Hunt Set to Cut Taxes in UK Budget With Election Looming

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Jeremy Hunt plans to put personal tax cuts at the center of his annual budget on Wednesday as he navigates tight public finances to deliver on Conservative demands for a pre-election giveaway to boost the ailing governing party’s standing with voters.

Most Read from Bloomberg

Chemical Linked to Cancer Found in Acne Creams Including Proactiv, Clearasil

New York to Deploy National Guard to NYC Subways to Fight Crime

Stocks and Bonds Climb as Powell Sticks to Script: Markets Wrap

Egypt’s Devaluation and Record Rate Hike Put IMF Deal in Reach

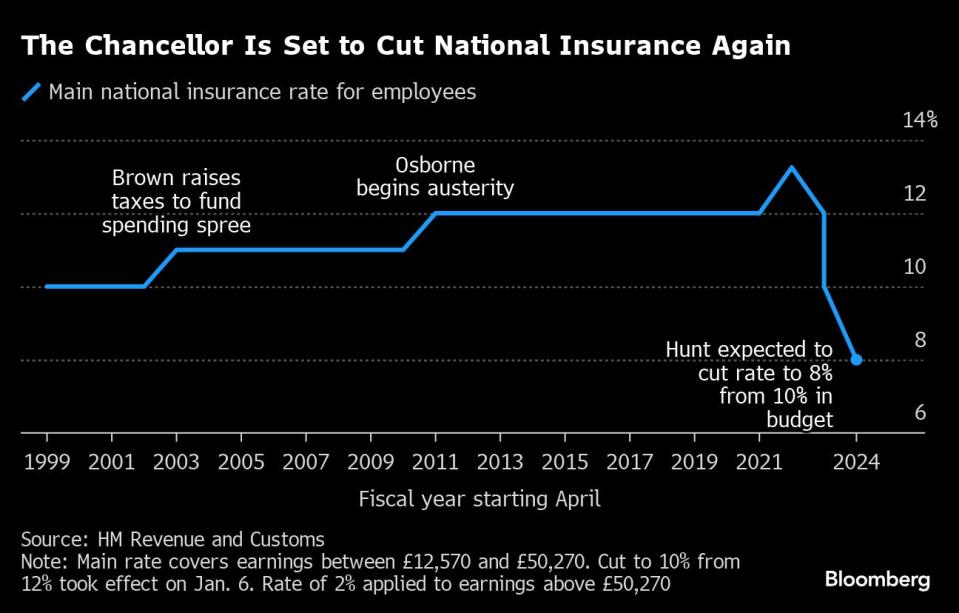

The Chancellor of the Exchequer plans to cut 2 percentage points off the UK’s national insurance payroll tax, according to a person familiar with the matter, who requested anonymity discussing decisions that haven’t yet been announced. While he’s not expected to unveil what would be a more expensive cut in income tax — as preferred by Rishi Sunak team — senior Conservatives have signaled the Prime Minister plans to fight the general election on a promise of future income tax breaks.

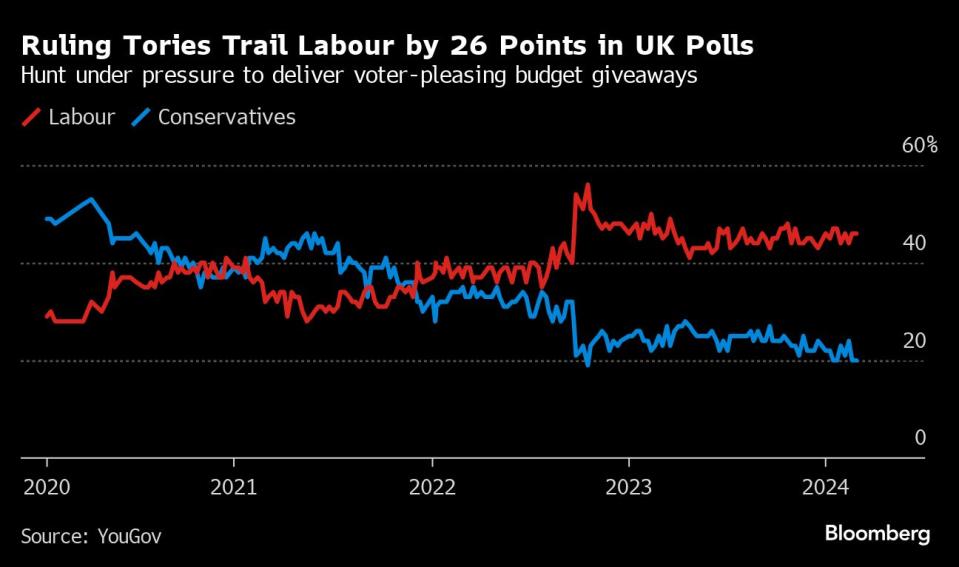

With the Tories trailing Keir Starmer’s opposition Labour Party badly in the polls — an Ipsos survey published Monday put the governing party on an all-time low of just 20%, with Labour on 47% — Hunt is responding to Conservative pressure for voter-pleasing giveaways ahead of a national vote due in the next 11 months. He’ll present Wednesday’s move as part of efforts to lift economic growth, according to pre-briefed remarks from the Treasury.

