iShares Treasury Bond Funds Raking In Assets Lately (TLT)

Today in our Fund Flows recap we point to the strong September that three well-known Treasury Bond ETFs from iShares have experienced in terms of attracting new assets.

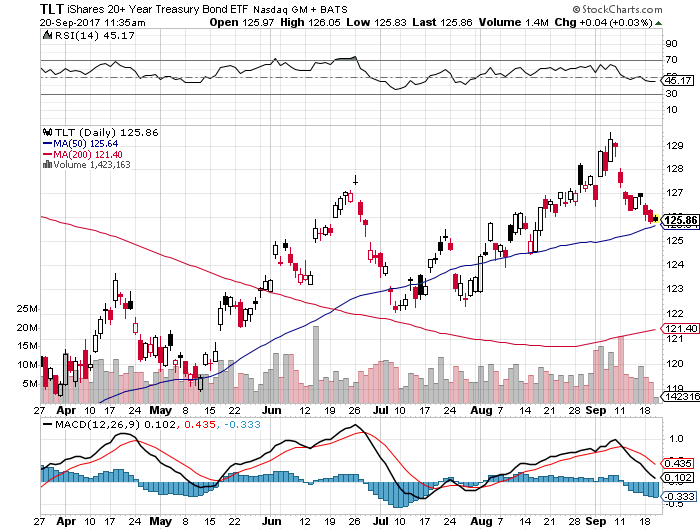

The longest duration fund, TLT (iShares 20+ Year Treasury Bond, Expense Ratio 0.15%, $9.9 billion in AUM), has had an exceptional September in terms of asset raising, pulling in over $2.6 billion this month alone. Also, it appears that the appetite for Treasury Bonds via these iShares products does not end with TLT, as we have seen similar buying, albeit to a much smaller degree in two other Treasury Bond based funds of different durations.

Intermediate term Treasuries have been purchased this month via IEF (iShares 7-10 Year Treasury Bond, Expense Ratio 0.15%, $7.9 billion in AUM), as the ETF has pulled in approximately $300 million via creation flows. Additionally, IEI (iShares 3-7 Year Treasury Bond, Expense Ratio 0.15%, $8.2 billion in AUM) has also participated with more than $770 million being created month-to-date.

Rates have increased over the past couple weeks after bottoming at the very beginning of September and perhaps portfolio managers have been using the weakness in Treasury Bond prices to scale into position in Treasuries via these ETFs with durations ranging from short to long term.

As we mentioned in our earlier recaps this morning the market is hotly anticipating today’s FOMC rate decision, and this has spurred activity in ETF land, not only in the Fixed Income realm but also in equities (we mentioned over $5 billion leaving SPY on Monday this week via redemption pressure, making more than $8 billion out month-to-date). With the FOMC widely anticipated to not raise rates today, many are looking for guidance on what the balance sheet “wind-down” may look like whenever it shakes out.

If the market does not get such guidance, we could very well be in for a wild ride in the Fixed Income markets in terms of rates and bond prices. Based on the larger outflows in equities via SPY this week and in September in general now on the whole, coupled with inflows across durations in Treasury Bond linked ETFs, the trend seems pretty clear to us that some portfolio managers may be positioning defensively going into the month of October which of course has a history marred with infamy in 1929, 1987 and 2008.

The iShares Barclays 20+ Year Treasury Bond ETF (NASDAQ:TLT) was trading at $125.90 per share on Wednesday morning, up $0.08 (+0.06%). Year-to-date, TLT has gained 7.24%, versus a 12.84% rise in the benchmark S&P 500 index during the same period.

TLT currently has an ETF Daily News SMART Grade of B (Buy), and is ranked #21 of 28 ETFs in the Government Bonds ETFs category.

Disclaimer: The content of this article is excerpted from a daily newsletter from Street One Financial. While ETF Daily News may edit the contents and add a relevant title to the piece, the author, Paul Weisbruch, does not endorse or recommend any issuer or security mentioned herein.

About the Author: Paul Weisbruch

Paul Weisbruch is the VP of ETF/Options Sales and Trading at Street One Financial. Prior to joining the team at Street One, Paul served as the Director of RIA and Institutional ETF Sales at RevenueShares ETFs from December 2007 until November of 2009. Before RevenueShares, Paul was employed by Susquehanna International Group from 2000 until 2007 serving in roles including OTC/NYSE Institutional Block Trading, Nasdaq/OTC Market Making, ETF/Derivatives Intelligence and Strategy, Algorithmic Trading, as well as acting as the PHLX Floor Specialist in the ETFs, SPY and DIA.Paul has been actively involved in the ETF space from both a product and trading standpoint since 2000. Additionally, Paul has well forged relationships with national RIAs, institutional pension fund managers and consultants, mutual fund and hedge fund managers, and also the ETF media. Co-authoring the “S1F ETF Daily” since 2009, the daily piece has become a must for many portfolio managers in the ETF space, with segments regularly appearing in the likes of Barron’s, WSJ, and ETFTrends.com for instance.

He holds his Series 4 (Registered Options Principal), 6, 7, 55 (Equity Trader), 63, and 65 licenses. He graduated from the University of Pittsburgh (B.S. – Economics), graduating magna cum laude, and has an MBA from Villanova University.