed a civil suit against E&K, securing a $370,930 judgment.

Phoenix Risk Management and E&K were also sued in 2020 over a different policy brokered by Phoenix in 2014, one of six lawsuits — four related to the same fatal accident — that accused Phoenix of fraud or negligence. One of those cases shows Phoenix has been reported to New Jersey authorities for fraud by Lloyd’s of London, which declined to comment.

The Attorney General’s Office also declined to comment on any actions regarding Parra, Uribe and Phoenix — including any allegations made by Lloyd’s — saying the office does not confirm or deny investigations. It did provide a general statement on the Menendez case:

“At the time of the indictment we made it clear that our office would continue to cooperate with the U.S. Attorney’s Office, and we announced that our office would conduct an independent internal inquiry into the concerns raised in the indictment. That review is ongoing in a manner that will not conflict with the actions of the U.S. Attorney’s Office.”

The New Jersey Department of Banking and Insurance has no enforcement actions against Phoenix Risk Management, or the person listed in state business records as its owner, Ana Peguero, who is a licensed insurance producer.

Peguero is also named in the subpoenas served on Uribe and his lawyers.

She referred questions to her attorney, Max Nicholas, who declined to comment.

The state insurance department also declined to comment on any actions related to Uribe, saying it does not confirm or deny the existence of an investigation.

In New Jersey, a person whose insurance producer license has been revoked can’t own an agency or be employed by one in any capacity.

Uribe’s continued connection to the business was recognized in his plea deal in the Menendez case. It agrees he won’t be prosecuted further by the Southern District for his participation in various crimes including “engaging or participating in the business of insurance” after his conviction for insurance fraud and theft by deception, from May 2011 through February 2024, “to the extent he has disclosed it to this office.”

Uribe owned and lost multiple properties

Uribe got his start in the insurance industry at the now-defunct Zorrilla Insurance Agency in Union City, and once told a judge he worked as a clerk for three years before deciding “the insurance industry was what I wanted to do.”

State records show his license was first active in 1990 and he formed Inter-America Insurance Agency in 1999.

That same year, working under the name Capital Builders, he bought property in North Brunswick and Elizabeth with cash from a private lender, one of several forays into real estate that documents indicate ended badly.

The North Brunswick property was eventually signed over to the lender for $1. One of the Elizabeth properties was sold to one of Uribe’s brothers, who lost it in a bank foreclosure; Capital Builders lost a separate connecting tract in a tax lien foreclosure.

A property Uribe bought in 1995 in Union City was sold in a sheriff’s sale in June 2017. The foreclosure complaint said he hadn’t made a mortgage payment since November 2008.

And a pair of multifamily properties he owned in Jersey City were lost in 2013, one in a tax lien foreclosure and the other to the mortgage holder. There is still more than $23,000 in outstanding state fines related to one of them.

Over the years, the properties flipped ownership several times, from Uribe and his wife to an LLC, then back to Uribe and finally to a second LLC formed using the name of one of his brothers. But a $550,000 mortgage taken out on the properties from a private lender was signed by both Uribe brothers.

Fort Lee attorney Antranig “Andy” Aslanian — who has ties to other defendants in the Menendez case — was involved in that transaction and a host of other legal matters for Uribe dating back to at least 2006, including legal matters involving his old insurance agency and the case before the Department of Banking and Insurance that culminated in his license revocation.

Aslanian called Uribe a hard worker who struggled to support his family.

“I’ll tell you this — the man works seven days a week, 14 to 16 hours a day,” Aslanian said.

He said Uribe helped a lot of people, “a lot of truckers, mostly Hispanics,” get insurance so they could support their families, including lending them the money to pay for their policies.

“One thing with Jose, if he has 100 bucks in his pocket, count on the fact that he will spend $110,” he said.

Aslanian, who was subpoenaed by federal prosecutors last year, has known Nadine Menendez for two decades and considers Wael Hana, another co-defendant of Menendez, a friend, handling some of his legal work, giving him space in his office for a while, and going out with him for drinks.

More recently, Aslanian has represented Phoenix Risk Management and some of its clients — including Elvis Parra’s old trucking company — in civil matters.

“He had another person operating it,” Aslanian said of Uribe and Phoenix. “He had his trucking company, too, so he can’t be doing everything.”

