JOBS DAY — What you need to know in markets on Friday

The June jobs report is here.

At 8:30 a.m. ET on Friday morning, the Bureau of Labor Statistics will release its employment report for the month of June.

Economists expect this report will show another strong month of labor market growth in the U.S., with nonfarm payrolls forecast to have increased by 195,000 with the unemployment rate holding steady at an 18-year low fo 3.8%, according to estimates from Bloomberg.

Wages will of course be closely watched by economists looking for signs of inflationary pressures in the economy, and expectations are for average hourly earnings to pick up by 0.3% over the prior month and 2.8% over last year.

Investors who stuck around for the holiday-shortened week will not only be digesting a jobs report on Friday, but also grappling with the reported implementation of new tariffs on $34 billion worth of Chinese imports to the U.S.

Reports on Thursday indicated these new tariffs from the Trump administration would take effect at midnight on Friday, with Chinese officials having indicated they would look to immediately counter these measures.

On the earnings side, there are no corporate results expected out on Friday.

June jobs report preview

The headline expectations for Friday’s jobs report is simple enough.

An additional 195,000 jobs were expected to be created and the unemployment rate should hold at 3.8% and average hourly earnings are expected to rise 2.8%. Which sounds like the same story we’ve been hearing for years now — good job gains, low unemployment, modest wage inflation.

These top-level readings on the labor market, however, don’t capture the recovery that is happening in the labor market. And don’t capture how much further U.S. workers have to go to see their fortunes match prior economic cycles.

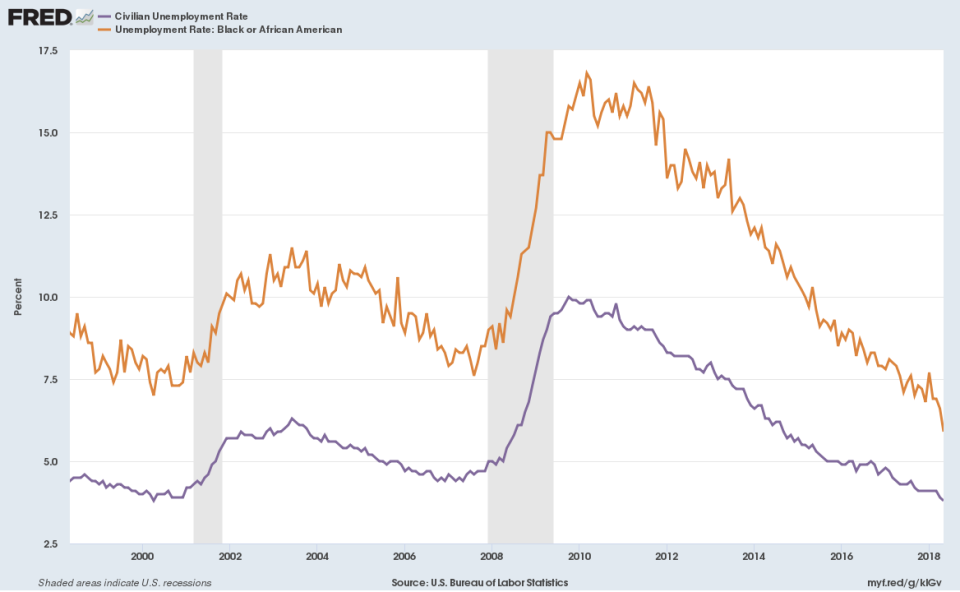

Outside of the headline unemployment rate and job gains on Friday, economists will also be looking at secondary indicators that we’ve highlighted in recent months, such as flows of working moving from of the labor force to getting a job right away, the black unemployment rate (which has historically lagged the overall unemployment rate but has fallen more quickly in recent months), and the number of workers out of work for more than six months.

Additionally, during its June policy meeting some officials at the Federal Reserve points to, “indicators such as a very high rate of job openings and an elevated quits rate as additional signs that labor market conditions were strong.”

That the labor market is tightening to a level that would become problematic for the economy, however, is still in doubt to some Fed officials.

According to the minutes from the Fed’s June policy meeting, “Several participants, however, suggested that there may be less tightness in the labor market than implied by the unemployment rate alone, because there was further scope for a strong labor market to continue to draw individuals into the workforce.”

In a note to clients published Wednesday, analysts at Macquarie said the current unemployment rate — which when rounded to three decimals comes in at a 48-year low of 3.755% — might be overstating the strength of the labor market generally.

The labor force participation rate, which stood at 62.7% in June and not too far above the generational low of 62.3% hit in September 2015, has been declining for decades as prime-age workers drop out of the workforce.

And the situation may not be improving imminently.

“We find that 45% of the deterioration [in the labor force participation rate] has been driven by an increase in those not working due to disability or illness, with most of the damage occurring among 45-54 year olds,” Macquarie writes.

“It is difficult to assess the cause of this, but the change has been partly attributed to wider opioid usage, greater obesity rates, and reduced incentives to look for work. While there has been a modest improvement recently (with the drag on prime-age participation falling from 1.3% to 1%), this suggests that it will be difficult to get many of these workers back into the workforce.”

So while overall employment continues to improve, the U.S. labor market is clearly still dealing with dislocations that are leaving many workers behind. And which is not just explained by a “skill mismatch” between employers and employees.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland