Hugh Hendry has a contrarian take on negative interest rates

In some parts of the world, extraordinary monetary stimulus pushed interest rates so low that they went negative. However, even negative rates have had limited success in bolstering growth.

Hugh Hendry, the legendary Founder and CIO of Eclectica Asset Management LLP, thinks interest rates are going up. Furthermore, he believes it may be more stimulative to raise rates than to keep them at negative levels.

A bona-fide contrarian, Hendry rose to prominence by nailing a series of bets leading up to the great financial crisis of 2008. His fund generated 50% returns in October 2008 alone, during a time when the vast majority of investors were losing large sums of money. Real Vision TV recently scored an interview with Hendry to get his thoughts on global interest rates – which are a key driver of stock markets and economies.

U.S. Treasuries, as you may know, have been in a bull market for nearly 40 years. The key 30-year interest rate, which moves inversely to bond prices, has dropped from 14% in 1981 to less than 3% today.

But Hendry believes the generational bull market may be ending. We’ve seen “the incredible performance of U.S. Treasuries”, Hendry explained, “I just think we’re creating a price top, a bottom in yields.”

If Hendry is correct, mortgages rates, student loan rates, and interest paid on savings account will soon rise from rock bottom.

“My book is a reflation book,” Hendry says. “And my portfolio today is clean, simple, and kind of punchy. I have essentially four positions. I have a big position where I’m long dollar-yen. Long dollar, short yen, which really takes me into that world of talking about 10 year Treasuries, talking about yield curves, because they’ve all come together with Japan pursuing its policy of targeting zero 10-year yields.”

Raising rates could stimulate

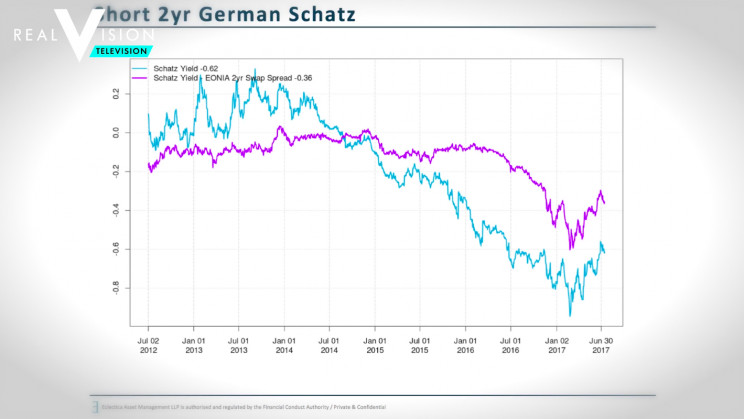

As you may know, global interest rates are near all-time lows. In some countries, central bankers have actually pushed key rates below zero. The yield on the German “Schatz” – a short-term bond – is currently -0.70%.

Hendry believes negative interest rates have failed to stimulate economies. However – and here’s where he departs conventional thinking – Hendry believes rising rates will actually stimulate economies:

“I actually think that raising rates, i.e. taking them from negative levels to flat actually could stimulate…”

Click here to watch the full interview and hear the thoughts of this contrarian financial genius.