Uribe’s plea with the Southern District names three trucking companies related to his tax evasion charges, two of which appear to have been formed in the names of relatives. It also includes Phoenix Risk Management, although it is named with an “LTD,” not the “LLC” used in state filings.

Aslanian said that as far as he knows, Uribe wasn’t selling insurance, but that he wouldn’t be surprised if someone asked him an insurance question, that he would answer it, and the reply would be “100 percent correct.”

“Jose happens to be very knowledgeable in the insurance field and understands insurance as well as anybody I’ve met,” Aslanian said.

He said that in the past, Uribe gave out "insurance cards that maybe he shouldn’t have given out.”

“Jose was trying to help people,” Aslanian said. “He did some things he shouldn’t have done. But that’s another story.”

Victims said they weren't paid

Uribe pleaded guilty to theft by deception and insurance fraud in 2011, but his actions dated back much further. There are references in the state record to a 2005 arrest and the related seizure of computers and documents from his offices.

At the time of his insurance fraud plea, Uribe admitted taking $76,819 in insurance premiums through Inter-America from seven clients from 2003 to 2010, creating the false impression that he used the money to buy insurance for their commercial vehicles.

A brother who worked at Inter-America — and who would also lose his license — pleaded guilty to conspiracy to commit insurance fraud. Both were sentenced to probation.

A restitution order filed with the courts naming both brothers in 2012 lists 11 individuals and more than $250,000 in restitution that was satisfied via settlement. Documents on file with the state insurance department, which started its own proceedings against Uribe on violations of the Insurance Producer Licensing Act in 2007, shows that a larger universe of clients may have been affected — one of the eight counts that the agency initially listed included more than 30 companies and individuals.

Some victims on the restitution order said they were not paid or made settlements that did not cover losses. The owner of a trucking company said it wasn’t worth the legal fees to try to recoup $13,000. Another said he never got the $8,500 owed, and recalled going to Inter-America when he learned there was no coverage after an accident.

“He was like, oh, no, it's good. It's good,” Bryant Dickey said. “But then the insurance company from the other side was like, listen, there's no insurance.”

Barbara Kurshnir said that when her firm’s Freightliner truck, valued at more than $100,000, was stolen, she settled for $50,000 — what the bank was owed, not the value of the vehicle, which had been recently purchased. There was also an accident that was not covered, and she was out the premiums paid for the insurance that did not exist.

“We got lucky; nothing else happened. Nobody was hurt,” she said. “I think we were able to pay the other party. He paid for the vehicle. But that was it. We didn't get anything else.”

During a hearing in February 2011 on penalties before an administrative law judge, Uribe, then 43, discussed how he had paid out over $90,000 in settlements to cover claims arising from accidents involving his clients.

And he painted a picture of an industrious family business that specialized in commercial trucking and catered to the needs of the community. In addition to his older brother, a sister served as clerk and secretary, and his father did some accounting part time.

Uribe said his stepson — who would later appear on paperwork for Phoenix Risk Management — was a “general helper” who got his license when he finished college.

They worked six days a week, sometimes until midnight. Most of his clients — he said 97% of 2,000 clients — were Hispanic and had been with him for years.

“I tend to know their kids, father and mother. I go to their parties,” he said.

Besides insurance, he said, people would “come in for anything, to read their mortgage statement” or to see how they were “getting penalized for parking tickets that they can’t even understand.”

Asked if there was another field in which he could earn a living, Uribe replied: “I didn’t even try. I have done but insurance all my life.”

A little over a month later, the judge concluded that his license and that of Inter-America should be revoked. He was fined $92,500, plus $2,125 for the department’s prosecution and investigation costs.

“Aside from characterizing respondent’s conduct as fraudulent,” the judge wrote, “the same conduct also demonstrates repetitive and egregious acts of incompetence, unworthiness and financial irresponsibility in the insurance business.”

The decision was affirmed by the commissioner of the state Department of Banking and Insurance six months later.

By then, Phoenix Risk Management had been created.

Phoenix Risk Management is created

Phoenix was formed in June 2011 under the names of two of Uribe’s relatives using the address of one of his Jersey City rental properties.

One of them was removed the next year. His stepson stayed on paperwork filed with the state until 2022, despite his moving to Seattle and having his insurance producer license expire in 2013.

