Hong Kong Stock Exchange drops £32bn bid for London Stock Exchange

The Hong Kong Exchanges and Clearing (HKEX) pulled its takeover bid for the London Stock Exchange Group (LSE.L), a month after proposing to merge the two companies in a £32bn ($39.1bn) bid.

The LSE rejected the offer the day after the proposal, saying that there were"fundamental" flaws and concerns over its ties to the Chinese government.

HKEX said in a statement today: “HKEX confirms that it does not intend to make an offer for [the LSE] ... The Board of HKEX continues to believe that a combination of LSEG and HKEX is strategically compelling and would create a world-leading market infrastructure group.

“Despite engagement with a broad set of regulators and extensive shareholder engagement, the Board of HKEX is disappointed that it has been unable to engage with the management of LSEG in realising this vision, and as a consequence has decided it is not in the best interests of HKEX shareholders to pursue this proposal.”

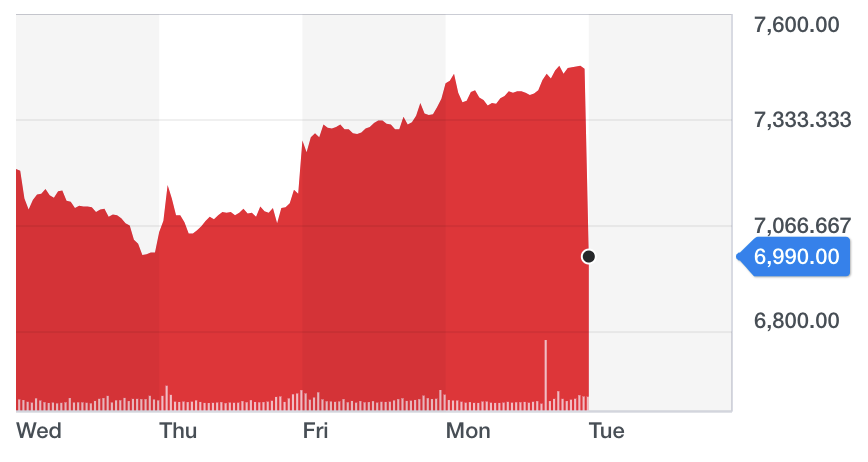

Shares in the LSE plunged by over 6% in early trading after the bid withdrawal.

Last month, HKEX made the surprise move to bid for the LSE and shares soared by more than 10% on the news at the time.

Charles Li, chief executive of HKEX, which also owns the London Metal Exchange, said the move would “redefine global capital markets for decades to come.

HKEX made clear its offer would only go ahead if the LSE abandoned its plans to buy financial Refinitiv. The LSE agreed to the purchase of the financial information provider a few weeks ago, in a deal aimed at offering trading across regions and currencies.

READ MORE: Surprise £32bn takeover bid from Hong Kong for London Stock Exchange

Li said at the time: “Bringing HKEX and [LSE] together will redefine global capital markets for decades to come. Both businesses have great brands, financial strength and proven growth track records. Together, we will connect East and West, be more diversified and we will be able to offer customers greater innovation, risk management and trading opportunities. A combined group will be strongly placed to benefit from the dynamic and evolving macroeconomic landscape, whilst enhancing the long-term resilience and relevance of London and Hong Kong as global financial centres."