Inflation-Fearing Investors Pile Into TIP

Investors have been piling into the iShares TIPS Bond ETF (TIP | A-99) this year, pouring more than $3.2 billion into the fund year-to-date, making it one of the most popular fixed-income ETFs of 2016, according to FactSet data.

Behind that demand is rising inflation, as well as a strong appetite for fixed income in general—$8 out of $10 headed into U.S.-listed ETFs year-to-date have thus far landed into fixed-income strategies.

The core Consumer Price Index in April rose by 2.1% year-over-year, above the Federal Reserve's 2% target. The CPI is only one of two main inflation gauges, the other being the Fed's preferred metric: the personal consumption expenditure (PCE). Year-on-year, the core PCE was up 1.6% in March, at its highest levels since 2014.

Low Inflation Expectations Persist

A look at the spread between 10-year TIP and 10-year Treasury yields, currently at about 1.6%, shows that inflation expectations remain historically low—and below the Fed 2% target—because economic growth is still too tepid. (The TIPS spread is often used as a gauge of expected future inflation levels.)

But the trend is pointing higher, nonetheless.

Market pundits such as Janus’ Bill Gross were already touting TIPS earlier this year as a viable investment idea due to wage pressure associated with an aging baby boomer generation. Others, such as ETF strategist Michael McClary of ValMark, prefer TIPS to gold as a diversifier in the face of inflationary pressure.

“TIPS bonds can be a valuable diversification tool for strategic investors,” McClary recently said in a blog. “In periods where realized inflation exceeds expected inflation, TIPS bonds generally outperform nominal Treasurys. Likewise, TIPS should do well in periods of high inflation while other popular asset classes may struggle.”

“While gold has developed a reputation as a valuable asset in periods of high inflation, we feel other risks involved in gold assets might outweigh the specific inflation benefit,” he added.

TIP was the first, and today it’s the largest, ETF in this segment today, with $18 billion in assets.

A look at the recent performance of TIP offers interesting insight into the market’s perception of risk and inflation.

TIPS have been underperforming Treasurys in recent years as realized inflation has not met expectations. That divergence in performance became even more evident when the stock market corrected last summer. As Treasurys rallied amid increased stock market volatility and investor fears about the economy, inflation expectations actually declined during that time—and again in January and February of this year—amid economic woes.

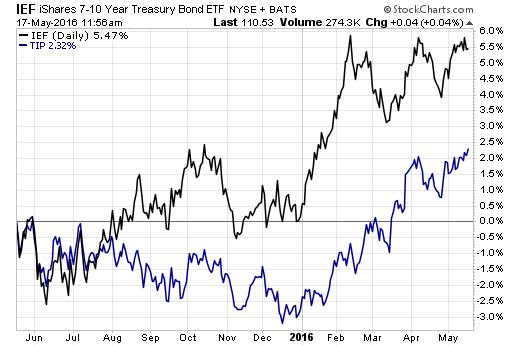

Consider this 12-month chart comparing the performance of TIP vs. the iShares 7-10 Year Treasury Bond ETF (IEF | A-55)—an ETF we are using as a proxy for 10-year Treasurys:

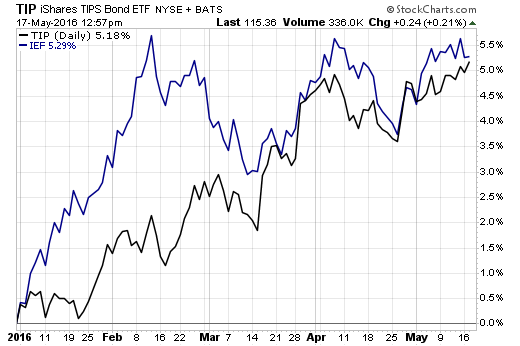

But a look at this year shows that the dispersion between TIPS and Treasurys has significantly narrowed as inflation picks up. The year-to-date chart below shows TIP and IEF neck-in-neck in terms of total returns:

Charts courtesy of StockCharts.com

That performance has come accompanied by asset gains. In all of 2015, investors poured $2.17 billion into TIP following two years of net redemptions—in 2013, TIP bled nearly $8 billion in outflows.

But so far this year, the ETF has already gathered $3.2 billion in fresh net assets—that’s about 45% more assets than the fund gathered in all of 2015, and a complete turnaround from the net redemptions the fund faced in the two previous years.

TIP tracks a market-value-weighted index of U.S. Treasury inflation-protected securities with at least one year remaining in maturity.

Contact Cinthia Murphy at cmurphy@etf.com.

Recommended Stories