The Huge Gains You’re Missing

Look at the chart below. I’ve whited-out the name of the underlying investment.

Any guess as to what it is? Perhaps a high-flying tech stock? Something 5G-related? Or perhaps a marijuana company?

You’d be surprised …

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

The chart above belongs to the Invesco Solar ETF (TAN). And it just had a big breakout. This week, it climbed over 8%. And it’s up more than 70% since its December low.

And remember — this is for an ETF, which means it holds a basket of solar stocks. For an entire group of stocks to climb a collective 70%+ in such a short period of time is highly unusual.

Better yet, if we narrow in on specific solar leaders, the gains are even more amazing.

For example, here’s SunPower — look at the staggering price breakout yesterday.

It shot up as much as 37% at one point. And since its December low, it’s pushed higher 223%. Look how it’s blown away the S&P …

As I write Friday morning, it’s up another 3%.

No one else is talking about this yet, but here’s the reality …

Solar is making people rich. Yet very few investors realize this is happening … which means there’s still plenty of room for huge gains.

For many years, solar stocks lagged behind the broad market. But I’m confident we’ll look back at April/May of 2019 and say that’s when investors “flipped the switch …”

That’s when the age of Solar Stock Millionaires began … when, with little fanfare, a massive wave of wealth creation began to form … when people started making fortunes from one of the biggest energy revolutions in human history.

People will lament missing out on it just like they missed out on Amazon, Netflix, Bitcoin, and cannabis.

But you’re here, reading this right now, at the right time — on the ground floor.

This is a chance to be a part of solar’s ascendency … from the beginning.

Here at InvestorPlace, we’re thrilled to feature one of the preeminent solar investors in the industry — Eric Fry, editor of Fry’s Investment Report. He’s been recommending solar to his readers for many months now … and yes, he has them in on SunPower, so they’re benefitting from yesterday’s pop.

Eric’s experience with macro trends has helped him call nearly every significant market move of the past 25 years … and he’s made more stock recommendations that resulted in 1,000%+ gains than anyone we know in the financial newsletter industry. Given this, he now has the nickname, “Mr. 1,000%.”

So, in today’s Digest, we’re turning to Chris Skokna, who works closely with Eric. He’s put together a piece featuring Eric’s solar research.

Solar’s time has come. Don’t let this one pass you by.

Jeff Remsburg

The Hidden Reason America’s Most Hated Technology Is Surging

Imagine if more than half of all the cars ever manufactured were sold in just the past three years.

Buy Detroit, right?

Or imagine if more than half of all the software ever sold had been installed just since 2016.

I don’t know about you, but if I heard that, I’d be moving even more of my money into Silicon Valley.

Well, a statistic like that is taking shape right before our very eyes. But too many investors are ignoring it because they “hate” this technology.

I’m talking about solar power.

Now maybe you were one of those mid-2010s investors who got burned by SunEdison Inc. They watched their shares soar 2,000% on hype and hope, only to plummet to nearly zero and get delisted from the New York Stock Exchange once the reality of falling prices and no profits kicked in.

That’s just one of many solar flameouts in the recent past. And that’s on top of many politicians bad-mouthing solar tech every chance they get. No wonder it’s so hated.

But things are changing.

Here’s what InvestorPlace Chief Global Investing Strategist Eric Fry has to say about the renewable power source’s profit prospects.

“The solar industry is gaining momentum,” he says. “And that momentum is building at the exact same moment that global demand for solar power is about to go parabolic.”

Check this out …

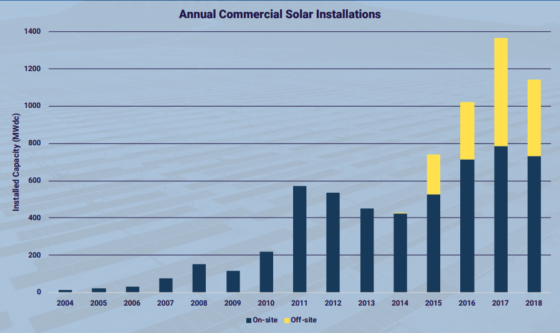

According to “Solar Means Business,” a newly released report by the Solar Energy Industries Association (SEIA), “2018 ranks as the second-largest year for commercial solar installations, with 1,144 [megawatts] MW installed” and “More than half of all corporate solar capacity has been installed in the last three years.”

Source: Solar Energy Industries Association

I first came across this data in an article on Forbes.com. It was a pretty good article, highlighting the fact that huge corporations like Amazon.com Inc.(AMZN), Apple Inc. (AAPL), and Walmart Inc. (WMT) are pouring huge amounts of dollars into solar.

Apple, the article notes, leads all corporate solar users, with 393 MW installed over the past three years.

And commercial solar adoption is accelerating, according to the article, for three main reasons …

• Declining costs

• More flexible financing

• Renewable energy-friendly state and local policies

However, that’s not entirely true, Eric tells me.

