JetBlue Hurt by High Fuel Costs Amid Unit Revenue Growth

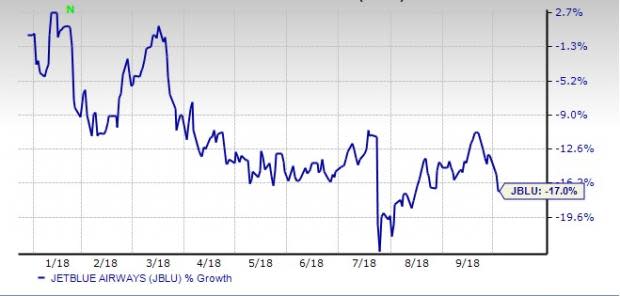

Shares of JetBlue Airways Corporation JBLU have struggled so far this year, shedding 17% of their value on a year-to-date basis.

YTD Price Performance

The main reason for this dismal price performance is the rise in fuel costs as oil prices have increased almost 20% year to date. Since expenses on fuel are significant for airlines, rise in oil prices are detrimental to bottom-line growth.

High fuel costs are likely to hurt JetBlue’s third-quarter 2018 results as has been the case in the past few quarters. Third-quarter fuel cost, net of hedges, is anticipated to be $2.33 per gallon, higher than the $2.28 registered in the second quarter.

High labor costs are also likely to limit JetBlue’s bottom-line growth in the third quarter. Earlier this year, JetBlue ratified a four-year agreement with its pilots represented by Air Line Pilots Association. Following ratification of the deal, this low-cost carrier raised its non-fuel unit costs view for the third quarter. It now anticipates the metric to rise in the band of 3-5%. The previous guidance had called for a 1-3% increase in the metric. Woes related to capacity overexpansion also represent a further challenge for JetBlue.

To counter the threat posed by high fuel costs and augment its top line, JetBlue increased fees for checked bags and ticket changes in August 2018. The carrier raised the fee to $30 from $25 for the first checked bag. Fees for the second and third checked bags have also been increased.

Apart from JetBlue, the likes of American Airlines Group Inc. AAL, Delta Air Lines, Inc. DAL and United Continental Holdings, Inc. UAL have raised fees for checked bags.

Not All Brickbats, Some Roses Too

JetBlue is being aided by strong demand for air travel. To this end, this Long Island City, New York-based company unveiled an improved projection for third-quarter revenue per available seat mile (RASM: a key measure of unit revenues) in September. The carrier now anticipates RASM to grow between 1% and 3% (the earlier view had called for the key metric to grow in the 0-3% range). JetBlue cited robust close-in demand as one of the factors behind its decision to issue an improved guidance.

We are also impressed by the carriers’ efforts to reward its shareholders. To this end, the company’s board of directors approved a new share repurchase program in December 2017. This apart, the company’s efforts to modernize its fleet are commendable. In July 2018, the carrier placed an order for 60 Airbus A220-300 planes (previously known as Bombardier CS300).

The above write-up clearly suggests that high costs are a bane for JetBlue. However, the carrier does have its share of positives and is taking steps to mitigate the impact of high fuel costs. Now, only time will tell the extent to which the efforts can bear fruit. Therefore, in the present scenario, we advise investors to wait for a better entry point before investing in JetBlue. The company’s Zacks Rank #3 (Hold) seems to suggest the same. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Companies Verge on Apple-Like Run

Did you miss Apple's 9X stock explosion after they launched their iPhone in 2007? Now 2018 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs. A bonus Zacks Special Report names this breakthrough and the 5 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains.

Click to see them right now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Continental Holdings, Inc. (UAL) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research