Jeremy Hunt Turns to Retail Investors to Save the UK Market

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Jeremy Hunt wants UK retail investors to help revive the fortune of the country’s ailing stock market, which has been beset by underperformance, outflows and an exodus of companies.

Most Read from Bloomberg

Ukraine to Get 155mm Artillery Shells Found in Czech-Led Effort

Bankers Sick of the NYC Commute Are Fueling a Boom in a Mini Greenwich

Trump Warns of Big Losses From Asset Sales During Property Slump

The Casino Crowd Is Back Across Markets With Soft Echoes of 2021

The Chancellor of the Exchequer is open to the idea of creating a so-called British ISA, a tax-free savings account for investing in UK equities. In addition, government plans to sell a stake in the bailed-out NatWest Group Plc are likely to include a direct pitch to consumers.

ISAs, or Individual Savings Accounts, were introduced almost 25 years ago offering tax-exempt savings up to a limit that’s now £20,000 ($25,250).

But one version of the UK ISA plan winning support in the industry wouldn’t just incentivize savers to put British money into British stocks, it wouldn’t allow tax relief on investments abroad. That may cost households a chunk of the premium they’ve been enjoying from holding shares in more dynamic foreign markets. Rather than handing taxpayers a giveaway, it could ultimately leave them worse off, to the tune of thousands of pounds.

For many in the sector, any initiatives that could reverse or stall the UK’s decline can’t come soon enough.

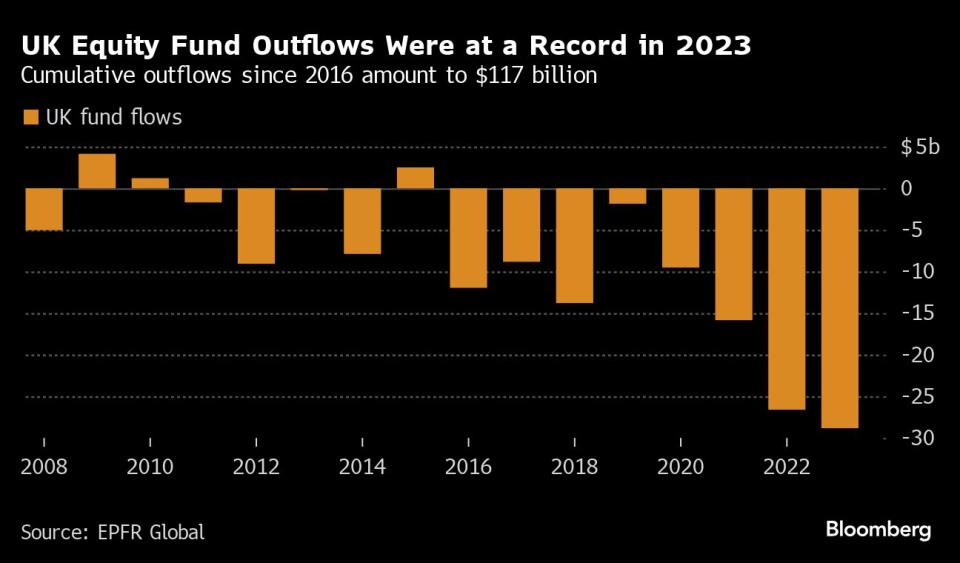

Investors pulled a record $28.8 billion from UK equity funds last year, according to EPFR Global, while US markets have been luring London-listed firms. Even Arm Holdings Plc, a national champion, chose to take its initial public offering to New York.

“I’ve never had such a turning point in my career where if we don’t do something now, then it could be so damaging for the UK economy and UK smaller companies,” said Judith MacKenzie, head of Downing Fund Managers and chair of the Quoted Companies Alliance, a lobby for small- and mid-cap companies. “It just would be tragic.”

Budget Plans

Hunt will unveil his Budget next week and is under pressure to deliver a plan that gives his Conservative Party a much-needed poll boost ahead of an election that’s probably just months away.

He’s already looking at various reforms to revive the UK market, which has seen its global financial reputation put into question by Brexit.

But measures that target consumers can’t be seen to just benefit the City of London. They’ll have to be sold as a way to get capital into growing companies, create jobs and help an economy that’s slipped into a technical recession.

There’s plenty of household money for Hunt to tap. An estimated £1.8 trillion of cash is being held in savings accounts, according to the Centre for Policy Studies. And the proportion of domestic shares held by UK residents has been declining for years and was just 11% at the end of 2022.

The British ISA would aim to increase that, though there’s no agreed design.

Momentum around the new version started back in September, when Mike O’Shea, chief executive of Premier Miton Investors, proposed increasing the existing allowance by £5,000 that would be eligible for investment solely in UK companies.

In November, a group representing money managers, brokers and companies argued for redirecting future ISA savings into UK assets — essentially steering the £68 billion a year invested in the vehicles toward British companies.

“Investors could still put money into overseas firms, just without the support of an overt tax break,” it said in an open letter.

The Quoted Companies Alliance would increase the allowance to £25,000, simplify the range of products and require at least half of new stock investments to be in UK shares. That could pump an additional £10 billion into UK equities per year, according to New Financial, a think tank.

Susannah Streeter, head of money and markets at Hargreaves Lansdown Plc, sees issues with all three proposals, but she singled out the prospect of eliminating tax relief on overseas investments as “particularly worrying.”

“It would unnecessarily concentrate portfolios,” Streeter said. “It’s crucial that investors abide by one of the golden rules of investing which is not to put all their eggs in one basket.”

Another wrinkle is how to define “British” equities. International FTSE 100 stocks that generate most of their business overseas may need to be excluded, according to Graham Simpson, head of Quest Research at Canaccord Genuity.

Allowing those firms to be in the ISA could channel investment outside of Britain, “depriving the smaller companies of capital that will actually benefit the UK economy through investment and jobs creation,” he wrote in a note.

Whatever happens on Budget day, there’s agreement in the industry that wider reforms are needed — such as cutting stamp duty on trading — to make the UK market more attractive.

“We are very encouraged by the progress being made and the widely held desire to ensure the UK capital markets and our position as a global financial centre continue to drive our economic growth,” said Charlie Walker, deputy CEO of London Stock Exchange Plc. “There is, however, more to do.”

For Andy Briggs, chief executive of life insurer Phoenix Group Holdings, the British ISA is one of a string of initiatives that should encourage more saving. Pension contribution rates are well below the norms in other countries, with auto-enrollment rates set at just 8% of earnings, he said.

“We’re actually doing a disservice to people thinking that 8% contributions are enough and they’re going to get a good standard living in retirement, because they won’t,” Briggs said. “Ultimately, if we want more money going into UK capital markets, one of the key things we can do is help people save more.”

--With assistance from Katherine Griffiths and Michael Msika.

Most Read from Bloomberg Businessweek

The Monaco Royals Whose Deals Have Brought Peril to the Palace Doors

Top Takeaways From Businessweek’s Investigation Into Monaco’s Royal Family

China’s Piano Dreams Are Fading for a Cash-Strapped Middle Class

©2024 Bloomberg L.P.