“We can now help families with permanent cuts in taxation,” Hunt is due to say on Wednesday. “Conservatives know lower tax means higher growth.”

For all the Tory demands for tax cuts, Hunt has been hemmed in by tight public finances. The government’s fiscal watchdog, the Office for Budget Responsibility said he had just £13 billion ($16.5 billion) to work with before breaching his own rule to have the national debt falling within five years.

That’s why Hunt has been considering a range of revenue-raising measures to help fund personal tax cuts, including ending UK non-domiciled tax status, squeezing public spending and extending a windfall tax on oil and gas companies.

Hunt “wants to do something that appeals to voters, but faces the reality of fiscal and economic forecasts that suggest there is very little room for maneuver,” said Gemma Tetlow, chief economist at the Institute for Government think tank. “There’s not an easy win or easy giveaways to reach for.”

If Hunt does change the non-dom regime and extend the energy windfall tax, he’ll be taking two Labour policies that until now Downing Street has rejected, posing a dilemma to the opposition party as to how it will fund its policies should it win the coming election.

“We will inherit, we’re very clear if we win the election, it will be the worst fiscal inheritance since the second world war,” Labour’s deputy finance spokesman, Darren Jones, told Bloomberg TV on Wednesday. “We can’t do anything about that.”

Hunt will present the national insurance reduction — which was first reported by the Times — as a £900 ($1,140) benefit to the average worker when combined with the identical cut he announced to the payroll tax in his last fiscal statement in November, according to the person. The Treasury declined to comment.

Ministers had been considering whether to cut income tax or national insurance. Sunak pledged to reduce income tax during the Conservative leadership contest in the summer of 2022, and some of his aides favored making good on that promise at this year’s budget, believing it would be noticed and understood more by voters in election year. However, income tax is not now expected to be reduced in the budget, people familiar with the matter said.

That’s in part because cutting income tax would be more expensive, at about £13.7 billion a year on average over the next three years for a 2 percentage-point cut compared with £9 billion to £10 billion for the same reduction in national insurance, depending on whether the self-employed are included or not.

Moreover, Treasury officials are concerned that cutting income tax would be inflationary, partly as it benefits pensioners as well as workers. Inflation is still running at 4%, double the Bank of England’s target, although it is forecast to fall below 2% in the coming months.

The budget “does need to be evaluated to make sure it is not inflationary,” House of Commons Treasury Committee Chairwoman Harriett Baldwin told Bloomberg TV on Wednesday. “We’ll have the chancellor in front of our committee next week and we can drill down into that question.”

Rather than cutting income tax, Hunt had favored a further reduction in national insurance in part because it specifically targets workers and could be seen by the Office for Budget Responsibility to help boost growth.

Instead, Conservative ministers, lawmakers and officials told Bloomberg they believe that later this year Sunak will revive his leadership campaign pledge to cut the basic rate of income tax to 16% from 20% by the end of the decade.

That could be possible at a second fiscal event this year if falling inflation and interest rate cuts create more fiscal headroom for the chancellor, the people said. Alternatively, it could form the key plank of the Conservative election manifesto. The biggest Tory promise to cut taxes will come later this year, said a senior government official, suggesting the election would be called in the autumn.

Opinion polls have consistently shown that the public prioritizes public spending over tax breaks, but Conservative strategists think campaigning on a major income tax cut would produce a clear divide with the Labour Party and claw back votes from typical Tory voters who are considering either staying at home on polling day or backing a different party.

Last week Hunt told a moderate caucus known as One Nation Conservatives that the budget’s fiscal giveaways wouldn’t be on the same scale as in the Autumn Statement, and at the weekend, he told Sky News that while he would “make some progress” in cutting taxes, “we’re going to do so in a responsible way.”

But the Treasury under Hunt — and under Sunak when he served as chancellor from 2020 to 2022 — has a history of lowering expectations before then delivering on the upside.

--With assistance from Andrew Atkinson, Lizzy Burden and Kitty Donaldson.

(Updates with comment from Jones, Baldwin, starting in ninth paragraph.)

Most Read from Bloomberg Businessweek

How Apple Sank About $1 Billion a Year Into a Car It Never Built

Humanoid Robots at Amazon Provide Glimpse of an Automated Workplace

Immigration Rage Drowns Out the US Labor Market’s Need for Workers

The Battle to Unseat the Aeron, the World’s Most Coveted Office Chair

©2024 Bloomberg L.P.