Janet Yellen is leaving: is the US economy in safe hands?

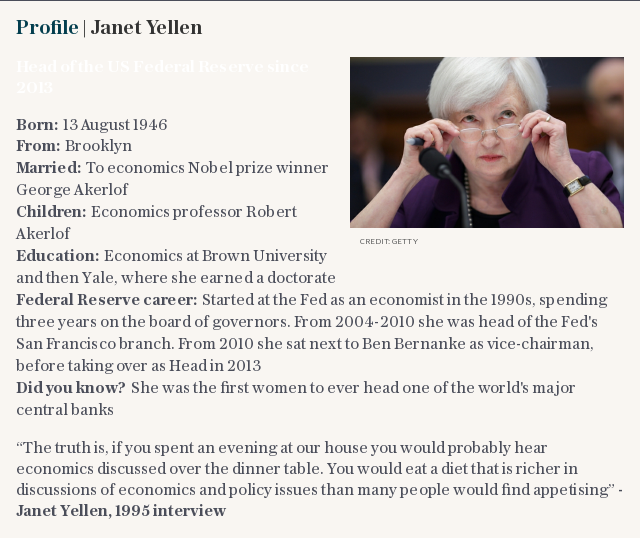

An era ends on Wednesday. A very short era, to be sure, but still a watershed moment: Janet Yellen will face the world’s press for the last time following an interest rate decision.

The chairman of the US Federal Reserve is being pushed out of her job in the new year. Donald Trump has chosen not to renew her term, making Yellen’s four years the shortest tenure of the Fed chair since G William Miller, who served from 1978 to 1979 (and his term only ended because he was snapped up to join Jimmy Carter’s administration).

This means Yellen has two more interest rate decisions to make: this week, accompanied by a press conference; and in January, without the same public questions. It could be a muted departure.

She leaves with economic growth accelerating, inflation below target and a president broadcasting his delight with the stock market’s performance. It is not a bad legacy.

But that also means her successor, Jerome Powell, faces a tricky situation. In years of strong growth, monetary policymakers must be on guard for risks that could turn boom to bust. And he must continue the tricky process of extricating the Fed from quantitative easing and low interest rates.

The beginning of that process was carefully handled. The Fed has not shocked markets since the taper tantrum in 2013 when the announcement that bond purchases would be slowed took investors by surprise around the world.

This week the Fed is set to hike the Federal funds rate from its current range of 1pc to 1.25pc, up to 1.25pc to 1.5pc. Markets are as certain as can be that this will happen on Wednesday. But next year is less certain.

Randy Kroszner, a former governor of the Fed, believes the crucial challenge is to work out the overall direction of the economy at a time when pay growth is weak despite low unemployment. It is a puzzle for central bankers across the globe, and particularly the Fed, which is leading the charge on tighter policy.

In particular, will policies aimed at boosting the economy’s potential – which should allow faster growth without letting inflation gallop away – continue to work?

“One of the main challenges for the Fed and other central banks during this next year as we see the details of the tax plan, once it is passed, is to suss out how much of it will lead to stronger underlying economic growth, and how much is just short-term stimulus,” says Kroszner, now a professor at Chicago Booth.

“Clearly, this is the goal the Republicans have talked about, trying to do a fundamental tax reform as was done in the early 1980s under Reagan.

“It took a number of years for the regulatory reforms and tax reform to have an impact on the economy, but when it did by the late 1980s and early 1990s, that was something which was very positive for economic activity and jobs in the US.”

Indeed, Trump often seeks to model himself on Reagan, calling his tax cuts “the biggest since Ronald Reagan”, or even “the biggest ever” – though tax analysts do not think he will eclipse the Gipper’s liberalising spree.

The promise of the policy is clear. Working out if it will have the desired effect is harder.

“One of the purposes of the reform is to have a more efficient tax system and to encourage more investment, and both of those are likely to increase productivity growth and, hence, overall economic growth,” says Kroszner.

“Regulatory reforms also have the potential to increase efficiency and productivity. If they affect the underlying growth rate then central banks would want to take that into account and say, ‘Aha! Growth is accelerating but it is unlikely to lead to inflation pressure’.”

However, if it fails to do that – if companies and consumers refuse to invest – then there is a problem.

Biggest Tax Bill and Tax Cuts in history just passed in the Senate. Now these great Republicans will be going for final passage. Thank you to House and Senate Republicans for your hard work and commitment!

