Jobs week, Apple earnings — What you need to know in markets this week

What a week.

In both markets and politics, this past week seems likely to be the summer’s busiest.

Almost 200 members of the S&P 500 reported earnings, among them Amazon (AMZN), Starbucks (SBUX), and Alphabet (GOOGL), which all declined after results.

Meanwhile Facebook (FB), Boeing (BA), and Verizon (VZ) all popped after results that topped estimates.

And jammed in the middle there was an uneventful Federal Reserve announcement that saw the central bank keep its interest rate policy unchanged. On the economic front, the first estimate of second quarter GDP came in a bit weaker than expected, with the economy growing at an annualized rate of 2.6% for the three months ending in June.

On the political side, Senate Republicans failed to get a so-called “skinny repeal” of Obamacare through, while President Donald Trump added a new member to his communications staff — hedge funder Anthony Scaramucci. “The Mooch” then had what he called a “colorful” conversation with The New Yorker.

And then at 4:50 p.m. ET on Friday, Trump named General John Kelly Chief of Staff, replacing Reince Priebus. Quite a week in the Trump administration.

Through it all, the Dow hit a new record, while the S&P 500 and Nasdaq closed the week just off fresh records they touched on Wednesday.

In the week ahead, the month’s biggest economic report — the July jobs report — will come out on Friday, with economists expecting 180,000 jobs were adding during the month while the unemployment rate should fall to 4.3%. Other key reports will be reading on inflation and manufacturing activity.

On the earnings calendar, notable earnings will include the world’s biggest company, Apple (AAPL) on Tuesday. Also, we’ll hear from Pfizer (PFE), Xerox (XRX), Under Armour (UAA), Time Warner (TWX), Humana (HUM), Mondelez (MDLZ), Metlife (MET), Yum Brands (YUM), Kellogg (K), Viacom (VIAB), and Berkshire Hathaway (BRK-A, BRK-B).

Investors will also keep on eye on shares of Snap Inc. (SNAP) on Monday, as the company’s post-IPO lockup period expires, leaving open the chance for many company insiders to sell their shares into the market for the first time.

Economic calendar

Monday: Chicago PMI, July (60 expected; 65.7 previously); Pending home sales, June (+1% expected; -0.8% previously); Dallas Fed manufacturing, July (13 expected; 15 previously)

Tuesday: Personal income, June (+0.4% expected; +0.4% previously); Personal spending, June (+0.1% expected; +0.1% previously); “Core” PCE, year-on-year, June (+1.4% expected; +1.4% previously); Markit manufacturing PMI, July (53.2 expected; 53.2 previously); ISM manufacturing, July (56.4 expected; 57.8 previously); Construction spending, June (+0.5% expected; +0% previously); Auto sales, July (16.8 million cars annualized, expected; 16.41 million cars annualized, previously)

Wednesday: ADP private payrolls, July (+190,000 expected; +158,000 previously)

Thursday: Initial jobless claims (241,000 expected; 244,000 previously); Markit US services PMI, July (54.2 previously); ISM non-manufacturing PMI, July (56.9 expected; 57.4 previously); Factory orders, June (+2.8% expected; -0.8% previously)

Friday: Nonfarm payrolls, July (+180,000 expected; +222,000 previously); Unemployment rate, July (4.3% expected; 4.4% previously); Average hourly earnings, month-on-month, July (+0.3% expected; +0.2% previously); Average hourly earnings, year-on-year, July (+2.4% expected; +2.5% previously); Trade balance, June (-$45 billion expected; -$46.5 billion previously)

Women at work, women at home

Over the last several decades, no trend has had a bigger impact on the U.S. economy than participation of women in the workforce.

And while, like men, participation in the labor force among women has declined some in recent years, comparing the composition of the workforce by gender today to the workforce just a few decades ago reveals a huge shift in how the economy operates.

In a note to clients this past week, Joe Song, an economist at Bank of America Merrill Lynch, took a look at how working women — now comprising fully 46% of the prime-age workforce (or workers between 25-54) — are spending their time and the impacts this is likely to have on the economy.

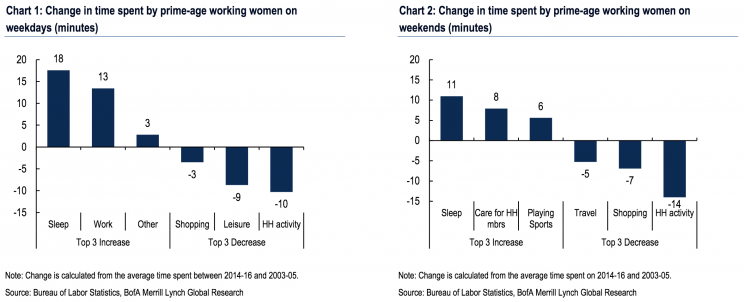

Song used data from the Bureau of Labor Statistics to compare time spent on certain activities from 2014-2016 against 2003-2005. And even in just over a decade, some of the changes in who does what at home have made big shifts.

Song writes:

On weekdays, prime-age working women are sleeping and working more and doing less household activities (chores) while spending less time on leisure and shopping. On weekends, women are consuming more sleep, spending more time caring for household members (e.g. childcare) and playing sports while spending less time on chores and shopping. These results suggest that women are prioritizing their careers and families while finding ways to reduce their time doing household chores and shopping.

Taking this data together with the broad shape of the U.S. economy as one that has moved to being levered to consumer spending and services — rather than manufacturing and good productions — it’s clear that this shift is not going to reverse.

Song writes that these figures suggest working women — and, by extension, their families — “will spend less time on household activities leading to greater demand for on-demand and home management services.”

Song notes that the changes we’ve seen in the retail and grocery sector, where online shopping has become an increasing part of the industry, are indicative of these shifts away from doing chores and other time-consuming, but less rewarding household activities, and towards things like sleep, work, and leisure time with family rather than away from it.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: