Introducing Altimmune (NASDAQ:ALT), The Stock That Collapsed 98%

Altimmune, Inc. (NASDAQ:ALT) shareholders will doubtless be very grateful to see the share price up 73% in the last quarter. But that doesn't change the fact that the returns over the last three years have been stomach churning. The share price has sunk like a leaky ship, down 98% in that time. Arguably, the recent bounce is to be expected after such a bad drop. Only time will tell if the company can sustain the turnaround.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Altimmune

Because Altimmune made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

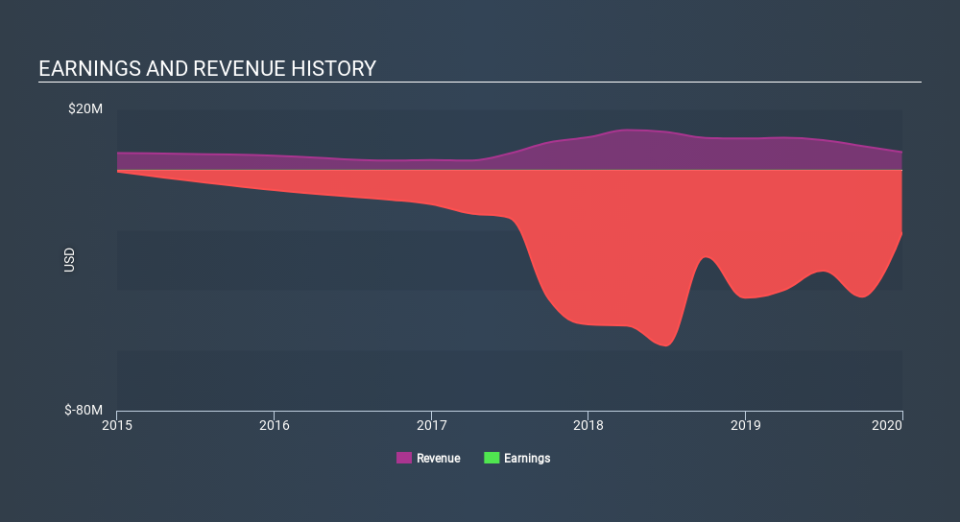

In the last three years, Altimmune saw its revenue grow by 15% per year, compound. That's a pretty good rate of top-line growth. So it's hard to believe the share price decline of 73% per year is due to the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Altimmune stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Altimmune rewarded shareholders with a total shareholder return of 13% over the last year. What is absolutely clear is that is far preferable to the dismal 73% average annual loss suffered over the last three years. It could well be that the business has turned around -- or else regained the confidence of investors. It's always interesting to track share price performance over the longer term. But to understand Altimmune better, we need to consider many other factors. Take risks, for example - Altimmune has 5 warning signs (and 1 which can't be ignored) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.