— Donald J. Trump (@realDonaldTrump) December 2, 2017

“If you have a simple stimulus package which spends more money but does not have an eye on the long-run growth of the economy, then central banks are more likely to offset that [with higher rates],” he says.

That is a serious risk.

Interest rates have been at rock bottom for years, yet companies have not borrowed to invest on a large scale, in the US or elsewhere.

The result has been painful – a lack of productivity growth in particular has held back wages and the wider economy.

So why would companies suddenly turn around and splurge on investment thanks to tax breaks?

“One of the motivations for the tax reform in the US is to try to address this head-on.

“Republicans argue that layers of regulation and anti-business animal spirits post-crisis need to be changed so that we can boost the US economic growth rate,” says Kroszner, who served as a Fed governor from 2006 to 2009.

“Obviously there is an enormous debate about that right now and we have not had enough of the detailed analysis to give a definitive answer right now,” he adds tactfully.

“One of central challenges of central banking is to have that crystal ball to know whether a shock is a temporary one or a permanent one.

“When all the dust settles it is very easy to say, ‘that was so obvious’. But when you’re making policy you only have past data.”

This leaves the Fed in a tricky position. Markets expect two or three hikes next year. But Fed policymakers set out a “dot plot” showing where each member expects rates to be in the future. That indicates three hikes in 2018, but one member anticipates five.

By the end of 2019 the range of expectations among policymakers is from 1.25pc – where we are now without even hiking this week – to 3.5pc. And by 2020 it is up to 4pc.

Someone is going to be wrong.

Quite possibly, neither the markets or any of the governors will be right at all. The analysis of the required rate levels could change, for example, either with new information or with a radically new board of governors as more empty seats are filled.

Anticipating a short-lived boom from the stimulus, economist Seth Carpenter at UBS expects rates will have to rise more quickly. “With the tax cut, the recovery in inflation, and the lower unemployment rate, the dot plot will show more hiking,” he says.

“We think they could move the median up to four hikes next year, with the level of the funds rate 50 basis points higher in 2019 and 2020 than was the case in September.”

Matt Cairns at Rabobank is not convinced the tax cut plans will stimulate long-term growth, and so agrees higher rates could be needed. “The outcome is more likely to prove a short-term shot in the arm with the benefits falling to companies that are already reluctant to invest in the expansion of plant and equipment that would see jobs created that could demand higher wages and thus spur the sort of inflation the Fed really needs to justify what the dot plot is currently suggesting,” he says.

By contrast, Alan Oster, chief economist at National Australia Bank, thinks the path of rate rises will have to be cut back. “The Fed’s minutes showed it is no longer sure that low inflation is transitory. This is a reality check. It now looks as though inflation could stay lower for longer,” he says. “If suddenly the Fed goes slower [in hiking rates], it has big implications for the market view. “If the FOMC cuts its outlook to two rate hikes next year there would be a reaction from markets who would take this to mean the Fed wants to see the whites of inflation’s eyes first. It would set off equities again.”

The pace of rate rises will have serious consequences for the US and world economies – too slow and a boom and bust cycle could ensue. But raise too quickly and the recovery could be stifled prematurely.

One key risk is that interest rates are traditionally hiked in a boom and help to precipitate a bust. The Fed is trying to signal its plans carefully, but there is no guarantee it will work.

Legal & General Investment Management fears that the global consequence of central banks slowing quantitative easing, as with the European Central Bank, or trimming bond holdings as with the Fed, will result in a surge of new government debts onto the markets. In 2017 there was a net fall of $300bn in government bond supply. Next year there will be a net rise of more than $500bn.

This will “crowd out the private sector”, says Anton Eser, LGIM’s chief investment officer, shifting investors out of equities and private bonds and into government debt.

There is potential for a 20pc to 30pc fall in stocks, he fears, or even “well in excess of that” if markets follow their usual pattern of overshooting when making big moves. This could shock businesses and households and force the economy into recession

“A large part of the pickup in consumer and corporate confidence has been a function of asset prices, and the same will happen on the way down,” says Eser. “This time around it feels like markets turning down leads to a drop in confidence, which leads to, in itself, a recession.”

The Fed wants to tread carefully. It has time to plan ahead and react to unfavourable market moves. But Janet Yellen will not be there to step in if her legacy looks to be in jeopardy.