Should you invest in NatWest if the Government offers cut-price shares?

- Oops!Something went wrong.Please try again later.

The Chancellor’s plan to launch a major public sale of NatWest shares next year, to cut the Government’s stake of almost 40pc, boost private investor involvement in UK-traded shares and revive a fairly moribund London stock market, will present savers with a decision: should they participate in the offer or not?

First, investors must decide whether the bank fits with their overall investment goal (capital, income or a bit of both), time horizons, target return and appetite for risk (which is best defined as the ability and willingness to suffer losses in pursuit of gains).

If the answer is positive to all four, or at least a majority of them, further research is warranted. If the answer is negative, the investor can move on elsewhere. Only each individual can decide this for him or herself as each criterion will be deeply personal.

Second, the investor must assess the bank’s competitive position, strategy, financial strength and management acumen (a little harder than it would have been after the former chief executive’s recent fall from grace following the Nigel Farage “debanking” scandal). All four could influence its profit potential over time.

All four can also influence the price investors are prepared to pay for a share of the company. A stock with a predictable profit stream from a business with a dominant position in its industry, respected management and a robust balance sheet will tend to command a higher price, relative to profits, than one that lacks those advantages.

NatWest operates in a highly competitive environment in which established big players and “fintech” upstarts alike are snapping at its heels. The trajectory of the economy is still uncertain, as the Office for Budget Responsibility’s new economic growth forecasts are not exactly exciting and the Bank of England continues to prevaricate on interest rates.

Political, public and regulatory pressure could put a lid on “net interest margins” – the gap between what a bank pays depositors and charges borrowers – and a recession could increase losses on bad loans to further dent earnings in 2024 or 2025.

On the other hand, Britain continues to dodge the dreaded recession, loan impairments are low by historic standards and the Bank of England is now expected to cut interest rates next year, even if it continues to hint otherwise. NatWest also comfortably meets all regulatory requirements for capital adequacy.

It is possible to argue that a lot of bad news is therefore already in the price, especially since the shares trade at a 25pc discount to their last stated net asset value per share of 271p.

A multiple of forecast earnings of less than five suggests that investors have largely given up on growth (and analysts expect pre-tax income to hover around £4bn for the next three years), but the yield of 8.4pc could compensate for that.

A deeply discounted offer price could make the shares more attractive still to income seekers or value hunters. Momentum investors who seek quick-fire capital gains or rapid growth are likely to look elsewhere.

Questor says: await offer details

Ticker: NWG

Share price at close: 204.2p

Russ Mould is investment director of AJ Bell, the stockbroker

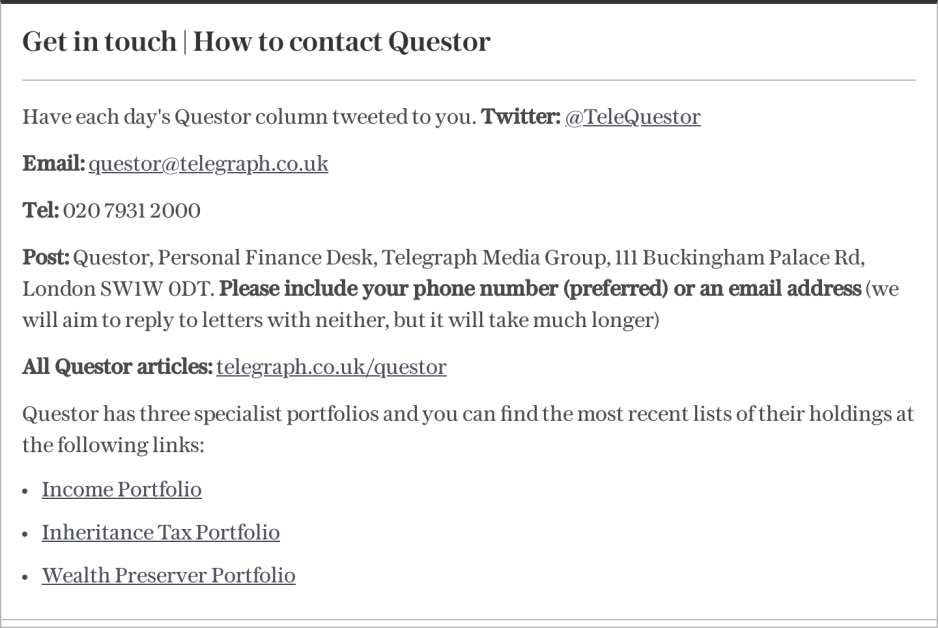

Read the latest Questor column on telegraph.co.uk every Monday, Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips