IDC lowers tablet sales predictions as competition heats up

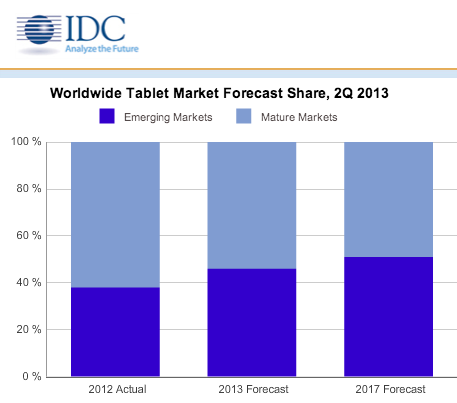

As our options for portable computing continue to expand, the market will become increasingly segmented. This has led market research firm IDC to lower its tablet forecast over the next few years from shipments totaling 229.3 million units this year to 227.4 million units. Although many tablets have failed to make an impact despite enormous marketing campaigns and others seem doomed before they even hit store shelves, IDC is confident that emerging markets will begin to take over when mature market sales level off. In fact, the mature market is expected to sink “from 60.8% of the worldwide market in 2012 to 49% by 2017.”

[More from BGR: iPhone 5S, iPhone 5C launch date seemingly confirmed by AT&T vacation blackout]

“Year-on-year growth is beginning to slow as the tablet market approaches early stages of maturity,” said Jitesh Ubrani, Research Analyst for IDC. “Much of the long-term growth will be driven by countries like China where projected growth rates will be consistently higher than the worldwide average.”

[More from BGR: Huge iOS, OS X vulnerability uncovered that can render apps unusable]

Saturation is noted as one of the causes for the slight dip in the forecast, but the rise of phablets and wearable tech, such as the rumored Apple iWatch, will begin to cut into the market share of tablets as well. For a better indication of how the market will shift, check out the chart below as well as IDC’s full press release.

IDC Tempers Long-Term Tablet Forecast as Competing Technologies Heat Up

SAN MATEO, Calif., August 29, 2013 – Faced with growing competition from larger smartphones and the prospect of new categories such as wearable devices diverting consumer spending, International Data Corporation (IDC) Worldwide Quarterly Tablet Tracker modestly lowered its tablet forecast for 2013 and beyond. The company now expects worldwide tablet shipments to reach 227.4 million units in 2013, down from a previous forecast of 229.3 million but still 57.7% above 2012 shipments. Despite the slight reduction for this year, the market will continue to grow at a rapid pace and by 2017 IDC expects worldwide shipments to be nearly 407 million units. The company also adjusted its regional outlook, with maturing markets such as the U.S. now expected to cede share more rapidly to emerging markets such as Asia/Pacific.

“A lower than anticipated second quarter, hampered by a lack of major product announcements, means the second half of the year now becomes even more critical for a tablet market that has traditionally seen its highest shipment volume occur during the holiday season,” said Tom Mainelli, Research Director, Tablets. “We expect average selling prices to continue to compress as more mainstream vendors utilize low-cost components to better compete with the whitebox tablet vendors that continue to enjoy widespread traction in the market despite typically offering lower-quality products and poorer customer experiences.”

While mature markets such as North America and Western Europe have driven much of the tablet market’s growth to date, IDC expects shipment growth to begin to slow in these markets. Market saturation, increased adoption of smartphones with 5-inch and greater screens, and the eventual growth of the wearable category will impact tablet growth in all regions, but are likely to impact mature regions first. As a result, IDC now expects the mature market (comprised of North America, Western Europe, and Japan) to shrink from 60.8% of the worldwide market in 2012 to 49% by 2017. As a result, emerging markets (comprised broadly of Asia/Pacific (excluding Japan), Latin America, Central and Eastern Europe, the Middle East, and Africa) will grow from 39.2% in 2012 to 51% in 2017.

“Year-on-year growth is beginning to slow as the tablet market approaches early stages of maturity,” said Jitesh Ubrani, Research Analyst for the Worldwide Quarterly Tablet Tracker. “Much of the long-term growth will be driven by countries like China where projected growth rates will be consistently higher than the worldwide average.”

A secondary trend in the tablet market is the rise of tablets in the commercial segment. Education projects and adoption in vertical markets such as retail are contributing factors as this segment is set to slowly double from the 10% share it held in 2012 to 20% by 2017.

This article was originally published on BGR.com

Related stories

Interest in large tablets fades as focus shifts to iPad mini, others

Fear of American pop culture drives European smartphone, tablet taxes