Peguero shows up as a contact for Phoenix that year, and as its registered agent in 2018, when the official business address was changed to her Jersey City residence.

Her title is listed as owner in a report the following year — and she becomes its sole member in 2022 when Uribe’s stepson is removed.

Search warrants in the Menendez case were executed that June.

Phoenix has faced some legal woes. In the 2020 lawsuit filed against Phoenix and E&K Trucking — Parra’s business — by another company named Flexi-Van Leasing Inc., it said it was defending multiple lawsuits in New York arising from a 2014 accident in which it had falsely been led to believe it had insurance coverage.

According to the complaint filed in Bergen County, Phoenix issued a certificate of insurance “stating unequivocally” that Flexi-Van had been named an additional insured on a 2014 policy obtained by E&K Trucking. But the insurance company, also named in the suit, said it was never added.

Phoenix denied the allegation. The matter was later settled.

More recently, Phoenix was added to four lawsuits arising from a 2021 accident that took the life of 25-year-old Stephanie Santora, caused serious, disfiguring burns to Fabian Lucciola, and injured others.

Phoenix, one of some two dozen defendants named, was the broker for interrelated trucking companies, one that owned the truck that struck Santora’s car from behind and another that had leased the truck. The suits claim Phoenix “negligently, carelessly and/or recklessly breached their duty to” the two companies, the general public and the plaintiffs by “failing to procure the contractually necessary and/or agreed upon insurance.”

Phoenix has denied the allegations in court filings on three of the suits; an answer on the fourth is pending.

Raymond Gill, the lawyer for Lucciola, said the chassis leasing company required $2 million liability coverage per incident but Phoenix placed only half that, despite having the contracts.

Another case indicates Phoenix has been reported to the state. Filed in 2021, it claims Phoenix issued a certificate of liability insurance that falsely stated the hauling company had commercial general liability coverage through Lloyd’s of London.

The lawsuit explains how Sandra Thompson hired a company to move her belongings from Piscataway to Florida. They were picked up by a subcontractor who got its insurance through Phoenix.

The hauler parked in a storage lot, where fire broke out. Later, when Thompson’s items were unloaded inside the home, they were broken and heavily damaged by smoke and water; some items were not even hers. She had to hire a service to clean and decontaminate the property, and eliminate smoke, soot, fumes and odors.

She received a $14,700 settlement from the cargo insurance for the shipped goods.

The Lloyd’s policy, the suit said, would have covered the extensive damage to Thompson’s home. But the policy number corresponded to a Lloyd’s program that covered 2016 and 2017, while the policy was for 2019 and 2020.

“This policy distributed by broker Phoenix Risk Management, LLC is a fraudulent policy,” an affidavit in support of Lloyd’s said.

“Lloyd's has had this same issue with fraudulent policies being distributed by Phoenix Risk Management, LLC and has reported Phoenix Risk Management, LLC to the proper New Jersey fraud authorities.”

Thompson won an $86,159 judgment against Phoenix, Peguero, the trucking company and its owners — none of them responded to the lawsuit.

A second favor

An unnamed insurance company connected to Uribe also played a role in the second favor he would allegedly ask of Menendez.

According to the indictment, in late July 2019, about six months after the senator tried to intervene in the prosecution of Uribe’s associate, a detective wanted to interview Uribe’s employee — a broker at the insurance company he controlled — in a related criminal investigation.

It was agreed Menendez would attempt to intervene again with the same senior state official — named in opening statements as former Attorney General Gurbir Grewal — a contact the indictment says occurred that September. By then, Uribe had been making the periodic payments on the Mercedes for several months.

After Uribe learned of the interview request, he met with Nadine Menendez. The next morning he sent her a series of texts saying he didn’t want anyone to “bother” the employee and “[w]e need to make things go away,” “[w]e need to move fast,” and “[w]e can still stop this.”

That same day, the senator did a Google search for the initials of the state agency that employed the insurance fraud investigator seeking the interview.

And a few days later Nadine Menendez texted Uribe that the senator had commented that “it would have been so easy if we had wrapped both [requests] together.”

This article originally appeared on NorthJersey.com: Jose Uribe bribed NJ Senator Menendez with a Mercedes. Here's why