Jobs and housing — What you need to know in markets this week

Stocks are at record highs.

Last week, the S&P 500 and the Nasdaq went out at fresh all-time highs as more and more commentary has focused on whether the run-up we’ve seen in tech stocks this year is leading us into bubble territory.

Yale professor Robert Shiller noted last week that while his famed CAPE ratio puts stocks at among their most expensive in history, the market could still go up. Historically, Shiller notes, high readings on the CAPE ratio have indicated lower future returns. But they need not reflect this necessarily, and as was the case before the height of the 2000s tech bubble, stocks could go up 50% or more before we see a fall.

And as Yahoo Finance’s Sam Ro noted this week, it is the end of bull markets that are often most painful for bears.

The bulls will point to strong earnings in the first quarter, when S&P 500 earnings rose 14.5% over the prior year. But as Gluskin Sheff strategist David Rosenberg noted week, earnings have risen just 7% over the last three years while the S&P 500 is up over 22% during that period.

“With price returns tripling profits, the market is now supremely overvalued,” Rosenberg writes. “In fact, the most overvalued in 15 years, and that includes the housing and credit bubble peak of 2007… I find it amazing as well as amusing that the cheerleaders are talking about how great earnings are when they are so woefully below the estimates that the consensus analyst community was forecasting years ago.”

In the week ahead, focus will turn more to the health of the U.S. economy, with inflation data, home prices, and the all-important May jobs report all on the schedule.

This should then have investors turning their focus to the June 13-14 Federal Reserve meeting, at which the Fed is expected to raise interest rates for the third time this year.

Economic calendar

Monday: Markets in the U.S. closed for Memorial Day

Tuesday: Personal income, April (+0.4% expected; +0.2% previously); Personal spending, April (+0.4% expected; +0% previously); “Core” PCE, year-on-year, April (+1.7% expected; +1.8% previously); S&P CoreLogic Case-Shiller home prices, March (+0.9% expected; +0.7% previously); Conference Board consumer confidence, May (119.8 expected; 120.3 previously); Dallas Fed manufacturing index (15.0 expected; 16.8 previously)

Wednesday: Chicago PMI, May (57.0 expected; 58.3 previously); Pending home sales, April (+0.4% expected; -0.8% previously); Federal Reserve Beige Book

Thursday: ADP private payrolls, May (+180,000 expected; +177,000 previously); Initial jobless claims (239,000 expected; 234,000 previously); Markit US manufacturing PMI, May (52.5 expected; 52.5 previously); ISM Manufacturing PMI, May (54.6 expected; 54.8 previously); Construction spending, April (+0.5% expected; -0.2% previously); Auto sales, May, (16.95 million vehicles expected; 16.81 million previously)

Friday: Nonfarm payrolls, May (+185,000 expected; +211,000 previously); Unemployment rate, May (4.4% expected; 4.4% previously); Average hourly earnings, month-on-month, May (+0.2% expected; +0.3% previously); Average hourly earnings, year-on-year, May (+2.6% expected; +2.5% previously)

Consumer credit slowdown

Consumer spending accounts for about 70% of economic growth.

As the U.S. consumer goes, so too goes the U.S. economy.

Recently, however, the growth in consumer credit has begun to slow and leaves open the question of whether a slowdown from the U.S. consumer is something to monitor as a potential problem for the economy at large.

Joe Song, an economist at Bank of America Merrill Lynch, writes in a note this week that “consumer credit creation has slowed, adding to concerns that consumer demand has weakened.” Growth in the number of credit card accounts opened in the first quarter slowed, while the latest Senior Loan Officer Opinion Survey, or SLOOS report, from the Federal Reserve showed demand for credit cards slowing down despite standards loosening.

“It‘s unclear whether the slowdown in the growth of revolving credit is just a temporary soft patch or a more nefarious sign of a downturn in the economy,” Song writes.

Soft spending data in the first quarter of this year, even when adjusted for seasonal effects, certainly points to a weaker environment for consumer spending. But Song notes that the demand for consumer credit has softened during economic expansions before later reversing, all without the economy falling into recession.

Among the factors potentially leading to weaker demand are demographic shifts, particularly the maturation of millennials and recent regulations that have made the credit histories for today’s young workers shorter than in prior generations.

Song also notes that, “due to the experience of the Great Recession, millennials may be less inclined to buy using credit or are ‘convenience users’ who pay off their entire credit card balance every month, limiting the need for multiple credit cards.”

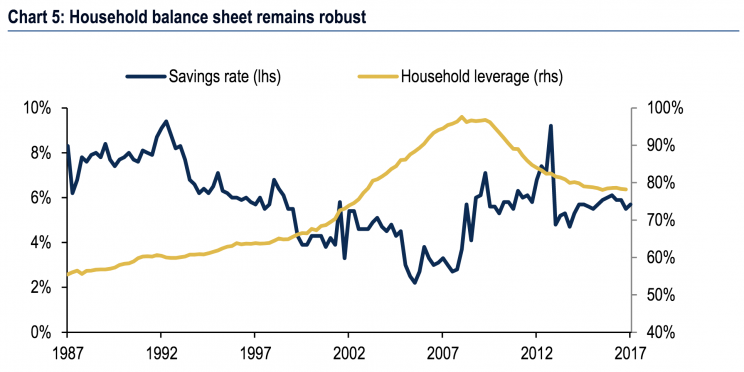

And when looking at the bigger picture on the finances of American consumers right now, household leverage remains low and manageable while savings rates remain high.

“At this point, we are inclined to mostly fade the weak signals.,” Song writes.

“The consumer backdrop is largely supportive. Job growth remains robust and given the low level of the unemployment, wage growth should head higher, albeit slowly… Credit demand seems to have slowed but lending standards remain favorable.

“On the other hand, we are starting to see pockets of stress on the household balance sheet that could spark weakness in the overall economy but so far it seems contained. We will be closely monitoring credit conditions for early warning signs of a slowdown in the economy. It squarely remains a risk to our outlook.”

And so while many in markets remain fixated on whether President Trump’s agenda will be enacted in part or in full, the story with the U.S. economy, as ever, starts and ends with consumers.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: