Why investors are paying huge premiums for enormous tech companies

Nvidia (NVDA) shares soared 11% after the release of its first quarter report, which showed that net income more than doubled to $507 million on revenue of $1.9 billion. That stock price rally comes despite an already high valuation multiple, which appears to price in some very lofty expectations for growth.

Why the surge?

Nvidia continues to prove it’s the company of the future. The technology powerhouse, which was named Yahoo Finance’s 2016 company of the year, powers Google searches, Amazon’s Alexa digital assistant, Tesla’s self-driving cars and Netflix’s movie recommendations. And it’s become a dominant force in the continued shift toward artificial intelligence.

The excitement over this company’s prospects can be seen across tech, including the big-cap tech.

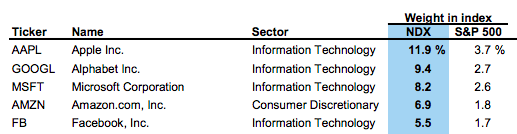

The impressive 19% gain for the S&P 500 (^GSPC) over the last year is eclipsed by the 32% surge in the Nasdaq 100 (^NDX). Importantly, the source of the Nasdaq’s outperformance are the major tech stocks, including Apple (AAPL) , Alphabet (GOOGL) , Microsoft (MSFT), Amazon (AMZN) and Facebook (FB), which make up 42% of the Nasdaq 100 versus 13% of the S&P.

And much of the upward movement of these names may not even incorporate optimism around long-term opportunities where monetization remains elusive.

Amazon

At an incredibly high 81x forward P/E, Amazon has not been trading on traditional metrics for some time.

But Needham analyst Kerry Rice said the high price doesn’t even incorporate long-term bets at this point.

“A lot of investors are counting on that at some point Amazon flips the switch on profitability where they pull back on investing and you get a hockey stick trajectory of profitability,” Rice said. In other words, because the company could eventually become significantly more profitable, its P/E multiple is only temporarily elevated.

The $450 billion company has continued to soar on progress in its core business, with its first quarter report merely the latest sign of dominance. Its stock is up almost 1,300% in the last ten years.

Last quarter, revenue of $35.7 billion topped analyst estimates, and the key focus remains the near-term market opportunity.

With about 100 million monthly unique visitors and about $1 out of every $3 spent online, analysts say there is still considerable upside in the core e-commerce business (with still only 10% of retail today). And growth in Amazon Web Services (AWS) is boosting profitability.

Bezos’ longer-term vision isn’t even baked in to the company’s seemingly high multiple, according to analysts.

The company has several multi-billion dollar opportunities, according to Rice, including video, advertising, groceries, and home services.

In his most recent shareholder letter, Bezos highlighted that Amazon remains a “Day 1 company,” just at the beginning of its potential.

“The outside world can push you into Day 2 if you won’t or can’t embrace powerful trends quickly,” Bezos wrote. “If you fight them, you’re probably fighting the future. Embrace them and you have a tailwind.”

Long-term projects like autonomous Prime Air delivery drones could lead to more upside, but in the meantime Bezos has focused on near-term practical applications of technology, which is really what is driving the stock, according to analysts.

Bezos emphasized in his letter that the company’s focus on artificial intelligence has led to outward facing initiatives like cloud-based AI assistant Alexa (the company announced updates to Amazon Echo on Tuesday). But it has also driven much beneath the surface, “quietly but meaningfully improving core operations,” including algorithms that aid with demand forecasting, product search ranking, merchandising placements and fraud detection for the core business.

Apple

With an $800 billion market capitalization, Apple’s more tempered valuation (15x forward earnings) is still based on growth for its core product, the iPhone, which makes up 60% of company revenue.

And even the company’s most recent quarterly results were overshadowed by expectations of the next smartphone (the iPhone 8 expected this fall, a decade after the initial iPhone launch).

CEO Tim Cook said that iPhone demand this past quarter may have begun to “pause” in anticipation of new offerings, particularly in China which is even more sensitive to new announcements.

