Home sales and big tech — What you need to know in markets on Wednesday

Tuesday saw a calmer day in markets though the overall news flow remained heavy with a speech from Federal Reserve Chair Janet Yellen, earnings from Nike (NKE), and more companies weighing in on the spat between President Donald Trump and the NFL.

On Wednesday, markets will have a lighter economic calendar — which on Tuesday saw home prices rise more than expected in August while consumer confidence remained solid — with the August reports on durable goods orders and pending home sales serving as highlights.

Tuesday also saw the retirement of Equifax (EFX) CEO Richard Smith, who became the latest company executive to leave since disclosing that the information of 143 million Americans was compromised as part of a data breach. Shares of Equifax eventually finished the day up about 1%.

Additionally, late breaking on Tuesday was news from Twitter (TWTR), which said it would begin testing 280-character limits on tweets for some users, doubling the amount of space given to users currently.

Yellen’s views on economic concentration

During a speech on Tuesday that was prototypical of Fed Chair Janet Yellen’s approach at the top of the central bank — Yellen was forcefully two-handed (on the one hand, on the other hand, etc.), considered that the Fed’s views might be all wrong, and opened up the possibility that Fed policy may evolve in a way no one is expecting right now — a quick sentence on the U.S. economy ought to have made today’s tech giants take notice.

“The growing importance of online shopping, by increasing the competitiveness of the U.S. retail sector, may have reduced price margins and restrained the ability of firms to raise prices in response to rising demand,” Yellen said.

“That said, the economy overall appears to have become more concentrated and less dynamic in recent years, which may tend to increase firms’ pricing power.” (Emphasis ours.)

And so while this commentary is largely focused on the effects some economists have posited that Amazon (AMZN) is having on the economy at large, Yellen’s note that activity has become “more concentrated and less dynamic” also makes note of the size these companies have grown to. And the way that this size has, to some extent, deadened the landscape around them.

On Tuesday, Yahoo Finance’s Erin Fuchs noted that Facebook (FB), most notably, is now playing by a new set of rules. As the social media platform’s role in the 2016 U.S. presidential election has come under increasing scrutiny, the era of Facebook — and, to a lesser extent, Google (GOOGL) — operating completely outside the interest of regulators could be coming to an end.

Yellen, we’d note, is not calling for increasing regulations on Amazon or Facebook or any other company. It is merely an economic observation. But this observation of the economy’s overall health and dynamism, and acknowledgement that power has become concentrated, cannot help but draw interested observers to the tech sector.

As we wrote earlier this year, the so-called FAAMG stocks — Facebook, Apple (AAPL), Amazon, Microsoft (MSFT), and Google — were at one-point worth over $3 trillion collectively (they are currently worth just slightly less), have been powering the market higher this year. This moniker builds off the FANG acronym, which includes Netflix (NFLX), that became popular last year.

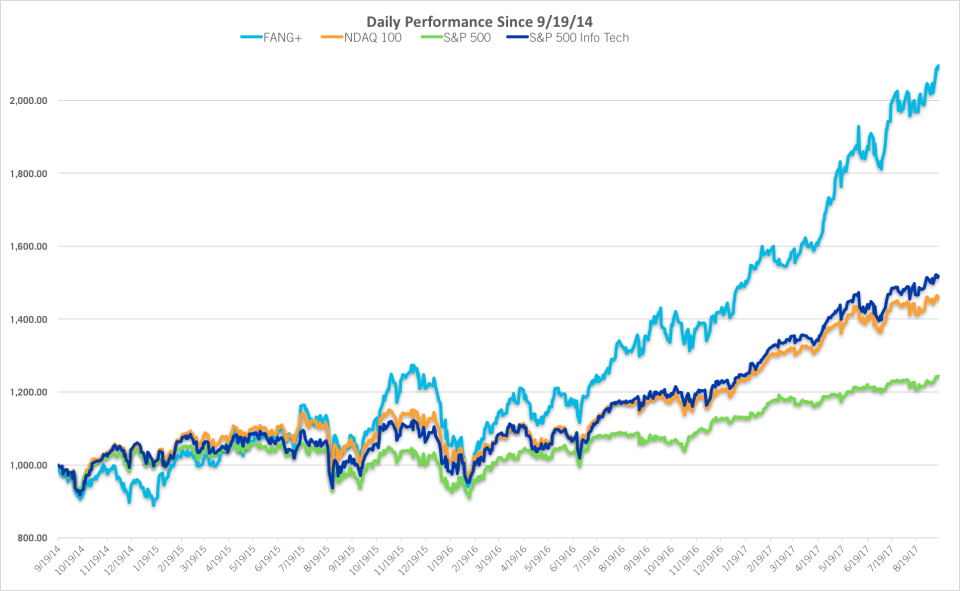

On cue, of course, the New York Stock Exchange announced Tuesday that it will now offer investors a new index, called FANG+, that will track these tech high-flyers along with a few others that “represent the top innovators across today’s tech and internet/media companies.”

Over the last year, the FANG+ index is up over 28%; over the same period, the S&P 500 is up 16%.

And so while this stock performance feeds a certain narrative that these companies have come for our modern economy and are simply operating and executing at a level that justifies higher prices and better returns, looking not at the stock performance but the overall economic landscape reveals a slightly different picture.

Yellen, looking at underlying inflation in the economy relative to the unemployment rate and how current data have presented a “mystery” for economists, see an economy that is stale. Or that is, perhaps, more stale than it ought to be, all else considered.

And in a post-crisis economy that has been defined by a pursuit of scale over almost all else, it is this scale that may be to blame for the dissatisfaction that seems to pervade the current moment. Which is at least something worth thinking about for regulators, for us as citizens, and for the next generation of American business leaders.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: