India Gets Record $25 Billion RBI Payout as Voting Nears End

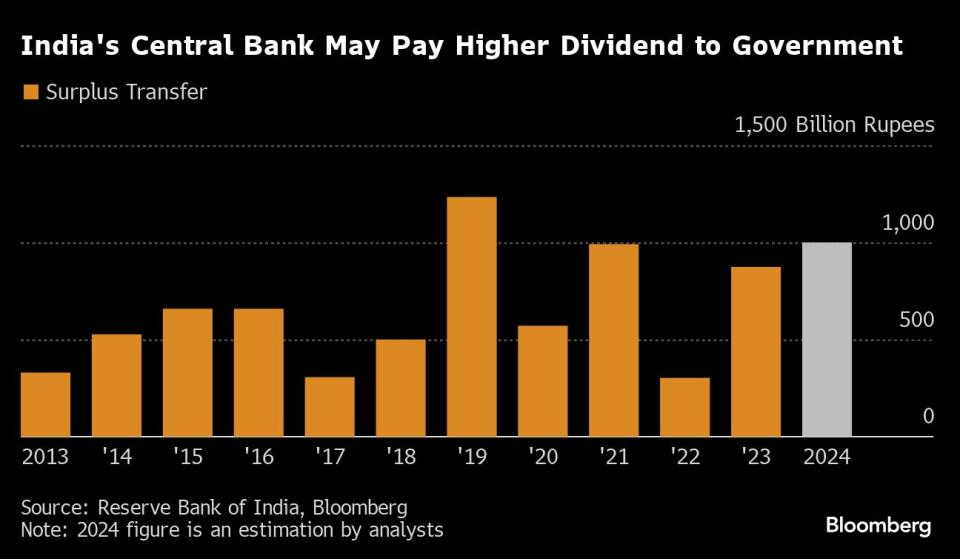

(Bloomberg) -- India’s central bank will pay a 2.1 trillion-rupee ($25 billion) dividend to the government, more than double what was budgeted, shoring up fiscal revenues before a new administration takes office after elections.

Most Read from Bloomberg

Citi Trader Got 711 Warning Messages Before Sparking Flash Crash

Harvard Defies Faculty Vote to Block 13 Students From Graduating

US Justice Department to Seek Breakup of Live Nation-Ticketmaster

The transfer was approved Wednesday by the Reserve Bank of India board in a meeting in Mumbai, the central bank said on its website. The government had budgeted to receive 1.02 trillion rupees in dividends from the RBI and state-controlled banks. The central bank also raised its contingency risk buffer to 6.5%, citing resilience in economic growth.

The RBI makes an annual payout to the government from the surplus income it earns on investments and valuation changes on its dollar holdings, and the fees it gets from printing currency. Last year, the RBI transferred 874.2 billion rupees to the government.

The higher dividend payout will lift government revenues and help narrow the fiscal deficit of 5.1% of gross domestic product in the current financial year that ends in April 2025. It also gives a boost to the new administration that takes office after nationwide elections ending June 1, allowing it to increase spending and spur economic growth.

The windfall may help the government lower the fiscal deficit by 0.4 percentage point to 4.7% of the GDP in the current fiscal year assuming expenditure is constant, said Upasna Bhardwaj, chief economist of Kotak Mahindra Bank, by phone.

The RBI dividend will be “definitely 0.2%-0.3% of GDP higher than what we expected as receipts,” said T.V. Somanathan, India’s finance secretary, speaking with reporters in New Delhi. “It’s good news, it’s always good when revenues go up,” he said.

The large dividend, coupled with the government’s high cash surplus, means it can reduce its borrowing for the fiscal year from a previously budgeted amount of 14.13 trillion rupees. Bloomberg reported Tuesday that the government may consider cutting its bond sales this year, prompting a drop in bond yields.

Sovereign bonds in India advanced Wednesday after the RBI’s announcement, with the yield on the benchmark 10-year note falling 4 basis points to 7.04%.

“It’s positive for fiscal balances,” said Gaurav Kapur, chief economist of IndusInd Bank Ltd. “This is the second consecutive year where the dividend has exceeded the budget estimate. This is helpful in pursuing the planned reduction in budget deficit.”

Big Bonanza

The dividend amount surprised even the most bullish of all analysts. While the exact details behind the RBI’s bigger payout won’t be known until the annual report is released in a few days time, analysts say higher interest income on foreign and domestic assets and gains from foreign exchange sales would have helped.

The RBI intervenes in the currency markets by buying and selling dollars. While selling dollars that it had bought cheaply in the past, at current market rate, helps it gain a profit, buying dollars and investing them abroad helps it earn an income.

“There was income from both sides for the RBI,” said Pankaj Pathak, portfolio manager at Quantum Asset Management Co. “Our idea was it could be somewhere around 1 trillion rupees of dividend transfer, and the rest will go in the reserves. It’s much larger than expectations,” said Pathak.

--With assistance from Malavika Kaur Makol and Siddhartha Singh.

(Updates with government official comments in sixth paragraph)

Most Read from Bloomberg Businessweek

A Hidden Variable in the Presidential Race: Fears of ‘Trump Forever’

The Dodgers Mogul and the Indian Infrastructure Giant That Wasn’t

©2024 Bloomberg L.P.