Meanwhile, the company’s services business remains a quiet beast, according to Credit Suisse’s Kulbinder Garcha, who pointed out that the division’s revenue could rise to $52 billion from $26 billion today. And given that gross margins for services are around 70%, it would mean services will drive gross margin over 40% longer-term .

While headlines continue to pop up about opportunities in automobiles, none of this is baked into the stock at these levels, according to Canaccord’s Michael Walkley, particularly at such a subdued valuation.

Alphabet

Ever since Alphabet separated its “other bets” business from its core search platform Google in the beginning of 2016, the stock has surged.

And the company’s 24x forward P/E valuation is largely based on strong core results, according to analysts. In its most recent quarter, paid clicks grew 53% across Google-owned sites.

Growth in its core search business has allowed the company to focus and separate its longer term projects.

Today’s “Other Bets”—which include smart-home technology Nest, autonomous driving, and Google Fiber to improve internet speeds—could potentially bring in significant revenue down the road and keep the company relevant, according to analysts.

“But right now, no one is buying the stock for those reasons,” Rice said. “Autonomous driving may be more impactful five to ten years out,” Rice said.

At 1.9 billion monthly users, an increase of 17% year-over-year, Facebook isn’t showing any signs of slowing down.

And the stock, trading at 22x forward P/E, was little changed after its most recent quarter despite commentary from founder and CEO Mark Zuckerberg and COO Sheryl Sandberg that revenue growth would decline “meaningfully” as it stops increasing the frequency of marketing spots in the news feed later this year in an effort to retain users.

Rice explained the near-term levers for the company haven’t even been flipped on.

Mobile now accounts for 85% of its advertising revenue and the company is looking forward to more opportunities. Instagram, with 700 million monthly active users, has just started adding to revenue growth. Zuckerberg said he has been focused on monetizing Messenger, which was spun off as a separate app in 2014, thoughtfully. The app now has 1.2 billion monthly users. WhatsApp, which was acquired in 2014 for $22 billion, is a big monetization opportunity for the company as well.

While Zuckerberg is seen as a visionary, Rice said at this point longer-term bets are not baked into valuation—and mobile-driven surge since its IPO five years ago.

During the company’s recent F8 conference, management highlighted its augmented reality platform which includes “Facebook Faces,” the new social experience for Oculus Rift. Management even discussed projects including its unmanned solar-powered aicraft that will beam internet connectivity to people around the world and brain interfaces (mind control!).

“Investors have fallen in love with Facebook,” according to Mark Moerdler said. “There are expectations for huge upside from a revenue point of view… especially long-term. But much of this is based on clearly outlined near-term opportunities from the company.”

Microsoft

Part of the driver behind Microsoft’s surge over the last several years is because of the company’s shift to cloud and long-term projects under CEO Satya Nadella who took over in early 2014. In short, the company is often discussed in the same breath as Amazon and Google and has somehow left the sphere of “old tech” and into “new tech”.

And Microsoft’s valuation, at 21x forward P/E, has pulled away from “old tech” names it used to be grouped with, like IBM (IBM) at 12x.

But “new tech” for Microsoft hasn’t meant out-there long-term projects.

The stock, up 36% in the last year alone, has been able to monetize its shift to cloud, according to analysts. While the company still relies on some of its traditional applications (like Office), commercial cloud revenues have grown to about 60% of the business.

The company’s acquisition of LinkedIn in June 2016 was emblematic of the company’s shift for near-term opportunities in a higher-growth arena.

The bottom line: Tech companies have been surging based on huge market opportunities, but the valuations may not even incorporate long-term bets, meaning there could even be more upside for this sector, which has been defined as driven by “secular growth” and more immune from macro shifts.

Nicole Sinclair is markets correspondent at Yahoo Finance.

Please also see:

Small business wages are growing but thanks to temporary workers

Three sectors with the most at stake under Trump’s tax plan

Starbucks is becoming a tech company that sells coffee