The House just passed a $1.5 trillion tax bill that’s brutal for poor people

The Joint Committee on Taxation, Congress’s nonpartisan scorekeeper in tax matters, released its evaluation of the House GOP’s tax bill, which passed the House on Thursday, 227 to 205, with 13 Republicans joining every Democrat to vote against the bill.

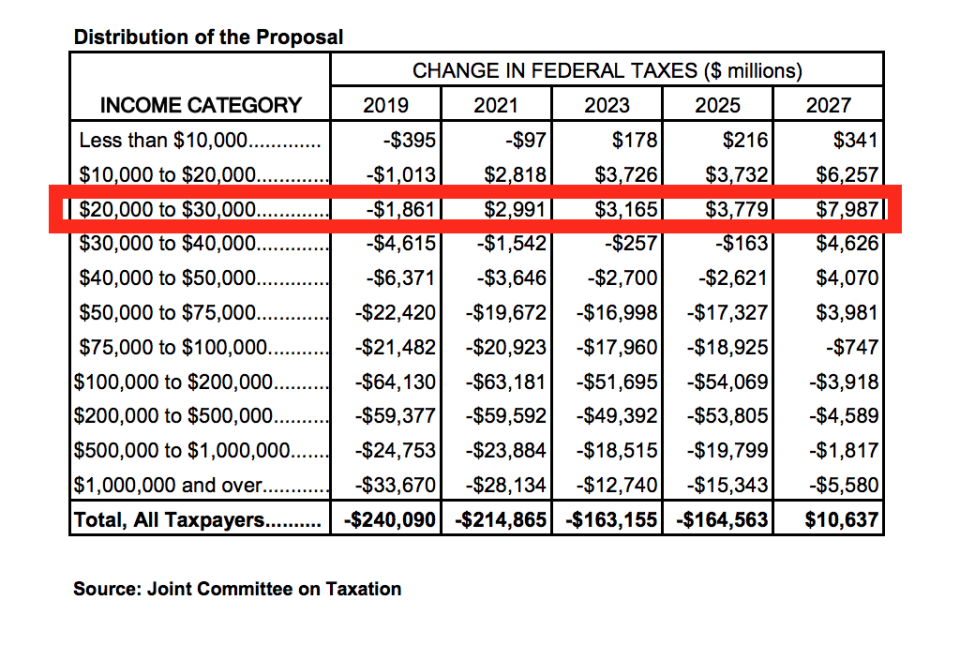

Broadly, the “Tax Cuts and Jobs Act” delivers quick tax cuts across all income brackets in 2018. Over time, however, the tax cuts phase out for lower-income taxpayers. Taxpayers making under $75,000 a year could see tax increases of much as $300 by 2027, and those making under $30,000 would see hikes by 2021.

At the same time, wealthier families will continue to see tax cuts at the end of the decade, with returns of at least $1 million, averaging $8,871 by 2027. The bill also slashes the corporate tax rate to 20% from 35%. In total, the total tax cuts would reach almost $1.5 trillion over the next decade.

As the Wall Street Journal noted in its live coverage, the report may result in both parties digging in. For the bill’s opponents, the long-term tax cut to the wealthier brackets at the expense of the lower-income brackets may drive a wedge further between the Republicans and Democrats and make the bill harder to sell.

On the other hand, the short-term tax cuts for all may prove enticing and some people may assume something will change between 2019 and 2027, the time frame the Committee examined.

The focus now shifts to the upper chamber in Congress as the Senate works on its own version of the bill, with the differences to be hammered out in the conference committee process. Ultimately the goal of the Republican-held legislature is to furnish a bill on President Donald Trump’s desk by the end of the year.

Ethan Wolff-Mann is a writer at Yahoo Finance. Follow him on Twitter @ewolffmann. Confidential tip line: emann[at]oath[.com].

Read More:

The phone industry’s clever plan to stop robocalls

Jack Dorsey on bitcoin and cryptocurrency

How cutting the 401(k) limit would affect people’s saving

Former ambassador: Mexico has ‘moved on’ from NAFTA

Vanguard, genocide, and a $18 million campaign to get you to vote

Venmo is one step further to becoming a full-service digital wallet

ATM fees have shot up 55% in the past decade

Big bitcoin-friendly companies like Microsoft and Expedia hedge their bet

The real reason Mexico will never pay for the Trump’s wall: It’d be ‘treason’

How Waffle House’s hurricane response team prepares for disaster

Trump weighs slashing one of the most popular tax deductions