Joe Biden takes 'small steps' in new plan to fix the student debt crisis

Democratic presidential candidate Joe Biden announced his education plan, tackling the hot-button issue of student debt in a series of modest yet potentially effective steps, analysts say.

The former Vice President’s plan, announced on Tuesday, doesn’t call for mass student debt cancellations backed by other 2020 contenders like Senators Bernie Sanders of Vermont and Elizabeth Warren of Massachusetts. Yet its more modest approach still has teeth, some experts contend.

Under Warren’s and Sanders’ plans, most or all student loan debt would be cancelled, and public colleges become tuition-free. Biden’s $750 billion proposal effectively cuts repayments in half, incentivizes free community college, and hikes the maximum Pell Grant amount.

Those incremental proposals provide “a clear contrast between the student aid proposals issued by Biden, and by Warren [and] Sanders,” according to Mark Kantrowitz, the publisher of Savingforcollege.com.

“Biden's proposals are more traditional and more narrowly targeted,” Kantrowitz told told Yahoo Finance. “Probably the Warren [and] Sanders proposals pushed Biden to adopt a more aggressive set of proposals than he otherwise would have.”

The student loan problem has become one of the hottest policy topics in the 2020 race for the White House, with economists warning the mound of debt is a ticking economic time-bomb. It has far reaching implications— including serving as a drag on home ownership and upward mobility.

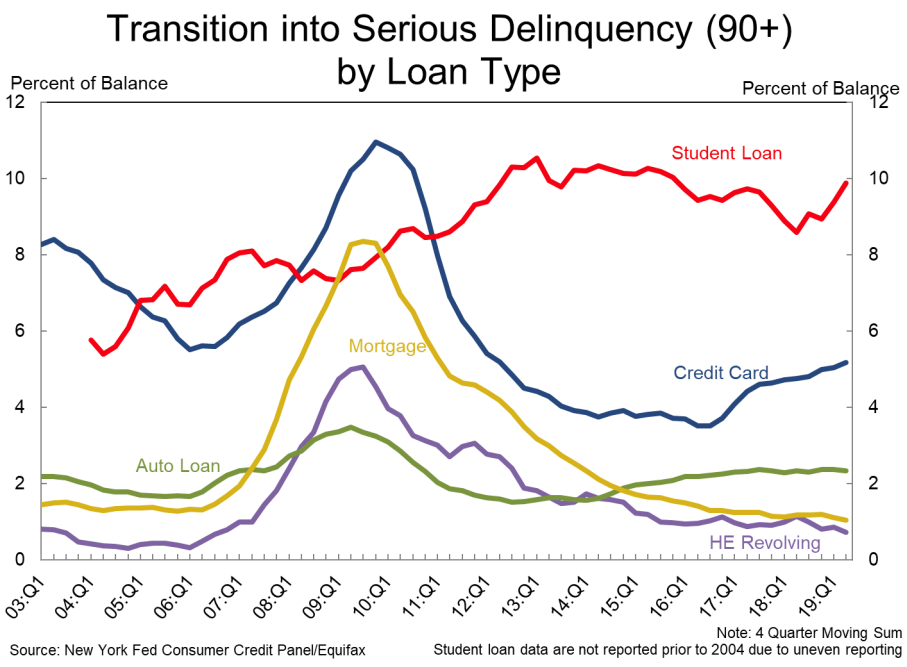

Outstanding student debt stands at $1.48 trillion, according to the New York Federal Reserve. The average balance per borrower was $33,500 this year. And those loans are increasingly going bad: In the second quarter of this year, 35% of the the outstanding balance of loans in the severely derogatory category were defaulted student loans. That surge represented a “stunning” increase, Fed researchers noted.

Despite being under pressure from more left-leaning Democrats, some noted that Biden “stopped well short of — and made no concerted effort to — match the more progressive education proposals of Warren and Sanders,” said Andrew Pentis, student loan expert at Student Loan Hero

“That doesn't mean his more targeted approach wouldn't affect real change, however,” Pentis told Yahoo Finance.

‘Small steps’

Biden’s ‘Plan for Education Beyond High School’ proposes to do the following to address the growing unpaid student debt problem by taking steps such as:

Doubling the maximum value of Pell grants

Slice income-based repayments by more than half.

Individuals earning less than $25,000 don’t owe any payments and their loans will not accrue interest. The rest of the borrowers will only need to pay 5% of their discretionary income instead of 10%. The income counted will be less taxes and “essential spending like housing and food.”Modify the tax code so that debt forgiven after 20 or 25 years of repayment via income-based plans will not be taxed.

Fix the “broken” public service loan forgiveness program which has a dismal 99% rejection rate.

Make for-profits “prove their value” to the Department of Education before they become eligible for federal aid.

“These are small steps in the right direction, but our supporters will continue to call on every candidate to fight for the boldest solutions that end today’s student debt crisis and makes college affordable for every American in the future,” Cody Hounanian, a spokesperson for advocacy organization Student Debt Crisis, told Yahoo Finance in a statement.

While Biden didn’t pitch mass student loan forgiveness, his point on income-based repayment plans could still leave taxpayers footing the bill, some experts noted.

Under Biden’s proposed plan, a borrower would pay less on repayments and interest, even if they earn $10,000 a month or $100,000. And because of those reduced payments across the board, “not only would it double the cost to the government for borrowers … It would also make the income-driven repayment plan the default choice,” Kantrowitz said.

On top of that, while the reduced percentage “could lessen the strain of student loan debt on American households… it could also entice many borrowers to prolong their repayment,” added Pentis.

—

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

Elizabeth Warren unveils 'broad cancellation plan' for student debt

Bernie Sanders unveils sweeping student debt cancellation plan

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.