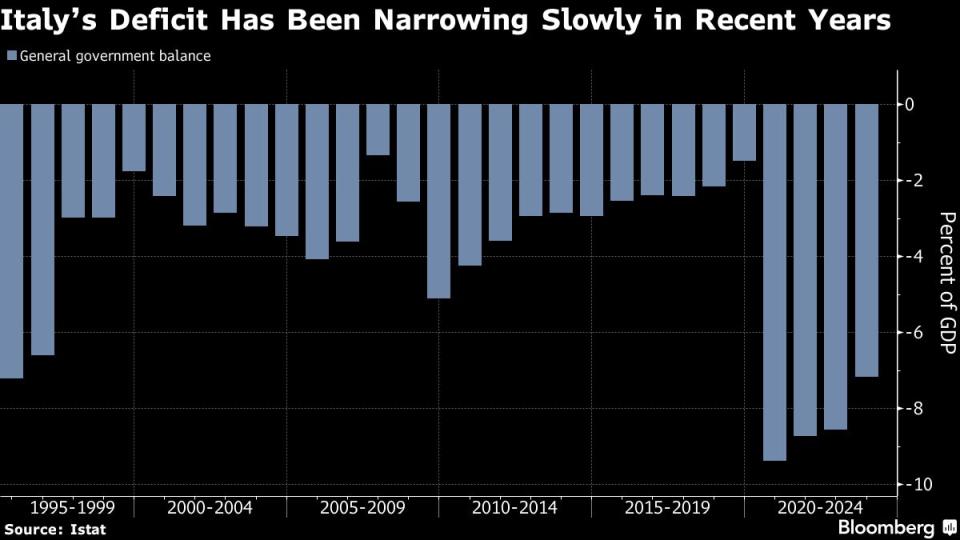

Italy Won’t Meet EU’s 3% Deficit Target Until at Least 2026

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Italy will take until at least 2026 to get its budget deficit below the European Union’s 3% limit, according to people familiar with the matter, potentially earning extended scrutiny from the bloc’s fiscal watchdogs.

Most Read from Bloomberg

Apple Explores Home Robotics as Potential ‘Next Big Thing’ After Car Fizzles

Texas Toll Road Takeover to Cost Taxpayers at Least $1.7 Billion

A Million Simulations, One Verdict for US Economy: Debt Danger Ahead

With the shortfall at 7.2% of GDP last year due to a tax break on home renovations, Premier Giorgia Meloni’s government will take several years to get its finances back onto a sustainable path, according to the people, who declined to be identified because the discussions are private.

The government is scheduled to unveil new economic targets and forecasts Tuesday. The Finance Ministry will likely say it expects 1% growth this year, well above economists’ estimates of 0.6%. The numbers could still change ahead of the announcement.

That faster expansion will help cut the deficit to about 4.4% this year and under 4% next year, according to the people. A target of 4.3% was reported earlier Wednesday by newspaper Il Sole 24 Ore.

The Finance Ministry declined to comment on the numbers as it is awaiting further data on a tax break to subsidize green building renovations, known as the “superbonus,” which could affect calculations.

Finance Minister Giancarlo Giorgetti has repeatedly assured that Italy’s public finances remain an “absolute priority.”

Giorgetti has had to explain a series of awkward revisions to Italy’s deficit projections since taking office in 2022, after an official reassessment of how to account for tax breaks including the “superbonus.”

That policy, introduced by the populist administration of Giuseppe Conte, allowed homeowners to pocket an extra 10% on top of the amount they’d spent on refurbishments and quickly spiraled out of control. Over the last months, Meloni’s government has sharply restricted the tax break, capping maximum spending.

As a result, Italy will likely spend the next few years in the EU doghouse for excessive borrowing, though new rules do put added focus on how much a country is progressing toward its targets. Giorgetti said Wednesday he expects an infringement procedure to be confirmed soon for Italy’s excessive 2023 number.

While largely expected, the procedure puts the spotlight on Italy which has historically struggled to manage its mammoth debt. The country is however in good company, with a dozen other economies on the rope for high deficits.

The EU’s fiscal rules were reactivated early this year after being suspended since 2020 to facilitate the extraordinary national spending required to weather the Covid-19 pandemic and the energy crisis. The bloc is ratifying a review of the rules that would give more leeway to member states to design their fiscal path in time for their drafting of next year’s budgets.

Infringement Procedures

The European Commission, the EU’s executive arm, has told member states that it will open infringement procedures against those countries that violated the 3% deficit threshold last year, once it receives the final data from Eurostat this month. The economies involved however, will be notified only after the European elections in early June.

If countries fail to meet such efforts, the procedure could, in theory, lead to sanctions. But no member state has ever been fined despite numerous breaches.

The bigger issue for Italy’s governing coalition at this time, however, is whether it will be able to successfully spend EU Recovery Fund cash, which is aimed at permanently boosting its economic growth in future years.

European Affairs Minister Raffaele Fitto has said the country probably won’t complete some of the projects needed to unlock such funds by their 2026 deadline, sparking concern that fewer investments will mean lower growth.

--With assistance from Jorge Valero and Chiara Albanese.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.