While those three items are indeed drivers behind solar’s rise, none is the main catalyst, he says.

In fact, Eric says, “the mainstream media often misses this ‘hidden’ reason behind solar’s arrival” as a dependable, affordable energy source for corporations- and as a moneymaking opportunity for investors.

“You see, a powerful new ‘X factor’ has entered the solar energy market,” he says. “And it has the potential to supercharge demand. That X factor is energy storage — batteries.”

Until recently, solar-power installations lacked the ability to store energy.

“They were simply use-it-or-lose-it power generators,” Eric says. “Energy storage technologies were too expensive to be viable additions to solar-power facilities.”

But this old story is changing rapidly. Energy storage has arrived – and its arrival could be a very big deal for the solar industry.

Looking globally, he says, the deployment of battery-based energy storage solutions (BESS) is ramping up quickly. According to JPMorgan, the cumulative installed base of BESS will soar 100-fold between now and 2030.

To see how we’re getting there, Eric wants us to take a trip — to Hawaii …

Profit in Paradise …

“In the olden days of 2015, a company like Target Corp. (TGT) would contract with a solar company to install solar panels on the roofs of its superstores,” Eric says. “Once installed, the panels would deliver daytime electricity to supplement the electricity Target pulled from the regional power grid.”

But now, he says, when Target installs new rooftop panels, it often also installs a battery system to store the excess energy it doesn’t use immediately.

Eric points out that in 2017, Target kicked off its solar-storage project at its store in Kailua-Kona, on the big island of Hawaii’s east coast. There it installed a 910-kilowatt solar system from SunPower Corp. (SPWR) that included a 250-kilowatt energy storage component.

“This may have been the first time a Target store had added energy storage to solar — but it won’t be the last,” Eric says.

“On emerging trends in energy innovation,” the giant retailer stated, “we see energy storage as an integral tool to increasing our renewable energy consumption and improving resiliency at stores in climate-impacted communities.”

By the end of this year, Target expects to install rooftop solar systems on more than 500 store locations. According to the SEIA report, Target is the third-biggest corporate solar user, with 242 MW installed 2016-’18. And by 2030, the company plans to produce 100% of its energy needs from renewable sources.

“This storage component of the renewable energy industry is the new-new thing,” Eric says. “And it has the potential to deliver big-big growth to SunPower and other solar companies that take advantage.”

This energy storage boom is increasing demand for new solar installations — and increasing the revenue-per-installation for companies like SunPower. It announced recently that one-third of its order backlog includes solar-plus-storage, and that these installs generate about 40% more revenue than ones without storage.

… and Beyond

Utilities are also embracing energy storage, Eric says. Increasingly, they are opting to add new generating capacity by building energy-plus-storage facilities, rather than gas- or coal-fired power plants.

Last year, for example, the Arizona Public Service Co. (APS) committed to deploying 850 megawatts (MW) of energy storage over the next six years. Along the same lines, NextEra Energy Inc. (NEE) announced plans to deploy a 409 MW solar-plus-storage solution at Florida Power & Light Co., replacing two gas-fired power plants.

“Here’s the bottom line,” Eric says. “Solar power is big — and getting much bigger.”

At the end of 2018, the world’s installed capacity of solar-power generation totaled nearly half a billion megawatts — accounting for more than 7% of the globe’s power capacity.

“In April of this year, for the first time ever, solar power generated more electricity in the United States than coal-fired power plants,” he says. “This landmark achievement was no fluke. This is going to keep happening with more and more frequency.”

As this chart shows, coal power has been trending lower for many years, while solar power has been trending higher.

Moreover, new capacity installations are on track to soar 25% this year, according to Bloomberg New Energy Finance, and to nearly double by 2021.

According to the International Energy Agency’s (IEA) “Sustainable Development Scenario,” solar-power capacity will soar fivefold between now and 2025, accounting for a whopping 38% of global power generation.

Looking further out, the IEA anticipates a 13-fold increase in solar-power capacity by 2040, at which point this renewable source would be providingtwo-thirds of the world’s power needs.

“The IEA anticipates global spending on solar power to total $4 trillion over the next two decades — or about $180 billion per year,” Eric says. “If investment of this magnitude were to occur, solar power would become the world’s primary electricity source by 2040.”

But you don’t have to wait 20 years to profit on this trend. By then, it could be too late — long after this spectacular growth trend has slowed.

There are a lot of companies out there that are jumping on the solar bandwagon, and there is clearly a lot of investing potential here, but it’s all about finding the right companies that offer significant long-term potential.

That’s why Eric recently released a special “all solar” edition of his brand-new newsletter — Fry’s Investment Report.

In it, he shares two recommendations — and a whole lot of research –to get investors in on this technology’s profit ground floor.

To learn more, I hope you’ll go here to find out how to join Fry’s Investment Report.

Take care,

Christopher Skokna

Senior Managing Editor, Fry’s Investment Report

The post The Huge Gains You’re Missing appeared first on InvestorPlace.