Do Jayant Agro-Organics's (NSE:JAYAGROGN) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Jayant Agro-Organics (NSE:JAYAGROGN), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

See our latest analysis for Jayant Agro-Organics

How Fast Is Jayant Agro-Organics Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Impressively, Jayant Agro-Organics has grown EPS by 32% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

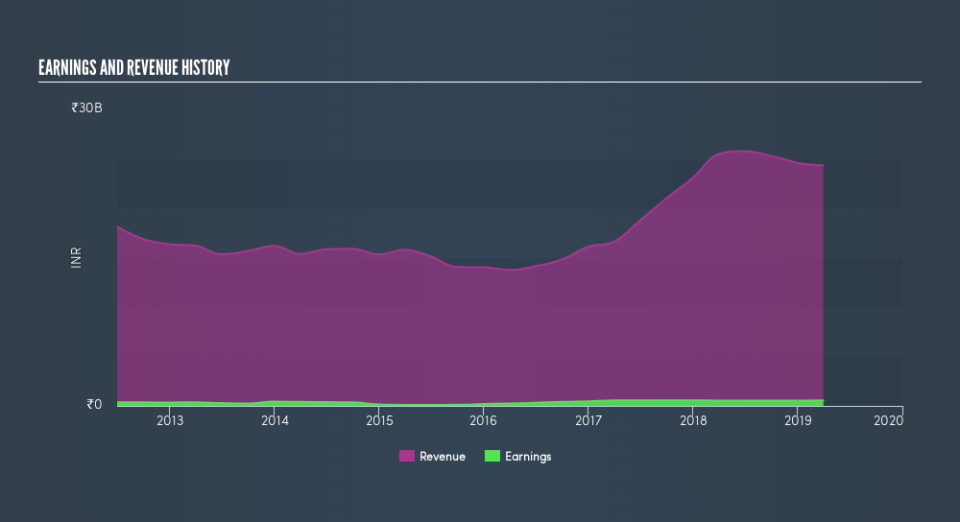

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Jayant Agro-Organics's EBIT margins are flat but, of some concern, its revenue is actually down. Suffice it to say that is not a great sign of growth.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Jayant Agro-Organics isn't a huge company, given its market capitalization of ₹6.1b. That makes it extra important to check on its balance sheet strength.

Are Jayant Agro-Organics Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Jayant Agro-Organics shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that Neeta Udeshi bought ₹406k worth of shares at an average price of around ₹202.93.

Is Jayant Agro-Organics Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Jayant Agro-Organics's strong EPS growth. Not only is that growth rate rather juicy, but the insider buying makes my mouth water. To put it succinctly; Jayant Agro-Organics is a strong candidate for your watchlist. Of course, just because Jayant Agro-Organics is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

As a growth investor I do like to see insider buying. But Jayant Agro-Organics isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.