Premier League chairman to land £15m payday from Hastings sale

Premier League chairman Gary Hoffman is set to pocket almost £15m from a deal to take insurer Hastings private.

Mr Hoffman - who was previously chief executive and then chairman at the firm - will share in a bumper payday worth up to £40m for current and recently departed bosses if the £1.7bn takeover by South African and Finnish investors goes ahead.

Meanwhile, Hastings founder Neil Utley is set to earn £73.3m from his 4.4pc stake in the company. He founded the business in 1997 but is no longer involved in its day-to-day running.

Hastings' board has backed the offer from Johannesburg-based Rand Merchant Investment Holdings (RMI) and Sampo, a Finnish insurance company linked to Nordic banking group Nordea, meaning it is likely to be approved by shareholders.

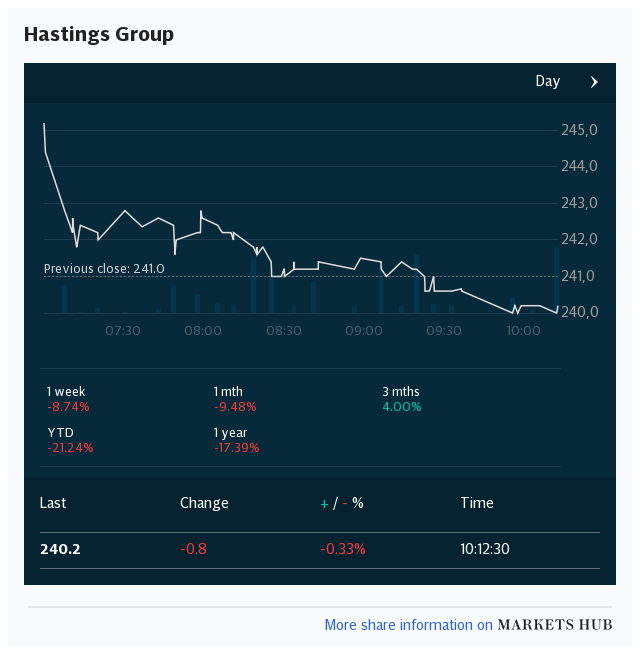

Investors will get 250p per share if the takeover goes ahead, meaning large pay-outs for senior management who own stock.

Current chief executive Toby van der Meer owns 3.5m shares outright and has up to 1.7m more coming if he hits various bonus targets, meaning the 43-year-old is in line for up to £13m.

Mr Hoffman, 59, took charge of Hastings in 2012 and oversaw a float five years ago in which he earned millions of pounds. He then moved to chairman in 2018, before giving up that role when approved for the Premier League job.

The businessman is understood to own 5.9m, worth more than £14.7m under the deal terms.

He was previously in charge of Northern Rock following its collapse during the financial crisis. He was forced to give up a £500,000 "golden goodbye" when quitting a decade ago in the face of public outrage after presiding over huge job cuts.

South African firm RMI is already the biggest shareholder in FTSE 250 company Hastings, with a 29.7pc stake.

The all-cash deal, which requires shareholder approval, will give investors a 47pc premium to the share price before Hastings announced last week that the bidders had made an approach.

Mr van der Meer said the deal was a sign of confidence in the UK.

No significant layoffs are expected as a result of the deal and management will remain in place, he said.

But because Hastings will become a private company after the takeover, it will seek to reduce some of the costs associated with being a listed company.

Listed companies face more stringent reporting and disclosure requirements to ensure that investors have enough information for shares to be priced accurately on the stock market.

Shareholders will also bag a dividend payout of nearly £30m after Hastings said it would match the 4.5p interim dividend it paid last year.

Pre-tax profits in the first six months of the year jumped £18m to £64m as Hastings managed to increase sales despite the pandemic.

The firm was helped by a lower number of car accident claims during lockdown, but this was partially offset by slower repairs forcing it to offer replacement cars to customers for longer than usual.

Mr van der Meer said the firm’s investment in recent years, including in its mobile app which now has 950,000 downloads, had helped it to recover after a difficult couple of years.

Hastings did not provide a figure for the discounts and refunds offered to customers as a result of the pandemic when some policies were of little as people were stuck at home. It said it spent tens of millions of pounds on support for colleagues, customers and communities.